Operations, Environment & Expectations

Small Business Operations: Fewer “Very” Comfortable With Cash Flow

Seventy-four percent of small businesses say they are comfortable with their cash flow, in line with last quarter. However, fewer report being very comfortable with their cash flow (24%) compared to Q3 (31%). Similar to last quarter, small businesses in retail report less comfort with their cash flow than those in manufacturing and professional services.

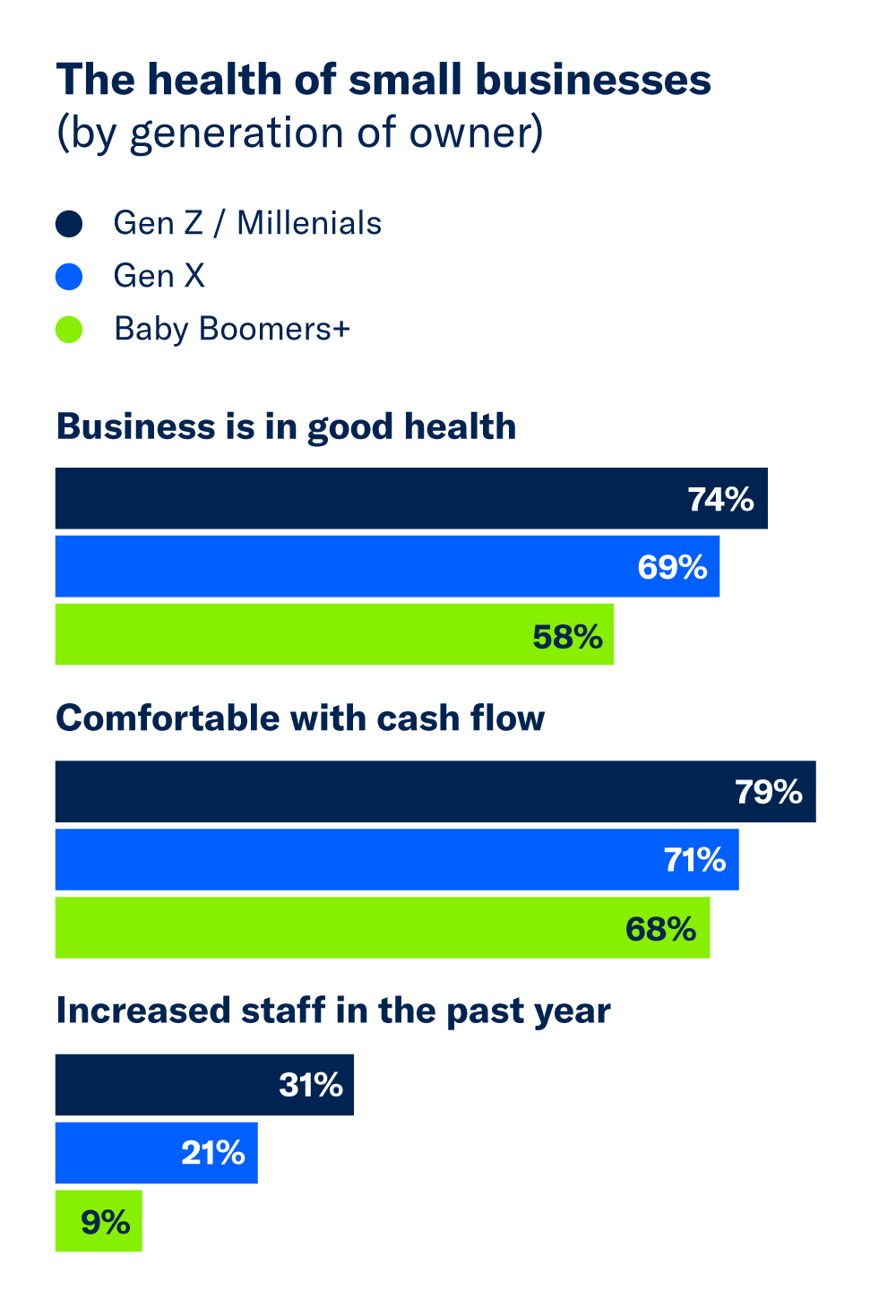

By generation, small businesses owned by Gen Zers or Millennials and Gen Xers are significantly more likely than those owned by Baby Boomers and older to report that their business is in good health. Gen Zers/Millennials are also more likely to report comfort with cash flow than their older counterparts.

When it comes to staffing, 23% of small businesses report an increase in staff in the past year, down five percentage points from last quarter (28%). Small businesses in operation for 10 years or less are more likely than those in operation for 21+ years to say they have increased staff in the past year (24% vs. 11%), continuing what has been a year-plus trend. Additionally, businesses in services are less likely than those in other sectors to report they have increased staff in the past year.

Small Business Environment: Views of Economy Stable

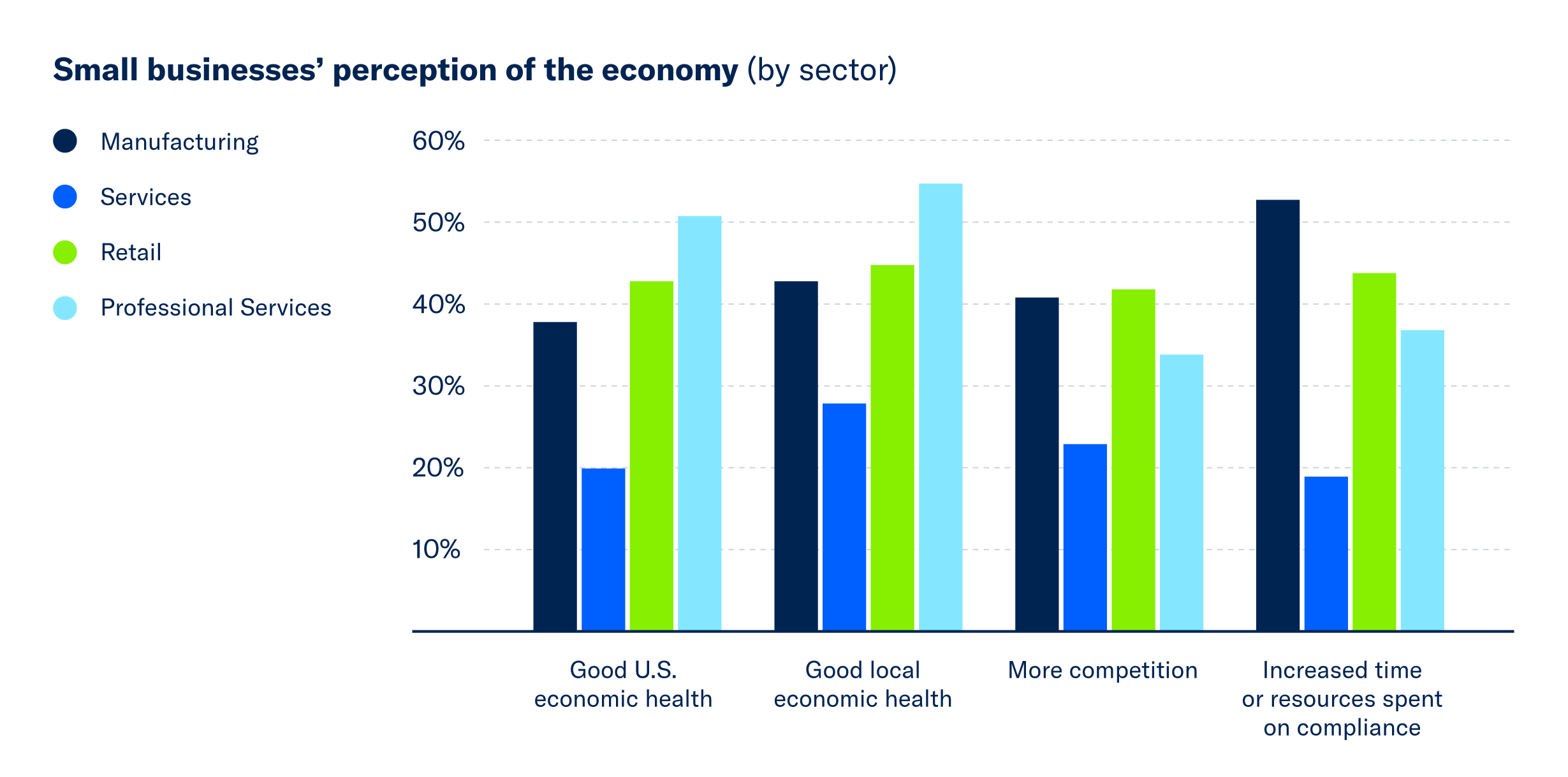

Small businesses’ perceptions of their local economic environment remain high, albeit dropping three percentage points from last quarter. Forty-three percent now say their local economy is in good health, a slight softening from last quarter (46%), but up from Q4 2024 (38%).

Small businesses see a more consistent, but slightly less positive nationwide situation, with 38% saying the U.S. economy is in good health, stable from Q3 (40%) and an increase from this time last year (32%).

When it comes to competitors, slightly fewer report seeing competition in their area. Thirty-four percent say competition from smaller or local companies has increased compared to six months ago, down four percentage points from last quarter (38%) and in line with Q4 2024 (34%).

When it comes to red tape, 37% of small businesses are now reporting spending more time on compliance, down from last quarter (42%).

By sector, small businesses in services are significantly less likely than those in other sectors to report that the national economy and the local economy are in good health and that they are seeing more competition. By generation, small businesses owned by Gen Zers/Millennials are more likely than those owned by Gen Xers and Baby Boomers and older to report that they are seeing increased competition.

Small Business Expectations Decline Slightly

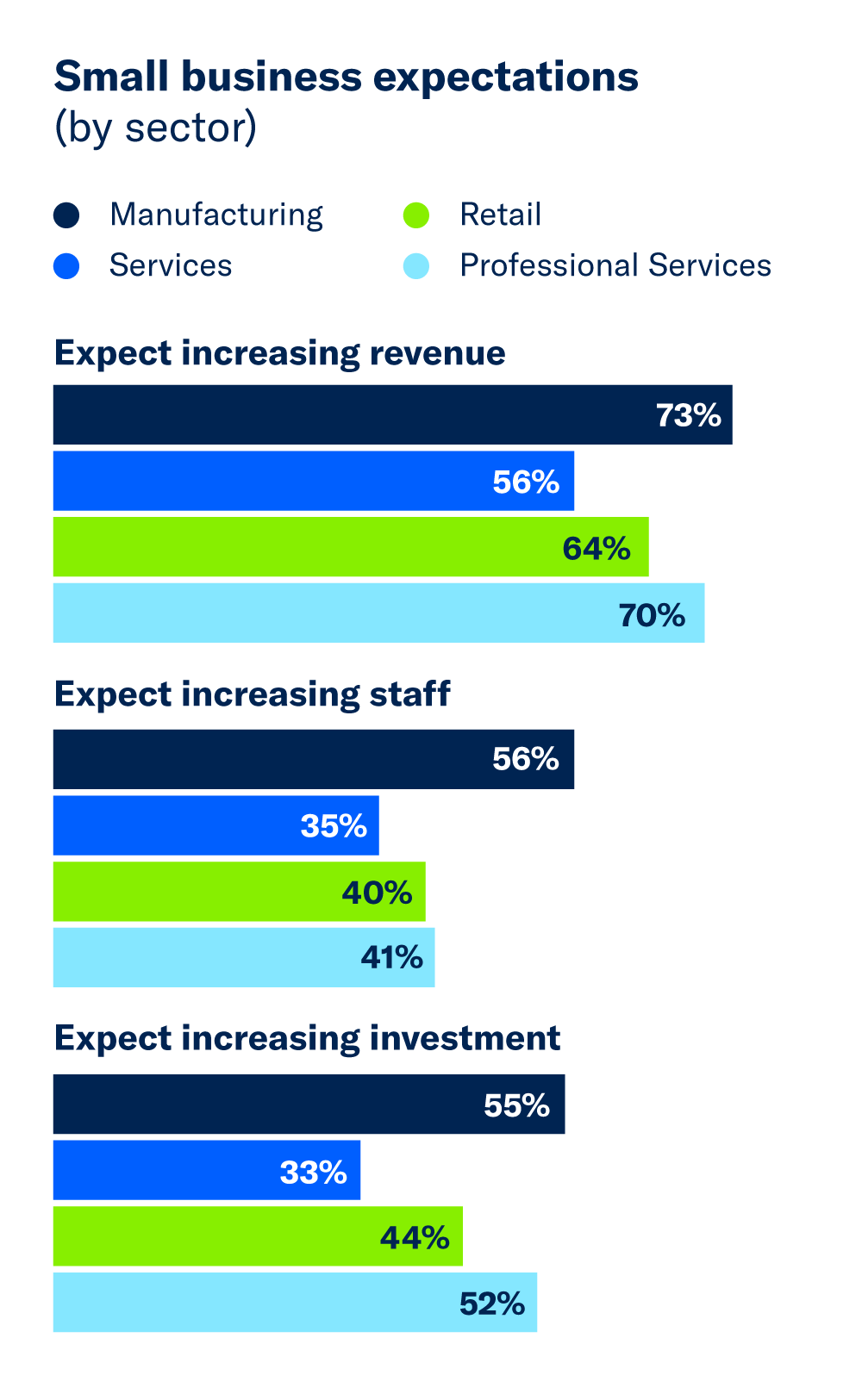

Forty-four percent of small businesses expect to increase investment in the next year, a slight but not significant decrease from last quarter (47%) and in line with Q4 2024 (46%). Likewise, 65% say they expect revenue to increase in the next year, down slightly from last quarter (69%) and matching Q2 2025 (65%).

On the other hand, 42% of small businesses expect to increase hiring in the next year, stable from both last quarter (44%) and this time last year (41%).

By sector, small businesses in manufacturing and professional services are significantly more likely than those in services to expect an increase in investment and revenue. Businesses in manufacturing are also significantly more likely than those in other sectors to expect an increase in staffing.

By business size, those with twenty or more employees are more likely to expect increases in investment and staffing than their smaller counterparts.

Similar to last quarter, across each measure of business expectations —future increases in revenue, hiring, and investment— businesses owned by Baby Boomers are older are significantly more pessimistic than their younger counterparts.