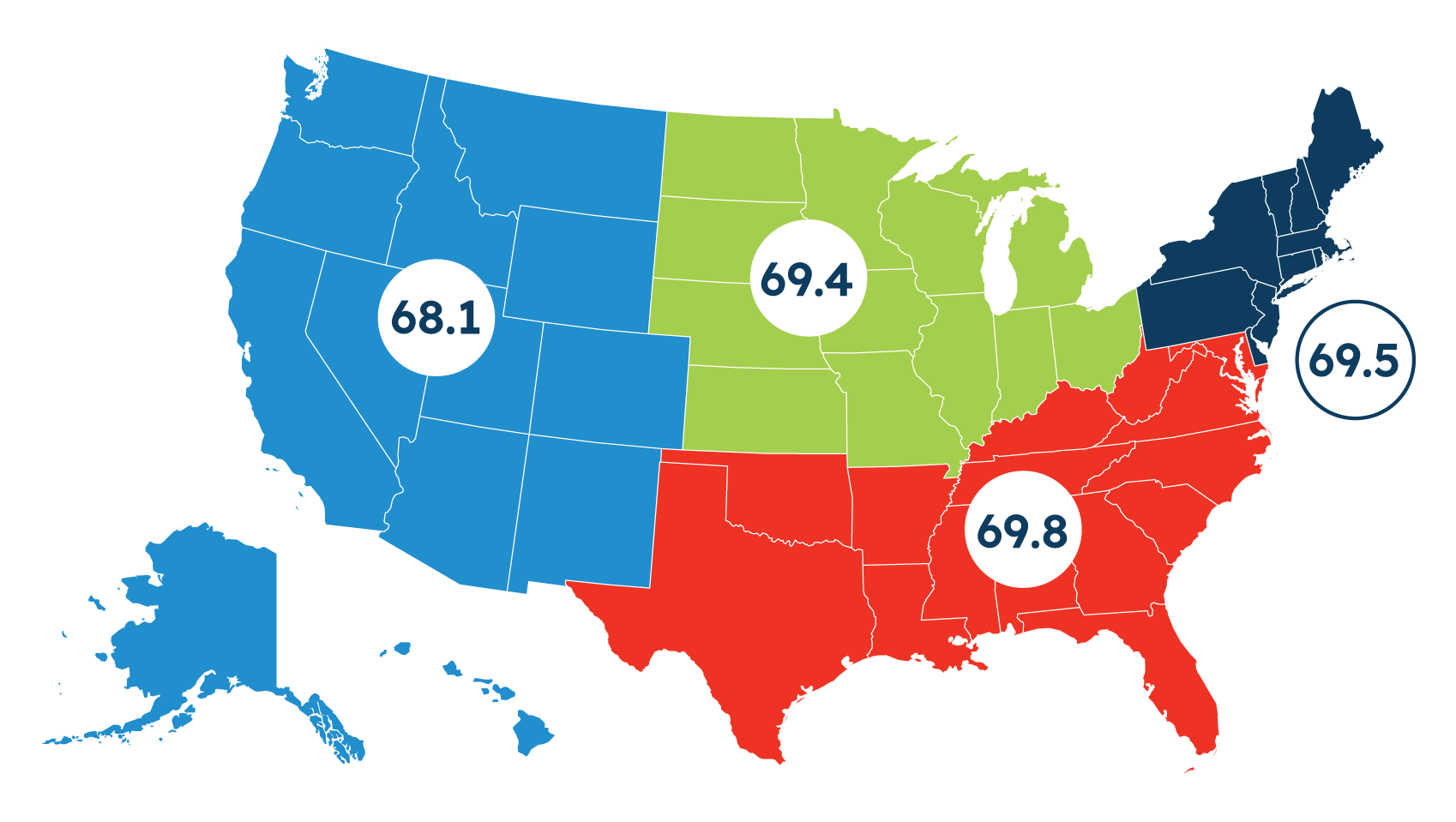

Regional Scores

National Score 69.2

South

West

Midwest

Northeast

Northeast (69.5)

Northeastern small businesses are increasingly positive about both the economy and business operations this quarter. Half of Northeastern small businesses say their local economy is in good health and 42% say the national economy is in good health, increasing by 19 percentage points and 12 percentage points, respectively, since last quarter. Similarly, seven in ten Northeastern small businesses say their business is in good health and they are comfortable with their cash flow.

South (69.8)

Nearly three in ten (28%) Midwestern small businesses say the U.S. economy is in good health. This is slightly, but not significantly, below the national average, but represents a significant positive shift in the region compared to last quarter (+11 percentage points). In contrast, Midwestern small businesses are less likely to report that hiring has increased this quarter (11% in Q3 vs. 29% in Q2). Regardless, Midwestern small businesses remain optimistic about improving revenue and investment next year.

Midwest (69.4)

More Southern small businesses say their business is in good health (74% vs. 63% in Q2) this quarter and Southern respondents feel slightly better than the national average when it comes to business health. Similarly, more are comfortable with cash flow (76% in Q3 vs. 66% in Q2), and report that they have increased staff in the past year (28% vs. 19%). Their perspectives around the business environment and expectations for the future are generally stable.

West (68.1)

Western small businesses are less negative about the national economy this quarter. Just 37% now say the U.S. economy is in poor health, down 17 percentage points since Q2 and 20 percentage points since Q1. Here, the gap between those who say the U.S. economy is good versus those who feel it is poor has closed significantly: They’re now the same (37% good and 37% poor this quarter).