Report Summary

POLL SHOWS MINORITY-OWNED SMALL BUSINESSES HARDER HIT BY PANDEMIC

MORE MINORITY-OWNED BUSINESSES FEAR PERMANENT CLOSURE, STRUGGLE TO SECURE LOANS

Minority-owned small businesses have been disproportionately impacted by the coronavirus and the accompanying economic fallout. More minority-owned businesses fear permanent closure, struggle to secure loans Minority-owned small businesses have been disproportionately impacted by the coronavirus and the accompanying economic fallout, according to the MetLife & U.S. Chamber of Commerce Special Report on Race and Inequality on Main Street.

The poll finds that two in three (66%) minority-owned small businesses are concerned about having to permanently close their business versus 57% for non-minority small businesses. However, the gap has narrowed significantly from May, when 52% of non-minority-owned businesses said they were concerned about closing versus a staggering 78% for minority owned businesses.

Minority-owned businesses are also slightly more likely to report trying and failing to secure a loan to help survive the economic turmoil (13% versus 8% of non-minority businesses) linked to the coronavirus.

The poll also revealed shifting attitudes toward minority-owned small businesses. There has been a 17-point increase from the beginning of 20201 in the number of small businesses believing minority-owned small businesses face more challenges than non-minority owned ones, from 52% in January to 69% in July. There was an even more significant jump among nonminority-owned small businesses, where in Q1 47% agreed and 40% disagreed; now, 67% agree and just 24% disagree.

Furthermore, two-thirds (66%) of all small businesses acknowledge that minority-owned businesses have been disproportionately impacted by COVID-19.

Most small businesses also think it is important for them to act in the wake of the recent protests over racial inequality. For example, four in five (79%) say it is important to make a commitment to fairness in hiring, promotion, and pay. In addition, three quarters (74%) say it is important to support local Black-owned small businesses.

Report Highlights

- Minority owned businesses slightly more likely to have tried and failed in securing a loan. Minority owned businesses are slightly more likely to report trying and failing to secure a loan to help survive the economic turmoil (13% versus 8% of non-minority businesses).

- More minority-owned businesses expect revenue to decrease. The number of minority owned businesses expecting revenue to decrease in the next year has increased fivefold (5% in Q1 to 24% now) compared to a much smaller two and a half times uptick for nonminority owned businesses (7% in Q1 to 17% now).

- Gaps exist in views around reopening. Minority-owned businesses are more concerned about the risks COVID-19 poses to their customers and employees (70% versus 58% of nonminority-owned small businesses).

- Differing views on reopening guidance. Minority business owners are slightly more concerned around the lack of guidance on reopening (62% versus 54% of non-minority businesses).

- Minority businesses report more competition. 44% of minority-owned businesses say the level of competition they’re facing has increased compared to six months ago (before the pandemic began), versus 27% of non-minority-owned businesses who feel the same way.

- Majority of small businesses believe it is important to take steps toward racial equality. The two actions seen as particularly critical are making a commitment to fairness in hiring, promotion, and pay (79% view this as important), and supporting local, Black-owned businesses (74%).

- Small businesses report taking some form of action to address or promote racial equality this year. 35% of small businesses have issued a statement of support for racial equality and fairness, 28% have found ways to support local, Black-owned businesses, and 18% report reevaluating their hiring, promotion, and compensation practices.

Key Findings

MINORITY-OWNED BUSINESSES HIT HARDEST BY ECONOMIC IMPACT OF VIRUS

The survey of small businesses indicates minority-owned businesses have disproportionately borne the brunt of the coronavirus pandemic in a number of ways.

Economically, minority-owned businesses say they are more concerned about having to permanently close their businesses. The poll finds that two in three (66%) minority small businesses are concerned about having to permanently close their business versus 57% for non-minority small businesses. However, the gap has narrowed significantly from May, when 52% of non-minority-owned businesses said they were concerned about closing versus a staggering 78% for minority owned businesses.

The number of minority-owned businesses expecting revenue to decrease in the next year has increased fivefold (was 5% in Q1 to 24% now) compared to a much smaller two and a half times uptick for non-minority owned businesses (7% in Q1 to 17% now).

Minority-owned businesses are slightly more likely to report trying and failing to secure a loan to help survive the economic turmoil (13% versus 8% of non-minority businesses). Viewed as a percentage of those who have applied for a loan, 35% of minority-owned businesses came up empty, compared to 30% of non-minority businesses. Notably, more minority businesses seem to need capital to sustain their businesses with 19% planning on applying for a loan versus 6% of non-minority businesses.

Also, minority-owned businesses are more likely to say they face increased competition lately: 44% of minority-owned businesses say the level of competition they’re facing has increased compared to six months ago (before the pandemic began), versus 27% of non-minority-owned businesses who feel the same way. That gap has increased from a seven-point difference in Q1 to a current 17-point difference.

Gaps also exist in view of reopening business and the risks coronavirus poses to their customers and employees. Minority-owned businesses are more concerned about the risks COVID-19 poses to their customers and employees (70% versus 58% of non-minority-owned small businesses). Minority business owners are also slightly more concerned around the lack of guidance on reopening (62% versus 54% of non-minority businesses).

ATTITUDES TOWARD MINORITY-OWNED SMALL BUSINESSES SHIFT

The report also surveyed small business owners about their perceptions concerning racial equality.

According to the survey, nearly seven in ten small businesses now think that minority-owned small businesses face more challenges than non-minority-owned businesses (69%), up 17 points from 52% since the start of the year. Propelling this shift is a large change in non-minority small business owners’ beliefs: the number of non-minority businesses owners who say “minority business owners face more challenges” shot up 20 percentage points since the first quarter (from 47% to 67%).

(74%) of all small businesses believe that there should be more business and investment opportunities available for minorities (39% strongly believe this).

66% of small businesses agree that minority-owned small businesses have been disproportionately impacted by COVID-19. 44% of minority-owned businesses say the level of competition they’re facing has increased compared to six months ago before the pandemic began, versus 27% of non-minority-owned businesses who feel the same way.

A strong majority of small businesses believe it is important to take steps toward racial equality. The two actions seen as particularly critical are making a commitment to fairness in hiring, promotion, and pay (79% view this as important), and supporting local, Black-owned businesses (74%).

Other steps seen as critical on racial equality include:

- 67% say it is important to make a statement of support for racial equality and fairness.

- 66% say it is essential to conduct training for employees on racial bias.

- 63% say it is vital to donate to organizations supporting racial equality.

- 61% say it is important to partner with organizations or educational institutions supporting Black-owned business development.

Over a third (35%) report making a statement of support for racial equality and fairness. Other popular actions small businesses have taken to promote equality this year include:

- 28% found ways to support local, Black-owned businesses.

- 25% donated to organizations supporting racial equality.

- 24% have done direct business with, or invested in, a Black-owned business.

- 18% reevaluated their hiring, promotion, and compensation practices.

Survey Methodology

These are the findings of an Ipsos poll conducted between July 9-16, 2020. For this survey, a sample of roughly 500 small business owners and operators age 18+ from the continental U.S. Alaska and Hawaii was interviewed online in English.

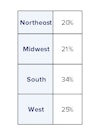

The sample for this study was randomly drawn from Ipsos’ online panel, partner online panel sources, and “river” sampling and does not rely on a population frame in the traditional sense. Ipsos uses fixed sample targets, unique to the study, in drawing sample. Small businesses are defined in this study as companies with fewer than 500 employees that are not sole proprietorships. Ipsos used fixed sample targets, unique to this study, in drawing sample. This sample calibrates respondent characteristics to be representative of the U.S. small business population using standard procedures such as raking-ratio adjustments. The source of these population targets is U.S. Census 2016 Statistics of U.S. Businesses dataset. The sample drawn for this study reflects fixed sample targets on firmographics. Post-hoc weights were made to the population characteristics on region, industry sector and size of business.

Statistical margins of error are not applicable to online non-probability polls. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error. Where figures do not sum to 100, this is due to the effects of rounding. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll has a credibility interval of plus or minus 5.0 percentage points for all respondents. Ipsos calculates a design effect (DEFF) for each study based on the variation of the weights, following the formula of Kish (1965). This study had a credibility interval adjusted for design effect of the following (n=500, DEFF=1.5, adjusted Confidence Interval=+/-6.5 percentage points).

Percentage breakdowns for region, employee size, and sector:

[1] Beginning in Q2 2020, the MetLife/U.S. Chamber of Commerce Small Business Index survey has been conducted via a monthly online survey, in place of the typical phone-based approach. This methodological shift is in response to anticipated lower response rates in dialing business locations as a result of mandated closures related to the COVID-19 outbreak. While significant changes in data points can largely be attributed to the recent economic environment, switching from a phone to online approach may have also generated a mode effect.