Published

January 24, 2017

In 2010, our country’s health care system was upended with the passage of the Affordable Care Act—Obamacare. In an attempt to expand coverage, families, individuals and businesses ended up paying for more and getting less.

Now in 2017, in the wake of the 2016 election, both Congress and the White House vow to reform health care. And let’s be clear, major reforms are needed. As currently structured, Obamacare is not sustainable.

As they go about this it’s vital that they do it in a way that provides employees, employers, and individual consumers more options and greater flexibility in selecting a plan that is designed to fit theirneeds and budgets.

Most importantly, future reforms must not jeopardize the employer-sponsored system which provides health coverage to millions of Americans.

For decades, the business community has provided health care coverage and purchased health plans for millions of employees and their families. This experience and the solutions that have resulted should serve as a template as Congress redesigns our country’s health care system to improve quality, extend meaningful coverage, and reduce unnecessary costs.

This explainer will help you understand the critical significance of the employer-sponsored system.

Why do employers offer health coverage?

First, employers care about the wellbeing of their employees. They don’t want their workers to suffer when they get sick.

But additionally, offering health coverage is good business.

In order to attract and retain the best talent, employers offer attractive and varied compensation packages that best reflect elements that are most valued by their workers. Compensation packages are a combination of wages, retirement plans… and health coverage. Benefit packages have long been part of a company’s recruitment strategy; employers and employees are better off because of this.

Why is employer-sponsored health coverage so important?

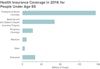

Employer-sponsored coverage is the foundation of America’s health care system. 155 million people under 65 years old—almost two-thirds--get their health coverage through an employer.

Source: Congressional Budget Office.

There was much anger when Obamacare created chaos in the individual market. Imagine the outcries if Washington undermined with how the vast majority of non-retired Americans get their health coverage?

How is employer-sponsored coverage being threatened?

Employer-sponsored coverage is being impacted in two ways.

First, as the ACA was slowly implemented, costly mandates took away employer flexibility in designing plans that best fit employees’ needs at a reasonable cost.

Employer-sponsored coverage is also being impacted by through the tax code.

As with other employee contributions made to employment-based benefits, dollars that an individual chooses to deduct from his/her paycheck to pay for employer-sponsored health coverage are deducted before being subject to income tax. Critics of this tax exclusion--which has been around since the 1940s--believe that this leads to out-of-control health care costs.

The ACA attacks the employer-sponsored system by imposing a 40% excise tax on employers (the Cadillac Tax) who offer so-called “high-cost” health plans. This tax will force employers to offer less robust health coverage to employees and their families. The true irony is that the ACA also mandates that employer’s offer “minimum value” health coverage which could very well one day be deemed “too robust” and subject to the Cadillac tax.

Although in 2015 Congress wisely delayed it until 2020, the Cadillac Tax is one of the many ACA taxes that should be repealed.

But what about reducing or ending the tax exclusion on health coverage?

Instead of taxing health benefits from the employer’s end as the Cadillac tax does, there are congressional proposals to limit the amount of money that could be deducted by an individual from his/her payroll on a pre-tax basis to pay for health coverage.

Unfortunately, this approach would do something similar to the Cadillac Tax—reduce the health care coverage offered and increase taxes on individuals and families. Only with this approach, individuals would see this tax increase on every paystub--unless they saw dropped or curtailed health care benefits. Not a very palatable proposition for politicians.

What role can employers play to control health care costs and create more value?

Employers who offer health coverage are on the front lines of improving health care quality while containing costs. As one of their biggest costs, they have skin in the game and are appropriately incented to offer health plans that provide high-quality coverage for good value.

There are other ways of taming health care costs rather than taxing health coverage—either through the employer or the employee. The Congressional Budget Office collected ideas in 2008. Congress should reexamine them instead of going the higher taxes route.

What does this all mean?

Health care is one of the most personal issues a family deals with.

Comprehensive and sound health reform should be built on the comprehensive and sound foundation of the employer-sponsored system that provides coverage for millions of Americans. Most Americans like this and want it to continue.

Instead of attacking employer-sponsored coverage through mandates and taxes, lawmakers should work with the business community to strengthen it. More flexibility and fewer taxes will allow for more choices and greater value in health care coverage offerings and encourage appropriate cuts in unnecessary costs.

About the authors

Sean Hackbarth

Sean writes about public policies affecting businesses including energy, health care, and regulations. When not battling those making it harder for free enterprise to succeed, he raves about all things Wisconsin (his home state) and religiously follows the Green Bay Packers.