Index Down Slightly as Small Businesses See Weaker Economy

This quarter, small businesses’ concerns over inflation remain at record highs and their perceptions of the economy have slightly dimmed according to the latest MetLife & U.S. Chamber of Commerce Small Business Index. However, most small business owners continue to feel good about their own business health and cash flow.

Overall, small business owners appear to be in a holding pattern, as many of their day-to-day operational and future expectations are in line with the previous two quarters.

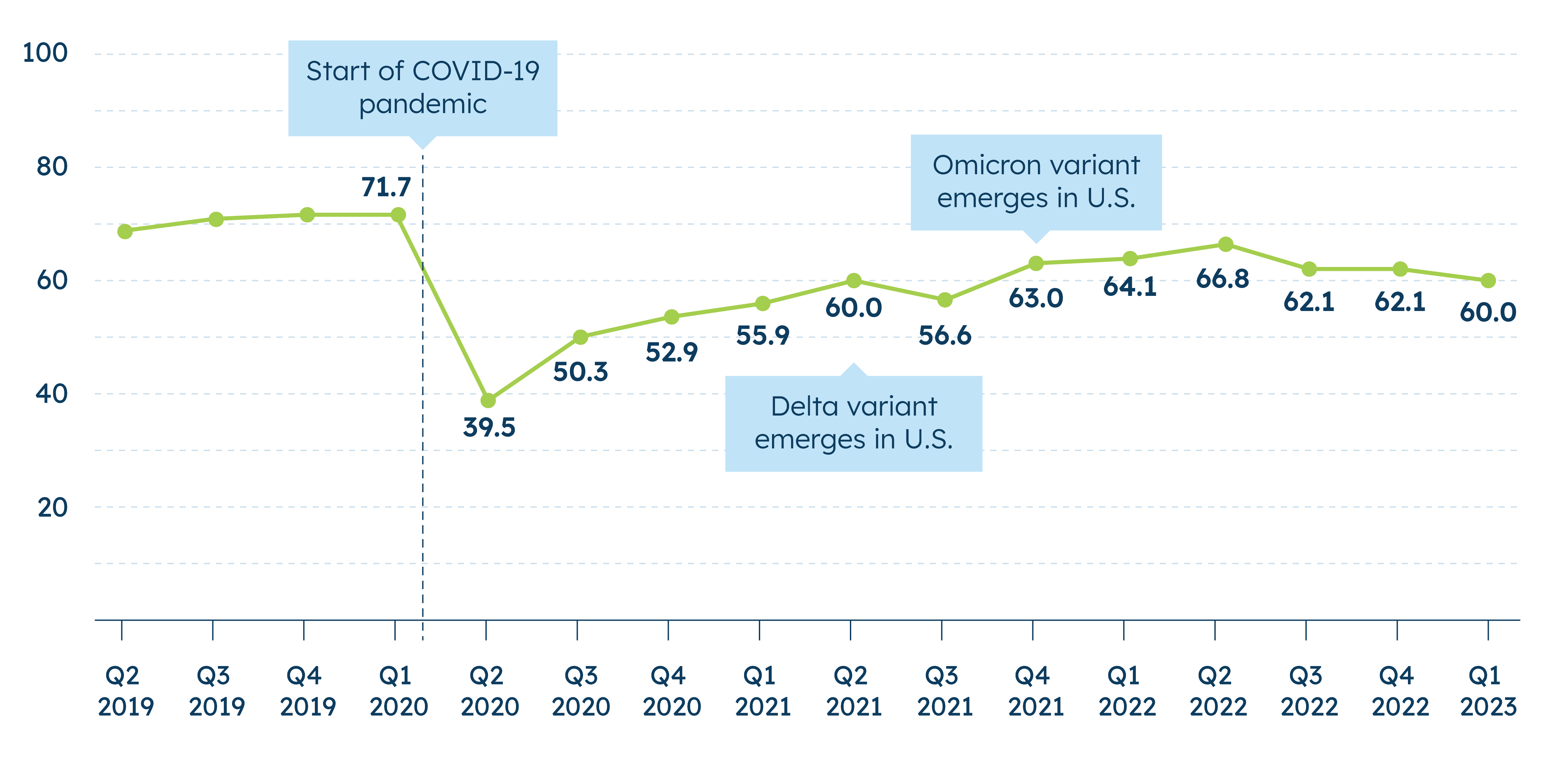

This quarter’s score of 60.0 is a small dip from last quarter’s score (62.1) and is mostly driven by worsening perceptions of the national economy. The Index is slightly lower than its post-pandemic high of 66.8 in Q2 2022 and closer to where it was in early 2021.

More than half (54%) of small business owners continue to cite inflation as their top concern, the fifth consecutive quarter that inflation has topped the list of challenges. In comparison, other issues like revenue, supply chain issues, and rising interest rates remain second-tier concerns.

Over the long term, small businesses’ perceived access to capital has declined significantly: Nearly half (49%) of small business owners say their current access to capital or loans is good, which is slightly, but not significantly, lower than in Q2 2022 (54%) and markedly lower than it was in Q2 2017 (67%).1

Finally, most small businesses see the benefit in offering health insurance coverage but often find the task of selecting the right options burdensome. A wide majority of small businesses say that offering employees healthcare is the right thing to do (89%) and that employer-provided healthcare helps attract and retain employees (85%). However, roughly seven in ten (65%) say that navigating healthcare options for their business is time-consuming.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q1 is 60.0. The Index score for Q4 2022 was 62.1.