Small Businesses Implement Changes to Keep Workers, Heightened Concern for Inflation

Flexible work is most popular offering in face of “Great Resignation”

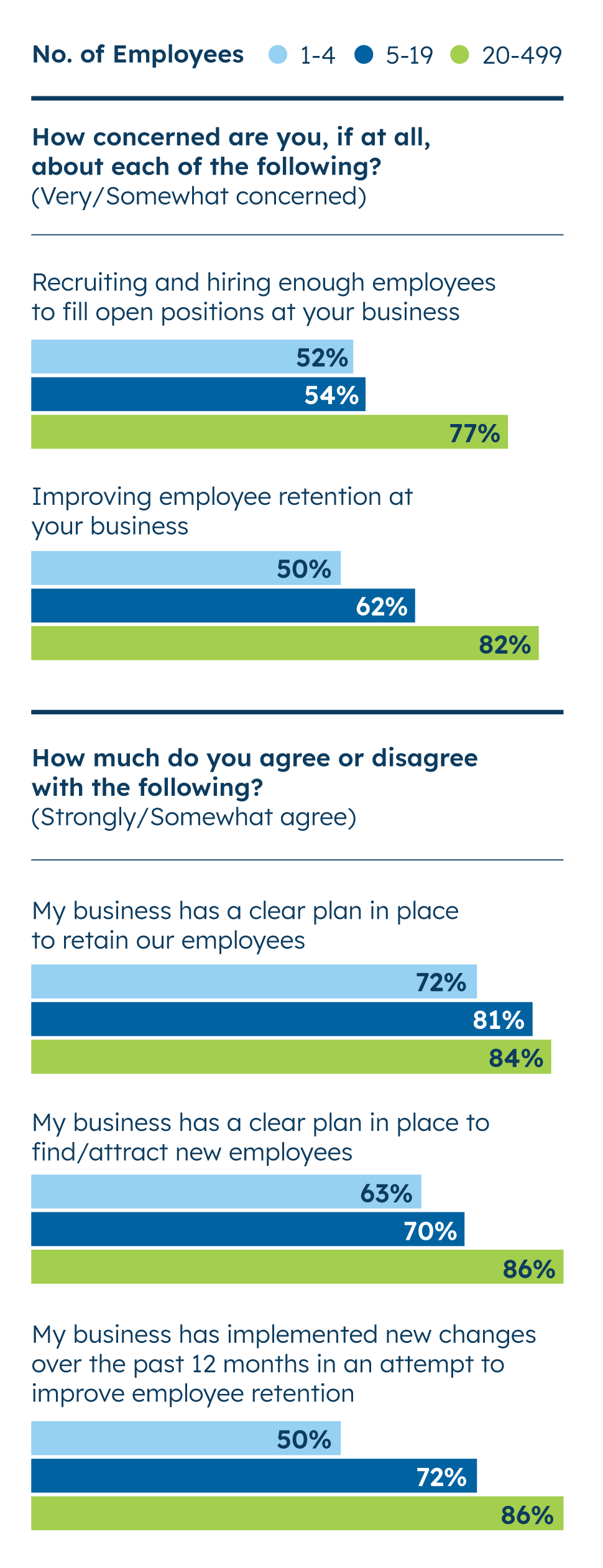

However, a majority report concerns about improving employee retention (57%) and recruiting enough employees to fill open positions (56%) at their business. Over half also cite increased competition for talent with large companies in their area (62%) and other small businesses (58%).

In this growing competition for employees, a majority (60%) of small businesses indicate they have implemented changes over the past year to improve employee retention. The most popular tactic is increasing schedule flexibility (37%), followed by increasing wages (31%), and providing employees with more opportunities to learn/grow (29%).

Looking ahead, less than half (48%) agree that worker shortages across the country will be resolved in 2022. But most small businesses feel they are well placed to win the war for talent: a majority agree their business has a clear plan in place to retain their employees (76%) or find and attract new ones (68%). Still, some businesses are considering implementing changes over the next six months to improve employee retention or attract new talent, including increasing wages (30%) and schedule and remote work flexibility (29%) and providing employees with more opportunities to learn/grow (21%).

The size of a small business reflects its concern about the impact of “The Great Resignation.” Larger small businesses have more concerns about attracting and retaining talent. Small businesses with 20-499 employees rank employee retention (21%) as a top challenge alongside inflation (24%), supply chain disruption (25%), and COVID-19 (26%). In fact, they are more than two times as likely to cite employee retention (21%) as the biggest challenge facing the small business community than those with just 5-19 employees (10%) or 1-4 (9%) employees.

Respondents from these largest small businesses are also more likely to say they have implemented new changes over the past 12 months in an attempt to improve employee retention and that they have a clear plan to attract and retain talent.

Salt Lake City, Utah

Small businesses have persistent concerns over COVID protocols

This survey was fielded during the height of the Omicron variant surge in January, and small business concerns around COVID-19 remained high at that time.

For example, a majority of small businesses expect a return to “normal” to be months away. 51% of small businesses say they believe it will be six months to one year until the small business climate returns to normal. This is in line with the share who said the same in Q2 2021 (54%). However, more than twice as many say they don’t know when the small business climate will return to normal than did in Q2 2021 (15% vs. 7%), pointing toward the lingering uncertainty small businesses owners face.

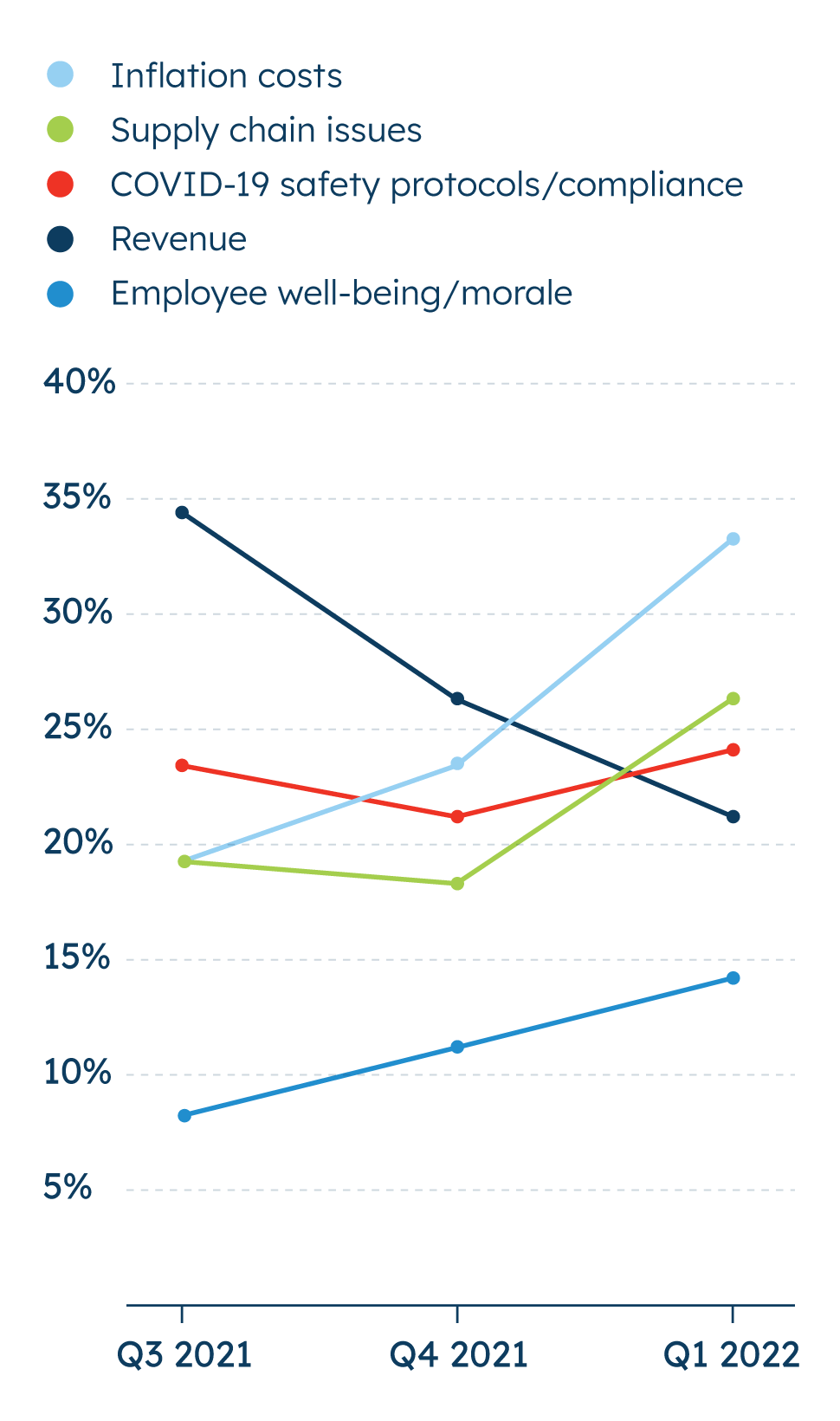

Additionally, almost one in four (24%) small business owners cite COVID-19 safety protocols and compliance as a top issue facing the small business community, while separately 49% say they find it difficult to maintain COVID-19 safety protocols (up from 41% in Q3 2021).

Concern over the impact of COVID-19 among small business owners is in line with concern levels this time last year, before many Americans were eligible for COVID-19 vaccines (75% vs. 76% in Q1 2021). Larger businesses (those with 20-499 employees) say they are having a harder time maintaining COVID-19 safety protocols and report heightened concern over the impact of COVID on their business than those with fewer than 20 employees.

Small businesses raise prices to cope with spiraling inflation

More than eight in ten (85%) small business owners or decision makers are concerned about the impact of inflation on their business and almost half (44%) indicate they are very concerned (up 13 percentage points since Q4 2021). Three in four small businesses find managing higher costs due to inflation difficult (76%) and say rising prices have had a significant impact on their business in the past year (74%).

To cope with rising inflation small business owners are adjusting, most often by raising the prices for their goods and services. A strong majority (67%) of small businesses report having to raise their prices over the past year. Another four in ten (41%) report having decreased staff or taken out a loan in the past year (39%) in response to growing inflation pressures.

Inflation is everywhere: the impacts of rising inflation are affecting small businesses of every size, in every sector, and in every region of the country.

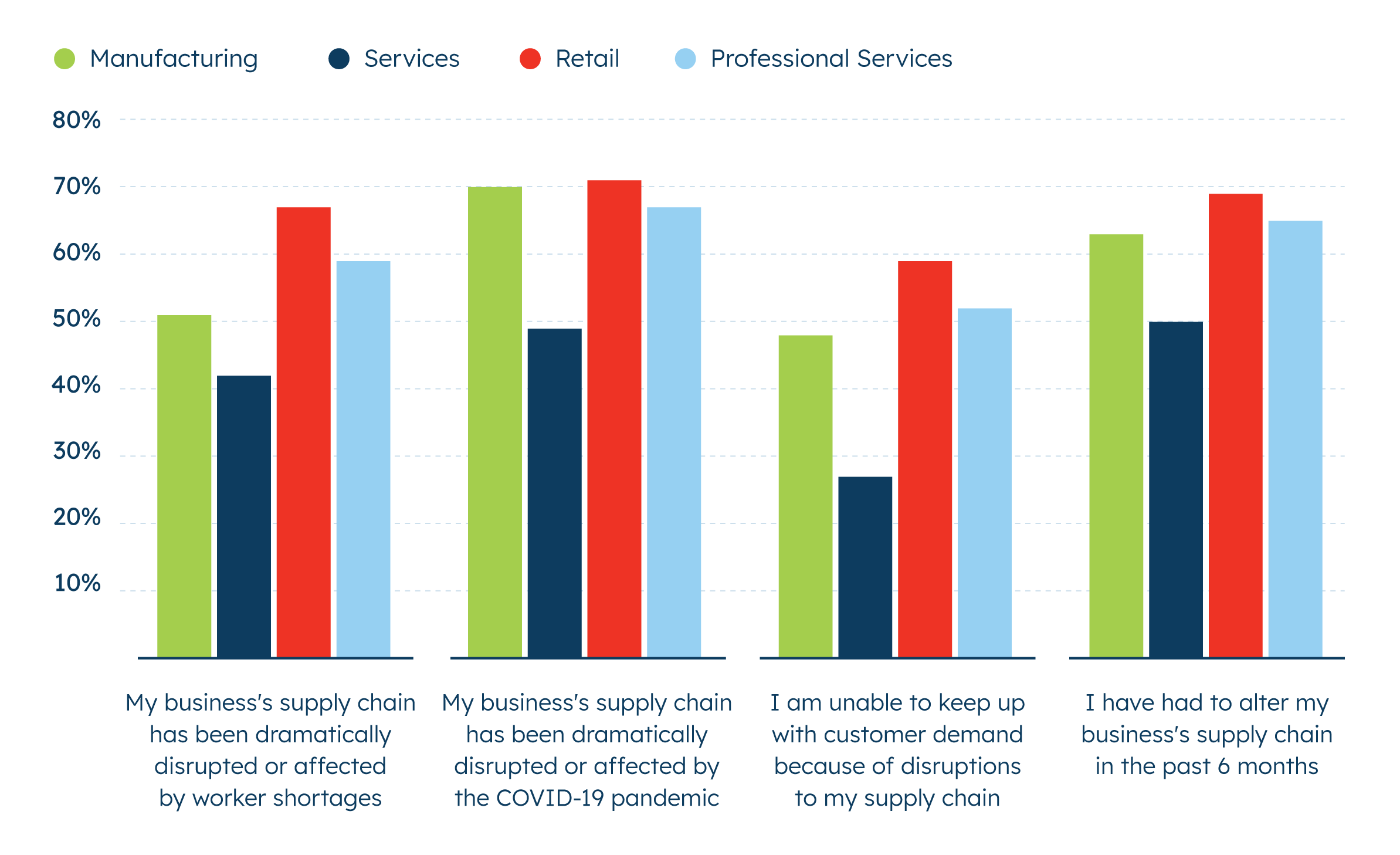

In fact, small business owners in every region of the country cite it as one of the largest challenges they face. Small businesses with 1-4 employees and 5-19 employees also rank inflation as the top challenge—while small businesses with 20-499 employees rate it as a top-tier concern alongside COVID-19 protocols and supply chain issues. It is also among the biggest concerns in all four regions of the country. Finally, across sectors, those in the manufacturing (41%), services (35%), retail (32%), and professional services (29%) sector all cite inflation as one of the top challenges facing the small business community.

Majority of small businesses say they have altered their supply chain

After inflation, supply chain issues (26%), along with COVID (24%), are the next biggest concerns for small business owners this quarter.

More small business owners (26%) now cite supply chain issues as their biggest problem, up eight percentage points from Q4 2021. (As noted above, 33% said inflation is their biggest concern.) The vast majority (76%) of small businesses are concerned about the impact supply chain disruptions are having on their business.

More than six in ten (63%) small businesses report having their supply chain disrupted by COVID, though this has not increased significantly since Q4 2021 (61%). A similar share (65%) state it is difficult to manage disruptions to their supply chain (similar to 61% in Q3 2021). In response to these disruptions, 61% of respondents report altering their supply chain in the last six months—consistent with the share who said the same in Q4 2021 (63%). Finally, a majority (55%) report having their supply chain disrupted due to a lack of workers.

70% of small businesses are concerned about rising interest rates

Interest rates have hovered near zero since March 2020. However, the Federal Reserve raised them during its March meeting. Anticipating this, seven in ten (70%) small businesses are concerned about the impact rising interest rates will have on their business.

In fact, nearly three in ten (29%) are very concerned about rising interest rates. However, when prioritizing the top challenges the small business community faces, business owners rank rising interest rates at the bottom of concerns coming out of the pandemic (only 7% said rising rates are a big challenge). The risk of rising interest rates is on small businesses owners’ radar but is not yet posing a significant challenge.