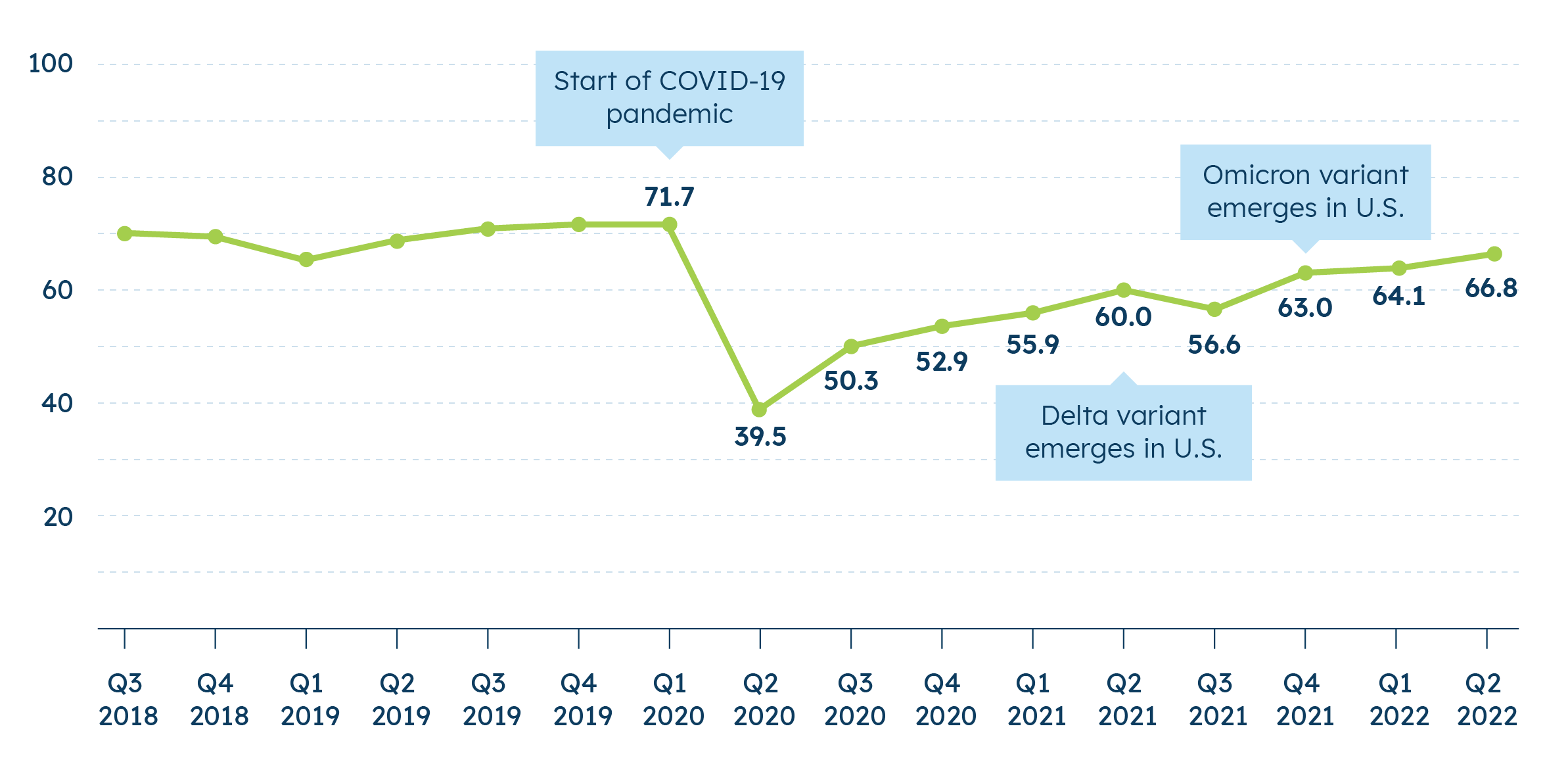

Index Reaches Pandemic-Era High, but Inflation Concerns Dominate

Small businesses say inflation is, by far, their top concern according to the latest MetLife & U.S. Chamber of Commerce Small Business Index. Despite this challenge, this quarter’s score is 66.8, the highest since the pandemic began. This is slightly higher than last quarter’s score of 64.1. The low point of the pandemic was reached in 2020 Q2 when the score reached 39.5.

The survey—conducted between April 29-May 17, 2022—found that inflation and related concerns are dominating small business leaders’ thinking as COVID concerns start to fade. Forty-four percent of the small businesses surveyed cite inflation as the biggest challenge facing small business owners, up from 33% last quarter. This is up significantly from 19% when the question was first asked in Q3 2021. Furthermore, nearly nine in ten (88%) are concerned about the impact of inflation on their business, with almost half (49%) indicating they are very concerned (up from 44% in Q1 2022 and 31% in Q4 2021).

More small businesses are also citing rising interest rates as a challenge this quarter. The number of small business owners who say this is their biggest challenge has doubled from last quarter (15%, from 7%), and it now rounds out their top five biggest challenges.

In contrast, concerns about the impacts of COVID-19 are fading in comparison to those over economic headwinds. A strong majority (68%) of small businesses still report continued concern over the impact of COVID-19 on their business. However, when forced to choose the most pressing challenges facing the small business community, the virus falls to a third-tier concern, behind financial challenges like inflation, supply chain issues, and revenue. Just one in six (15%) small businesses cite COVID-19 as a top challenge that small businesses are facing now: this marks the lowest level since we first asked the question in Q3 2021.

Overall, many of the individual measures that comprise the Index are consistent with findings last quarter. The Index is likely bolstered by optimism on future expectations for the business environment and the economy. However, small businesses’ optimism around cash flow has softened, indicating that while small businesses are doing well now, anxious undertones may be rising.

This quarter’s index also marks the five-year anniversary of the Small Business Index. Over that time, one key finding stands out: Half (50%) of small business owners say they are working more hours now than they were a year ago. This question was first asked in the inaugural SBI (Q2 2017). Five years ago, 30% said they were working more hours. This equates to a 20-percentage point increase1 in the share of small business owners that report working more hours, which speaks to the myriad challenges small business owners continue to face.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q2 is 66.8. The Index score for Q1 2022 was 64.1. At the start of the pandemic in Q2 2020, it reached an all-time low of 39.52