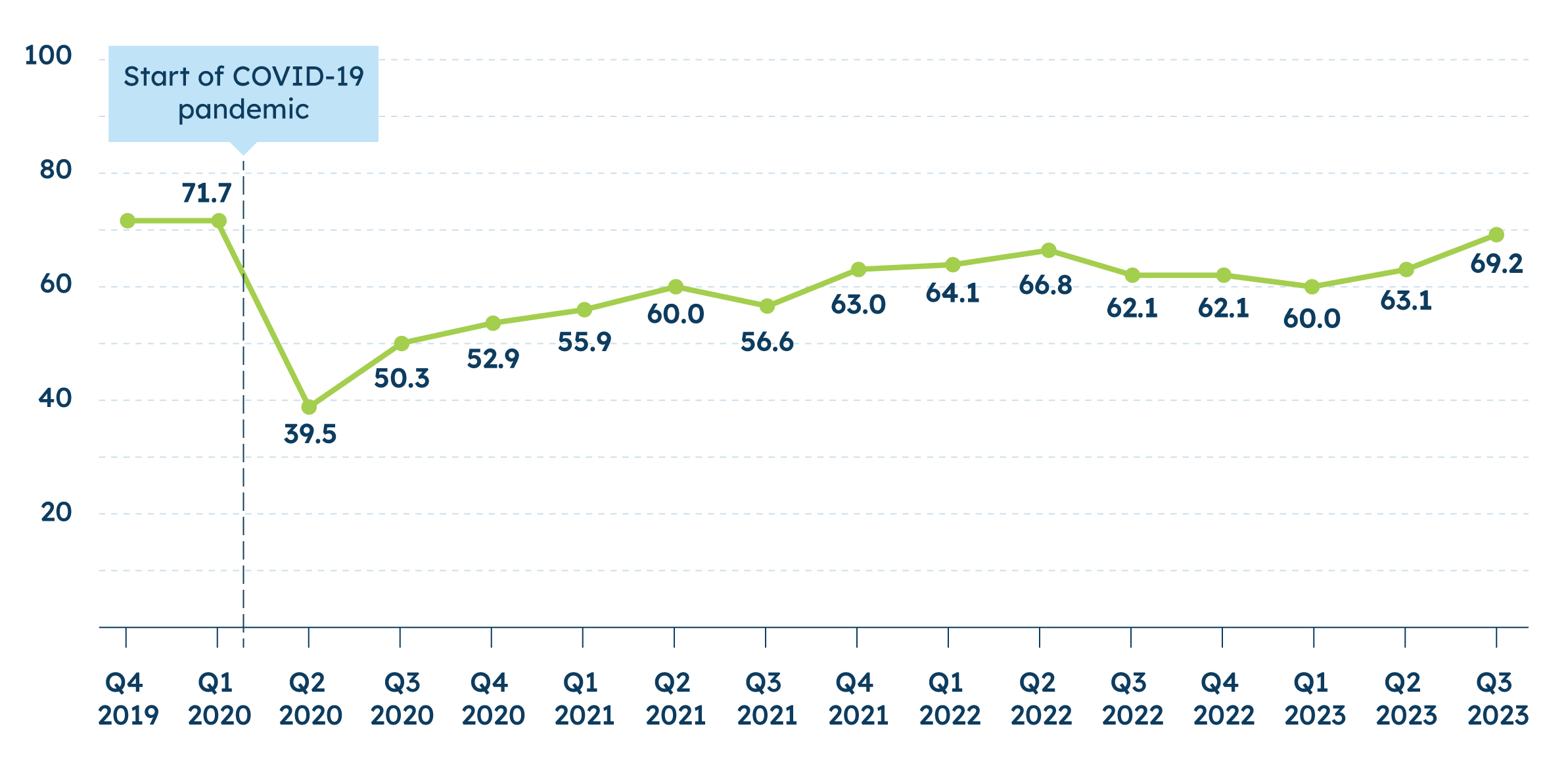

Index Reaches Post-Pandemic High As More See Improving Economy

This quarter, the MetLife & U.S. Chamber of Commerce Small Business Index hits a post-pandemic high as more small businesses see an improving economy. The Q3 2023 MetLife & U.S. Chamber of Commerce Small Business Index rises to 69.2 this quarter, an increase since last quarter (63.1) and the highest reading since the start of the COVID-19 pandemic in early 2020.

Small businesses are clearly more positive about the economy and their overall business health this quarter. Currently, one-third (33%) of small businesses say the U.S. economy is in good health, a nine-percentage point increase from last quarter. A similar number (38%) feel the same about their local economy (up eight percentage points from Q2). Small businesses also are feeling better about their business health and cash flow : Two in three (66%) small businesses report that their business is in good health and roughly seven in ten (72%) say they are comfortable with their cash flow. Both measures jumped several points from last quarter.

In addition to increasing optimism about the local and the national economies, small businesses remain optimistic about future revenue and many have plans to increase investment and hiring. 71% say they expect next year’s revenue to increase, the highest levels recorded since the start of this survey (Q2 2017). In addition, 42% of small businesses say they plan to increase investment in the next year and two in five (40%) small businesses say they anticipate increasing staff in the next year.

At the same time, the survey (conducted between July 20 – August 8, 2023) shows inflation and rising interest rates are persistent concerns for small businesses, and they are making themselves felt in different ways. A majority (52%) of small businesses continue to report that inflation is their biggest challenge, a consistent pattern over the past year. This quarter there was also notable concern about growing wage expectations: A majority (56%) of small businesses say keeping up with employee salary expectations is a challenge. At the same time, slightly fewer small businesses say that rising interest rates are limiting their ability to raise capital or financing for their business (70% in Q3 vs. 76% in Q2 2023).

Compared to last quarter, small businesses are less concerned about interest rate hikes (17% say it’s one of their biggest challenges, similar to late 2022 and early 2023). Furthermore, as they currently feel better about their own bottom line, some seem to be widening their focus to other issues, such as employee retention or affording employee benefits or healthcare.Small businesses are also actively addressing employee mental health and well-being as priorities and that sentiment has risen compared to two years ago. In fact, 68% now say they utilize at least one resource to assist with employee mental health and well-being. Many small businesses also report leaning into their small, tight-knit family culture to retain employees—perhaps making them stand out as they compete to retain employees and attract new recruits.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q3 is 69.2. The Q2 Index score was 63.1.