Why it matters:

- 82% of SMBs surveyed by American Express said a cash flow management hub would save time.

- 70% of SMBs surveyed by PYMNTS.com said their supplier costs had increased, and 37.3% said inflation was their top concern.

- Other business costs have also increased, including expenses such as marketing and IT.

Most small business owners probably didn’t start their companies because they loved to do the accounting that’s involved.

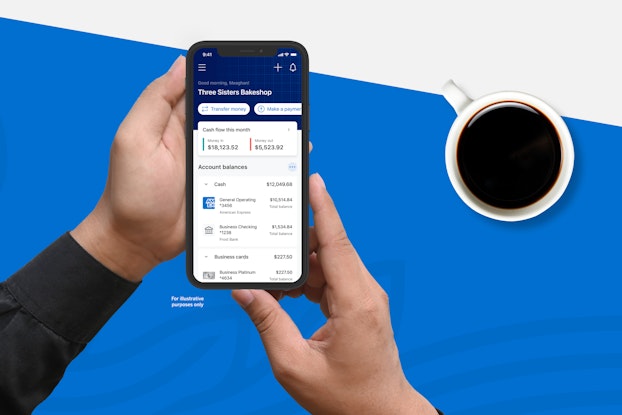

That’s why American Express this year launched American Express Business Blueprint, a digital cash-flow management hub that seeks to integrate the various financial accounts that businesses juggle and provide greater visibility into cash flow. The product is an outgrowth of Kabbage, the online banking company that American Express acquired in 2020.

“Business Blueprint is basically a digital one-stop shop for small business owners’ financial needs,” said Brett Sussman, Vice President of American Express Business Blueprint.

It allows companies to link all of their financial accounts and applications — payroll, checking accounts, credit cards, and others — into a single dashboard. Access to the service is free to anyone with an American Express account, and users can link any of their financial accounts and services, even if they are from other providers.

“We really want to give them visibility into the money coming into their business, and then also the money going out of their business, and to understand projections going forward, and having this all consolidated in one place,” said Sussman.

[Read: What Businesses Must Know to Establish an Effective Pricing Strategy Today]

We really want to give them visibility into the money coming into their business, and then also the money going out of their business, and to understand projections going forward, and having this all consolidated in one place.

Brett Sussman, Vice President, American Express Business Blueprint

A ‘digital one-stop shop’ for small business owners’ financial needs

A recent American Express survey of 1,100 small businesses found that 82% of respondents said a cash flow management hub would save time, leading to improved efficiency (cited by 72% of respondents) and profitability (cited by 50% of respondents).

The tools provided by Business Blueprint are especially important in the current economic climate, with inflation driving up costs and the potential of a recession in the months ahead. Businesses need to have a clear view of how their costs are trending and whether or not their revenues are keeping pace, Sussman said.

A survey by PYMNTS.com last year found that small and medium-sized businesses (SMBs) are concerned about the convergence of rising costs and declining sales in 2023. Only 56% of SMBs surveyed said they expected their revenues to increase in 2023, down from 64% who had expected revenues to increase in 2022. In addition, 70% of SMBs in the U.S. reported that their supplier costs had increased, and 37.3% cited inflation as their biggest challenge.

“Fifty-three percent of business owners who we spoke with said they are expecting increased costs in 2023,” said Sussman. “Marketing is one area that is getting more expensive, as well as supplies — everything from lumber and cooking oil to the cost of doing business, such as IT costs.”

[Read: How Top Marketers Are Capitalizing on the $360 Billion U.S. Mobile Commerce Market]

Providing visibility into cash flow and expenses amid rising business costs

Having a hub where both income and expenses are readily visible makes it easier for SMBs to make decisions about managing their cash flow, he said. For example, companies can easily isolate their travel expenses and determine if they are driving enough returns.

In addition to the increased visibility into cash flow that Business Blueprint seeks to provide, SMBs can also use the Business Blueprint portal to access other American Express financial products that they may be interested in applying for, such as flexible business loans through an American Express Business Line of Credit or an American Express Business Checking Account.

The primary focus, however, is on providing visibility into cash flow and consolidating all of the financial services that businesses use into a single portal, which Sussman said not only saves time but has the potential to increase profitability.

“Many of these small business owners got into this business because they're passionate about creating something, working with people, helping people,” he said. “It often is not the back office that gets people the most excited.”

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

CO— Exclusives: Insider Strategies

How the buzziest brands and hottest startups are solving today's biggest business challenges. CO— brings you advice from startup founders and top executives for thriving in a new world.