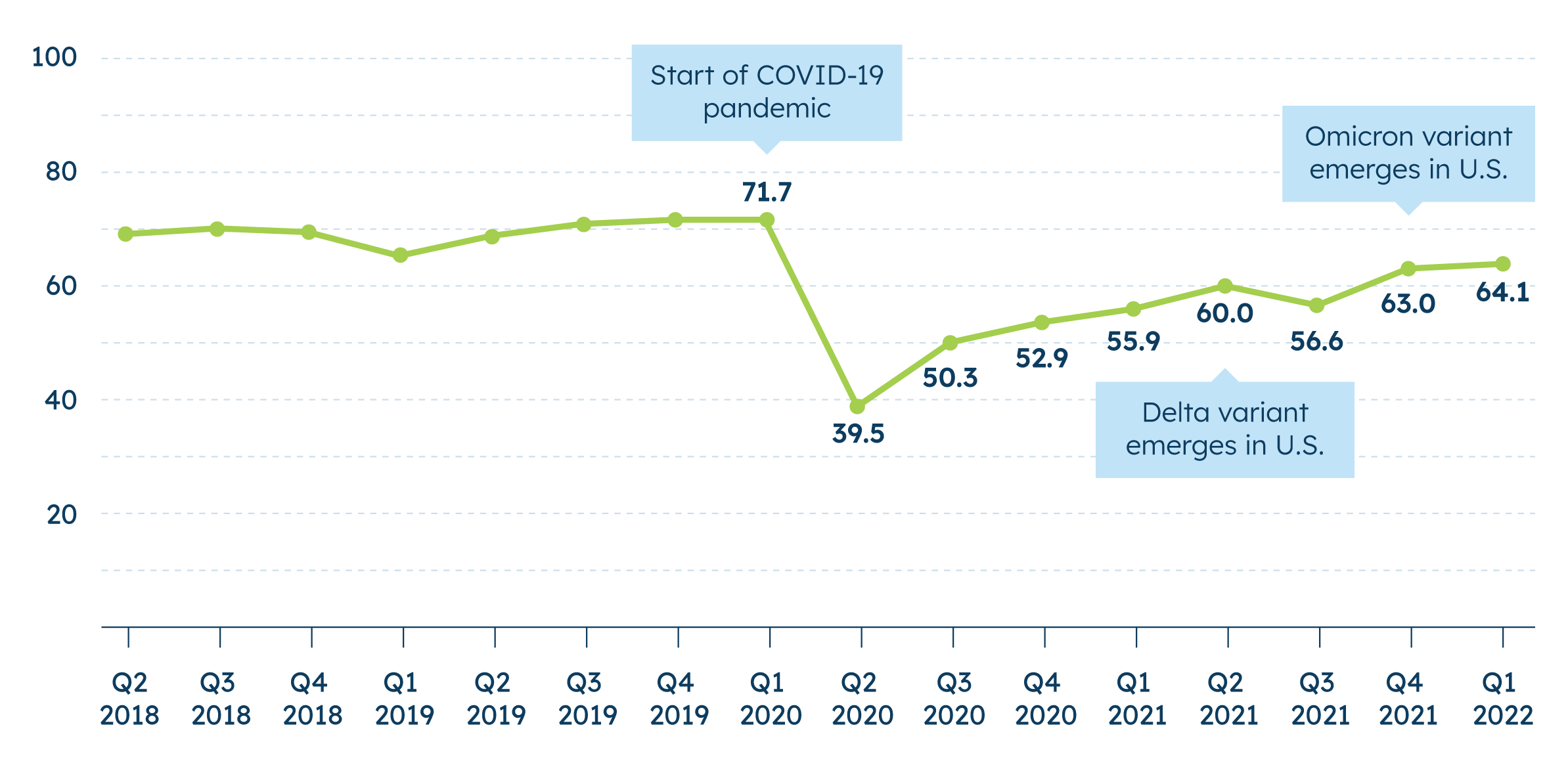

Index Reaches Pandemic-Era High, but Inflation Concerns Grow

The MetLife & U.S. Chamber of Commerce Small Business Index reaches a new pandemic-era high this quarter, but many small businesses report struggling with surging inflation and persistent supply chain issues.

This quarter’s Small Business Index score is 64.1, the highest score since the start of the pandemic. This score is consistent with last quarter’s score of 63.0. (The low point of the pandemic was reached in 2020 Q2 when the score reached 39.5). This score comes after a tumultuous 2021, where the Index fluctuated more than usual, though ultimately it ended with increased optimism relative to the onset of the pandemic in 2020.

The survey was conducted between January 14 - January 26, 2022 in the wake of the Omicron variant. COVID-19 remains a persistent challenge, but the underlying challenges, namely inflation and supply chain issues, are top of mind for most small businesses.

Over the last three quarters, inflationary costs and supply chain issues have become more challenging according to small business owners. One in three small business owners (33%) cite inflation costs as the primary concern facing the small business community, a 10 percentage point increase from last quarter. Small businesses are taking action on inflation. A vast majority (67%) report having to raise prices to combat inflation. Similarly, one in four say supply chain issues (26%) are a top challenge.

Overall, the SBI remains stable, with small business owners feeling generally optimistic about their day-to-day operations and expectations for the future. Similar to last quarter, about three in five (61%) small businesses owners say their business is in good health. Perceptions of the local and national economy have begun to stabilize when compared to early 2021.

Challenges due to “The Great Resignation” take a backseat to inflation and supply chain issues, but still pose a big challenge. A majority of small businesses are concerned about improving employee retention (57%) and recruiting enough employees to fill open positions (56%) at their business. The impact of The Great Resignation is felt more acutely among the largest small businesses (those with 20-499 employees).

Small business owners have consistently ranked COVID-19 safety protocols and compliance as a top-tier challenge over the last three quarters (ranging from 21%-24%). As the pandemic continues, small business owners are in a holding pattern over when the small business climate will return to normal. A majority (51%) believe it will be six months to one year. This is in line with the share who said the same nearly a year ago (54% in Q2 2021).

Wasatch I.T. Salt Lake City, UT

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q1 is 64.1. The Index score for Q4 2021 was 63.0. In Q2 2020 it reached an all-time low of 39.5.1