Stories on scrappy startups hatched in dorm rooms, garages or the trunk of a car that score millions in funding have become darlings of the business press (including this very publication).

But those millions from investors are hard won, a “yes” that often comes only after startup founders have endured a battery of “nos.”

While there’s no easy funding-windfall formula, startups have closed hefty investment rounds by “living and breathing” their vision, summoning buzz, carving an unserved niche and delivering a sharp elevator pitch — all while tracking the flaws in their business model along the way, the founders of BloomNation, Fernish, Gemist, Gig Wage and Seated told CO—.

Although the long-term success of these businesses will hinge on leadership, strategy, market conditions and more, their founders share a doggedness that’s thus far spurred funding wins. “Remember, most investors will say no,” said Madeline Fraser, founder of jewelry startup Gemist. “You need to realize that you are looking for the diamonds in the rough. You want the investors that will help you, support you and believe in you. Those people are hard to find, but they are out there.”

Seated: Landed $30 million in funding with a multisource revenue platform for restaurants

Seated, which launched in 2017, wooed investor dollars by honing a niche in both the restaurant rewards space among the likes of OpenTable and Yelp Reservations, and via food delivery with players like DoorDash and Grubhub — offering one multisource revenue platform for eateries. It’s an anomaly in the sector that solved a pain point, Brice Gumpel, CEO and co-founder, told CO—.

“Investors had become disenchanted with marketplaces benefiting just one side, eventually leading to a warped view and lopsided results,” he said. “As a restaurant rewards platform, Seated needed to provide value to both sides of our marketplace: for restaurants, a reliable business partner that would drive revenue and customer volume, and for consumers, dynamic rewards,” Gumpel said, like 30% off a meal or a Sephora gift card. “Our top priority was to create a harmonious two-sided marketplace that balanced and served the needs of both consumers and restaurants.”

The investment paid off, he said. “We successfully landed $30 million in funding, which has helped us expand to new markets and refine our product offerings, which now include dine-in, pickup, delivery and private events.”

[For more on Seated, see profile here.]

BloomNation: Scored $10.7 million to date by creating a floral alternative to an industry goliath

In building his business, Farbod Shoraka, co-founder and CEO of BloomNation, who bills the marketplace as the largest online portal to shop top local florists and studios across the country, grew inured to rejection, which proved valuable.

“The one thing that proved critical in getting funding for us was never giving up when people tell you ‘no.’ When you are doing something innovative that often times has never been done before and breaks the status quo, people won’t understand it and will most definitely question its validity,” Shoraka said. “Some of the biggest companies in the world — Netflix, Airbnb, Tinder, etc. — were told by early investors, ‘that will never work.’”

Still, it’s wise to keep an ear perked for the “why” behind the “no” to recognize if there’s a need to course correct, he said. “You should take people’s questions or concerns to heart and leverage their perspective as a tool for you to iterate on your vision if needed.”

BloomNation did just that, and with its tech-for-the-local-florist hook, the startup tweaked its model and investor pitch to distinguish its value proposition from the goliath of the industry.

“In our case, investors were doubtful that we could drive consumer demand to our marketplace without outspending big players like 1-800-Flowers. We knew we couldn’t outspend them, so we took that feedback and realized that if we offer the same technology we built for our marketplace to the independent florist to use on their own website, we could drive tons of organic traffic without having to spend millions of dollars on ads,” Shoraka said. “So, by shifting our focus from trying to build a marketplace brand to building software for the independent florist to use and making partnerships with them, we were able to scale the business without spending a single penny on advertisements. We still kept our conviction of helping local florists and changed our strategy to still move us towards that north star,” he said. “Your conviction will eventually find you that one investor that believes in you and where you are headed. Don’t give up and you will land funding.”

Fernish: Furniture rental brand raised $45 million thus far by summoning lessons learned from startups past

“Furniture-as-a-service” rental startup Fernish has been riding the wave of the sharing-economy trend: Rentals of consumer goods generated $60 billion in revenue in the United States last year, according to retail analytics firm GlobalData.

But this is not an overnight funding success story. Instead, it reflects a senior team that’s endured the startup trenches and applied its collective lessons.

"One thing that ended up being critical to successfully fundraising here at Fernish has been the leadership team we put in place early on,” Michael Barlow, co-founder and CEO, told CO—. “Our senior team — myself, co-founder Lucas Dickey and chief operating officer Kristin Smith — all have been members of leadership teams at other startups where we've seen a variety of outcomes — from successful sales and even an IPO to a few cases where our companies didn't find a product-market fit.”

It’s this mixture of trial and error and team-based institutional knowledge that’s informed Fernish’s funding success. “Our combined ability to balance competing priorities such as [sales] growth versus [product] margin and [customer] retention versus acquisition, based on our combined experience, has been critical,” Barlow said, “as has our ability to keep our focus on a short list of objectives at a time, rather than boiling the ocean, which is a very common mistake that startup management teams make.”

[Read more on Fernish here.]

Some of the biggest companies in the world — Netflix, Airbnb, Tinder, etc. — were told by early investors, ‘that will never work.’

Farbod Shoraka, co-founder and CEO, BloomNation

Funding

Read on for more tips for attracting investors.

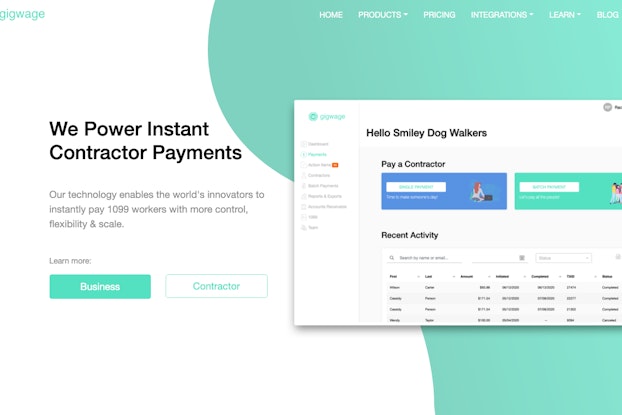

Gig Wage: FinTech payroll platform raised $7.5 million to date via storytelling and mining ‘unconventional sources’

Craig J. Lewis, founder and CEO of financial technology startup Gig Wage, said the power of unapologetic and relentless storytelling — of his personal tale and that of the payroll platform he launched for gig economy workers — proved critical to funding success.

“I play to my strengths. And my strengths are storytelling, especially my and my company's story. I tell it well and I tell it often to anyone that'll listen. I've found that eventually other people start telling your story for you: press, customers, friends, etc.”

Indeed, drumming up outside buzz for your brand is key to stoking the interest of potential investors, Lewis said. “Investors love to hear about the next hot company or great entrepreneur but they often need external validation. The trick is to get them to want to invest in you versus spending your energy pitching them.”

What’s more, “I don't mind securing funding from unconventional sources,” he said. “I'm not afraid to pick up a phone and cold call someone directly that I think is a strategic fit. At the end of the day everyone has a different fundraising journey — they are as unique as a fingerprint and you have to be willing to put in the work, do whatever it takes, iterate and improve. P-U-S-H: Persist until something happens.”

Gemist: These six tips landed the jewelry disruptor six figures in funding

“Fundraising is a strategy. Unfortunately, there isn’t one thing that closes the deal,” said Madeline Fraser, founder and CEO of the “try before you buy” jewelry startup that lets customers design their own bling online.

“It’s many things that work together to enforce you as a founder and your company as one that’s worthy of an investment. You may have hundreds of meetings to get the round closed, especially if you are a first-time founder or this is the first round of your business. This is a marathon, not a sprint.”

These five steps proved critical to Gemist closing rounds of funding:

- Have the first look at your business turn heads for the right reasons. “Your [presentation] deck and initial email are what gets you the meeting,” Fraser said. “If this isn’t fantastic, you will have trouble. Get feedback and test this out before sending it to everyone you can.”

- Craft a captivating pitch. “Understand your company and your vision better than anything else you know in this world. Live it, breathe it. You should be able to do this pitch at any moment and to anyone. It should be second nature to you.”

- Know how to answer the hard questions. “Understand the flaws in your business. Think critically about where the holes are and do your best to guess the hardest questions,” Fraser said. “That way when they come up, you will be prepared. You may not know every answer and that’s fine. Stay confident and if you don’t know an answer, tell them you will get back to them. If you say that, you better make sure to follow up with that answer and quickly."

- Follow up, stay organized and ‘don’t be annoying.' “Persistence is key, but make sure to not be annoying,” she said. “You need to come across like you have things figured out and that you don’t need them to make this happen. Stay cool, keep organized and track your progress. Keep lists and notes on every conversation. Follow up strategically with updates that entice investors."

- Create urgency. “You have a great business, you are a strong founder, people want to invest in you. Keep that energy and find ways to create urgency,” she said.

[For more on Gemist, see feature here.]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.