Inflation Remains the Biggest Challenge for Small Business

Concern over inflation remains near record highs

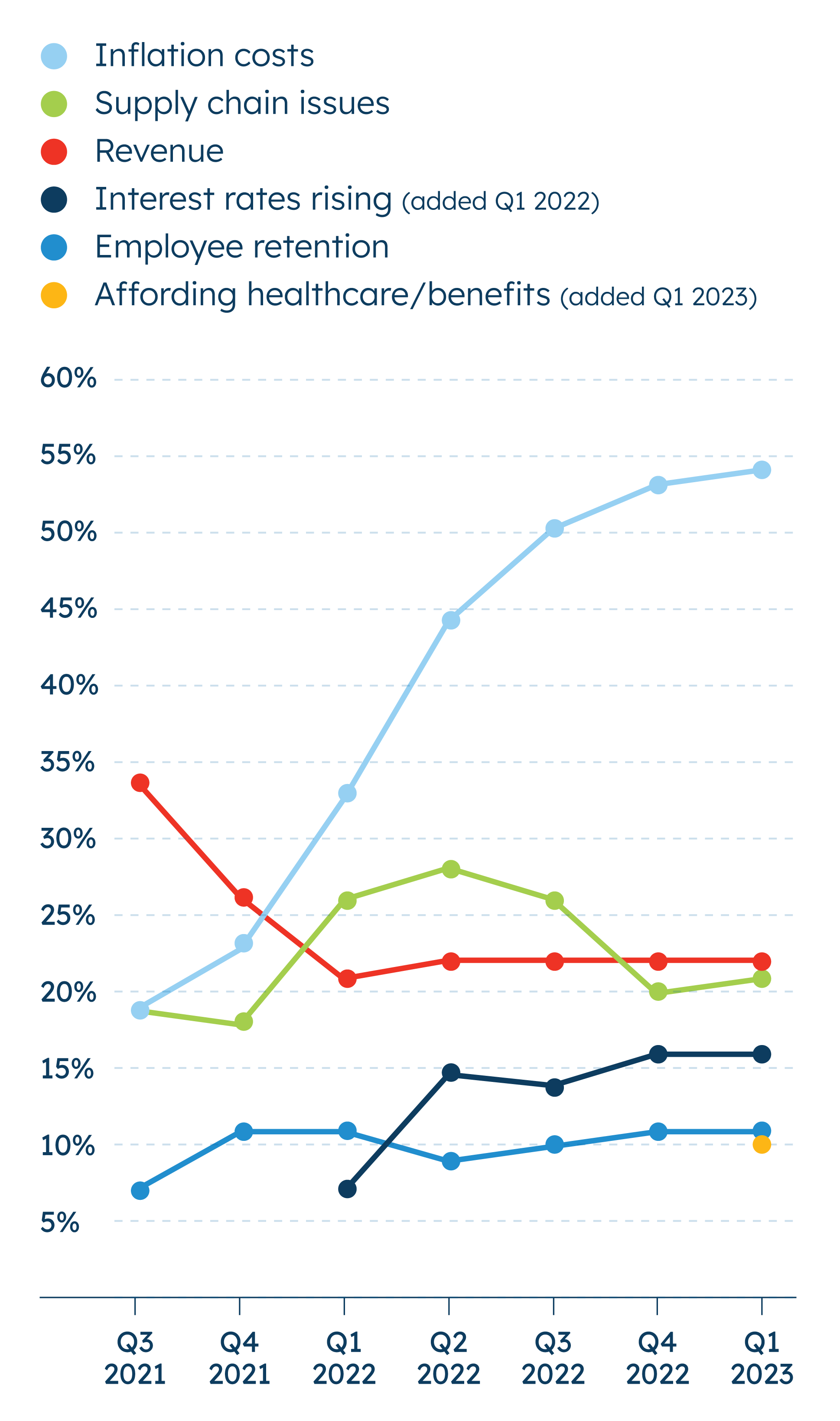

The impact of rising prices is widespread, as inflation is the top concern for small businesses regardless of region, number of employees, or sector. By sector, professional services small businesses (28%) are more likely to cite rising interest rates as a top concern than those in services (13%), retail (12%), and manufacturing (10%).

In contrast, just 22% of all small businesses surveyed see revenue as a top challenge, the next biggest challenge cited. Similarly, 21% said supply chain issues are a top concern and 16% said rising interest rates were. Just 9% said COVID-19 safety protocols are a top concern.

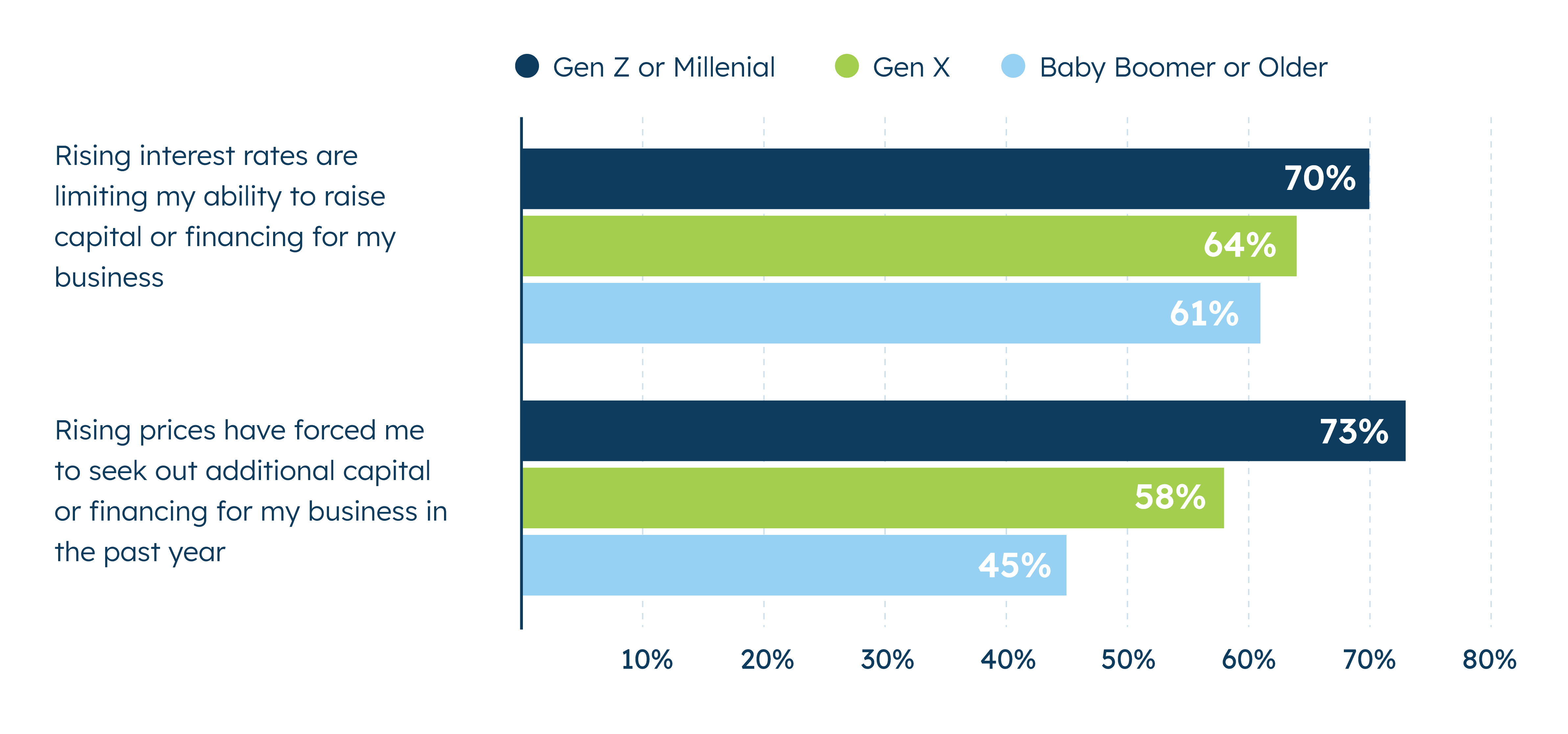

Rising interest rates are causing some in the small business community to say they are seeking out financing more earnestly. Two-thirds of small businesses (66%) say that rising interest rates are limiting their ability to raise capital or financing for their business. Larger small businesses—those with 20-500 employees—are more likely to say that inflation is forcing them to seek out more capital (75%) and that rising interest rates are limiting their ability to raise capital (77%) than those with fewer than 20 employees.

Meanwhile, rising prices have pushed many small businesses to seek more financing. A majority of small business owners (62%) say that rising prices have forced them to seek out additional capital or financing for their business in the past year. Younger generations of small business owners indicate they are feeling the pressure more keenly: Small businesses owned by Gen Z or millennials (73%) are more likely than both Gen Xers (58%) and baby boomers and older (45%) to say rising prices have forced them to seek out additional capital.

San Francisco, CA

As Perceived Access to Capital Declines, More Turn to Personal Savings

More small businesses perceive access to capital declining over the long run. To help make up the difference, more of them indicate they are opting to turn to personal savings to fund their businesses.

Almost half of the small business owners (49%) say their current access to capital or loans is good. This is slightly, but not significantly, lower than the share that rated their access to capital as good in Q2 2022 (54%). However, this is significantly lower than in Q2 20171 when 67% said their access to capital or loans was good.

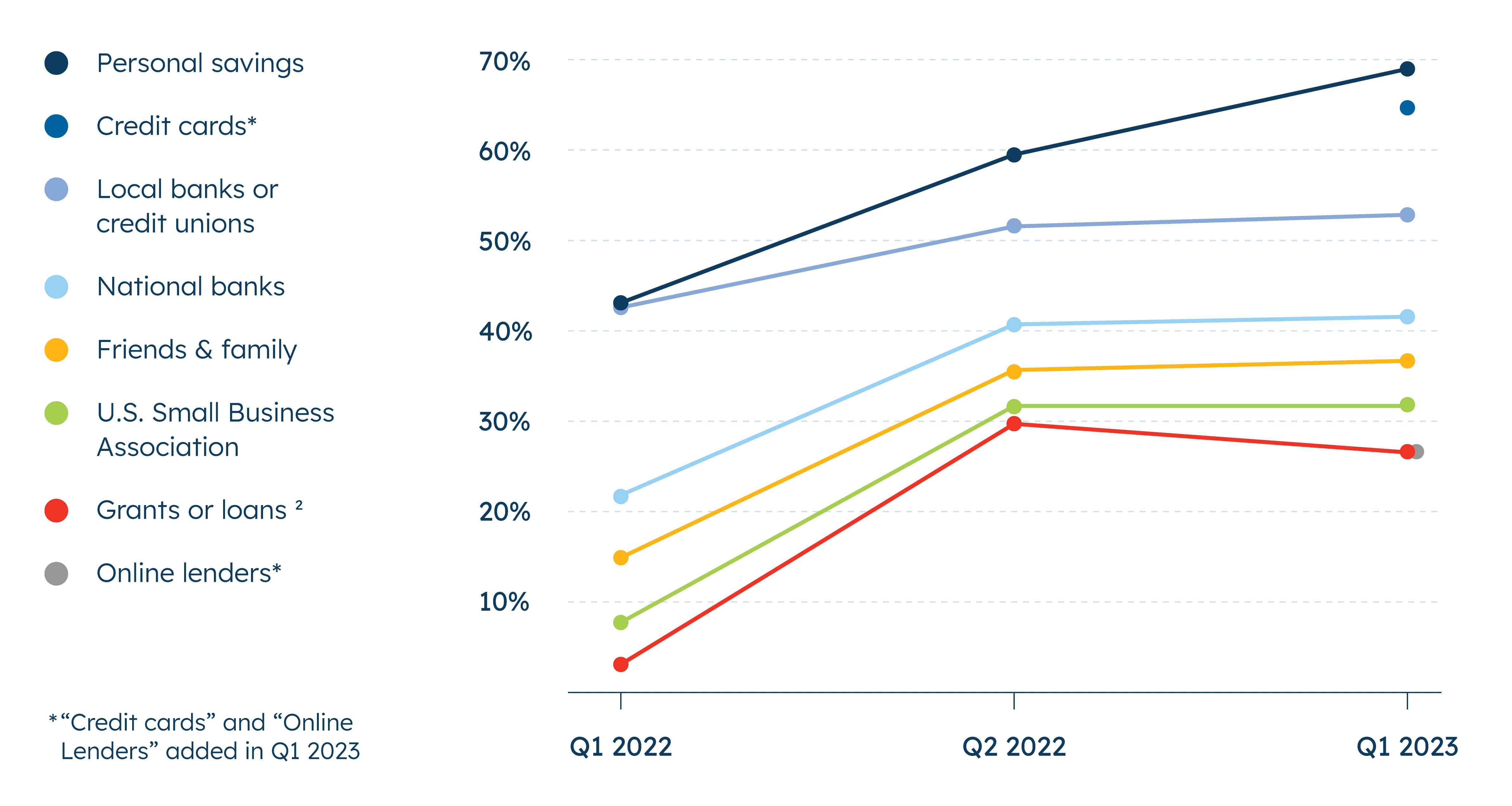

Personal savings are the most popular means of financing a small business, followed closely by credit cards. A majority of small businesses rely on their personal savings (69%), credit cards (64%), and local banks or credit unions (53%) for capital/loans.

Using personal savings to finance a small business is also growing in popularity. More small businesses now (69%) say they rely on personal savings to finance their business than in Q2 2022 (60%) and also up from Q1 2020 (43%).

Where small businesses turn for funding—and how they feel about their own access to capital—is also dependent on demographic factors.

Male-owned small businesses are more likely to say their access to capital or loans is good this quarter than female-owned businesses (52% vs. 43%, respectively). Male-owned businesses are also significantly more likely to report having gone to national banks (48% vs. 33% for female-owned businesses) for capital or financing. In contrast, female-owned businesses are significantly more likely to say they have turned to personal savings (74% vs. 66% for male-owned businesses). However, both men and women-owned small businesses say they are relying on personal savings more now than in Q2 2022.

Additionally, small businesses with younger owners are more likely to perceive they have poorer access to capital. Gen Z or millennial-owned small businesses are more likely to say their access to capital or loans is fair or poor (46%) versus 35% of Gen X-owned businesses and 34% of baby boomers or older-owned businesses. Gen Z or millennial-owned small businesses are also more likely than baby boomers or older generations to say they have turned to their personal savings or to friends and family for capital or financing to grow their businesses.

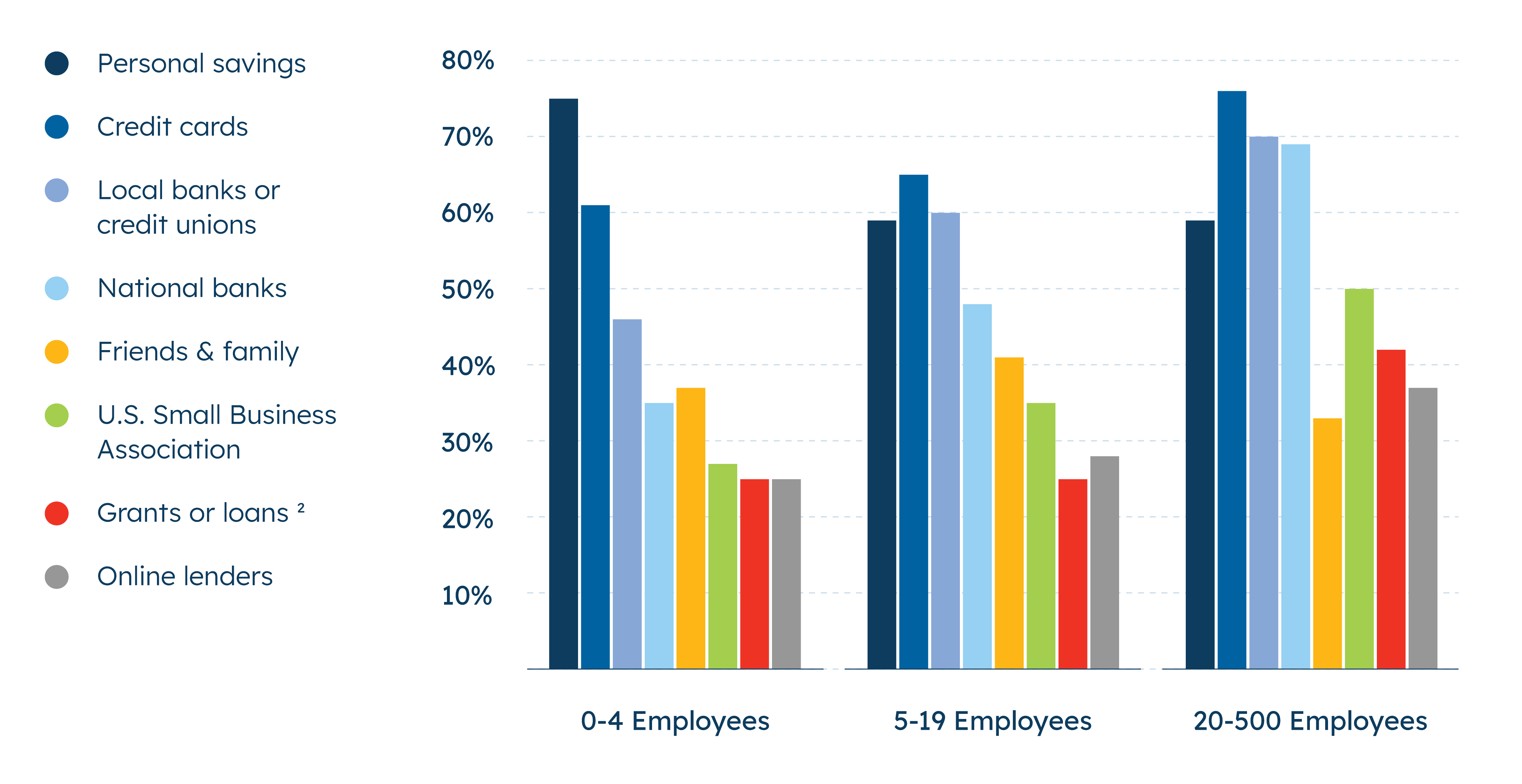

Perceived access to capital also increases with the number of employees a business has. Nearly three in four (73%) small businesses with 20-500 employees say they have good access to capital, compared to 55% of those with 5-19 employees, and just 41% of those with fewer than five employees.

Smaller small businesses are also more likely to turn to personal savings to fund their businesses. Small businesses with fewer than five employees are more likely to say they rely on personal savings to finance their business (75%) than those with 5-19 and 20-500 employees (59% each). In fact, more of the smallest businesses (less than five employees) now say they rely on personal savings than in Q2 2022 (65%). The largest small businesses, those with 20-500 employees, report turning to more sources for financing in general than those with fewer than twenty employees.

Perceptions of access to capital also vary by sector, with one sector in particular standing out. Small businesses in the services sector are less likely to rate their access to capital as good (38%) than those in retail (53%), professional services (52%), and manufacturing (51%).

Midvale, UT

Almost Half Say Limited Revenue Poses Barriers to Securing Capital

Small business owners cite varying barriers to securing financing for their business. When it comes to loan financing specifically, nearly half of small businesses (46%) say that not having enough revenue or assets to qualify for a loan makes it difficult for them to get financing.

When it comes to securing grants or loans, many find the application process cumbersome and confusing. More than half (52%) find the application process time-consuming, and 46% say the process is confusing to the extent that it makes it difficult to get financing or credit for their business.

Relatively less say that a bad credit score is a barrier to financing their small business. Around one in three (34%) small businesses say that having a bad credit score or credit history poses challenges to securing financing. In particular, Gen Z or millennial-owned small businesses (42%) are more likely than Gen Xers (29%) or baby boomers and older (26%) to say that having a bad credit score or credit history makes it difficult for them to access financing.

Almost half (46%) report that not having enough information on what sources of capital are available makes it difficult to secure financing. However, many small businesses (76%) say that they understand where to find sources of capital for their business.

There are some key demographic differences in perceived barriers to financing a small business. Women-owned businesses are more likely to say that confusing application processes (55% vs. 40% for men-owned) or limited information (56% vs. 41% for men-owned) have made it hard to get financing for their business. Similarly, minority-owned small businesses (56%) are more likely than non-minority-owned small businesses (43%) to say that not having enough information about sources of capital makes it difficult for them to get financing.

The smallest small businesses especially struggle with not having enough financial resources to secure a loan. Small businesses with fewer than five employees are most likely to report not having enough revenue or assets to qualify for a loan as a barrier to financing. In fact, half report facing this issue, compared to just 40% of small businesses with 5-19 employees and 36% of those with 20-500 employees. They are also more likely to say poor credit poses financing challenges than small businesses with 20-500 employees (38% vs. 22%).

Majority of Small Businesses Think Offering Health Insurance Is “Right Thing to Do”

The vast majority of small businesses see offering health insurance as a crucial recruitment tool, and as the right thing to do.

Nearly nine in ten small business owners believe offering employees health insurance is the right thing to do (89%) and that employer-sponsored health insurance helps attract and retain employees (85%).

Despite their belief in the value of employer-sponsored health insurance, small businesses indicate they face challenges when actually trying to offer those benefits. Nearly two in three (65%) say that navigating health insurance options for their business is time-consuming. Fewer now say that they have enough information to make informed decisions about health benefits for their employees than in Q2 20193 (65% vs. 74%).

Also, affordability is a top issue for some small businesses. Ten percent of small business owners rate affording employee benefits or healthcare as a top challenge facing the small business community. However, 62% believe the cost of health insurance crowds out other priorities for their business.

Across generations, Gen Z or millennial-owned small businesses are more likely than Gen Xers to say that figuring out how to offer benefits to full-time employees is difficult. Despite these challenges, Gen Zers and millennials (80%) are more likely than Gen Xers (70%) and baby boomers and older generations (62%) to say that their business prioritizes its employees when deciding where to invest capital.

Many small businesses also struggle with which benefits to offer and how to select them. A majority say they find it difficult to figure out what benefits to offer their business’ full-time employees (55%) and how to offer those benefits (51%). Another 58% say they wish they had outside help when it comes to offering employee benefits.