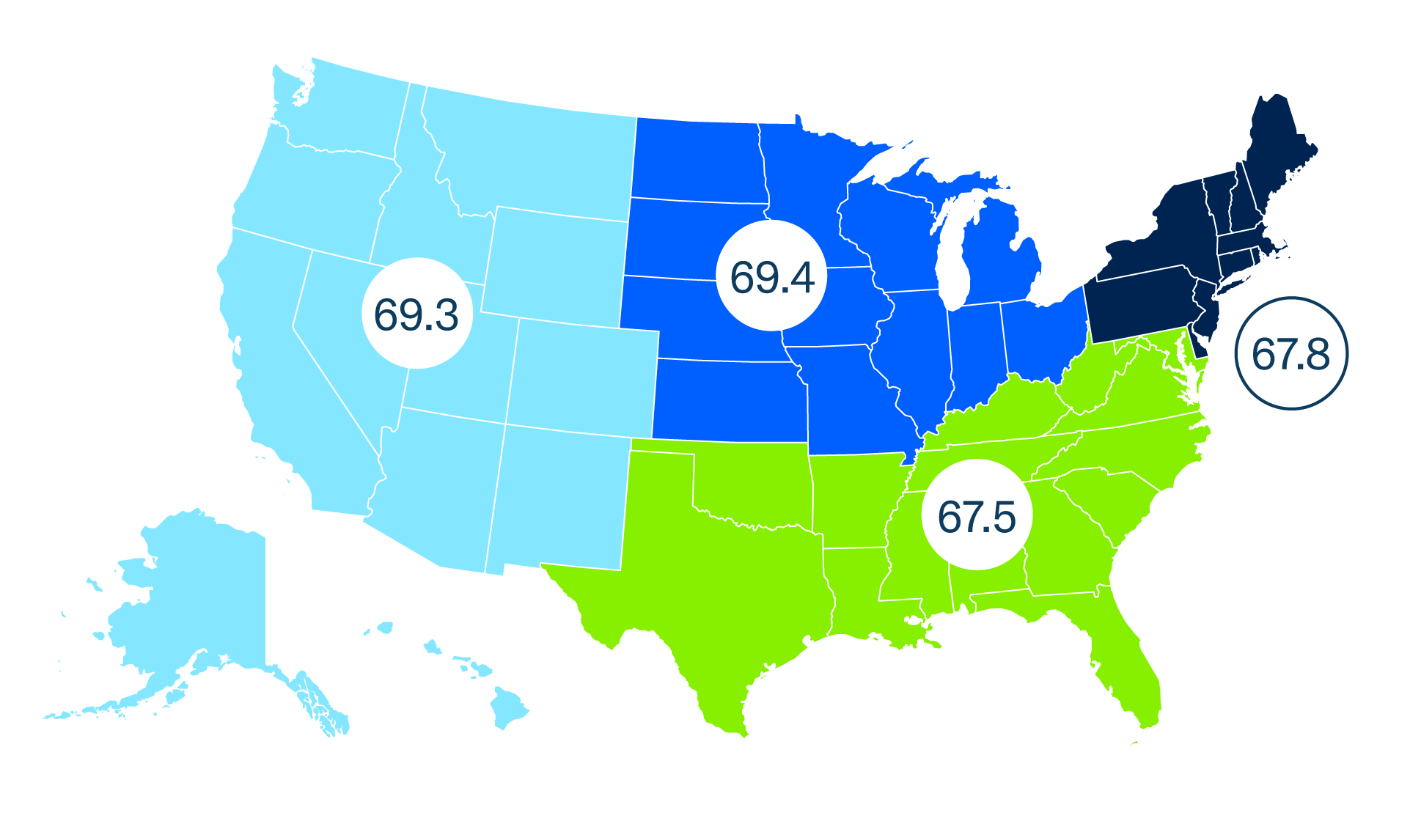

Regional Scores

National Score 68.4

South

West

Midwest

Northeast

Northeast (67.8)

This quarter marks a decline in reported business health and views of the national and local economies. Two in three (66%) now report that their business is in good health, down ten percentage points from last quarter (76%) and returning to levels seen in Q2. Around two in five say that the national (37%) and local (38%) economies are in good health, a slight softening from Q3 (down seven and eight percentage points, respectively).

South (67.5)

The South Index score showed the biggest decline among all regions this quarter, and sentiments have softened in many areas. Seventy-two percent of Southern small businesses report that their business is in good health, compared to 77% in Q3. A similar percentage (73%) are comfortable with their cash flow, down nine percentage points from last quarter (82%). Thirty-eight percent say that the national economy is in good health, down from Q3.

Midwest (69.4)

Thirty-four percent of Midwestern small businesses report seeing more competition from local businesses, a nine percentage point decrease from Q3 (43%). Two in five (41%) plan to increase investment, down significantly from last quarter (58%). However, 74% of Midwestern small businesses say their business is in good health, in line with Q3 (69%). Similarly, 40% say the national economy is in good health, in line with last quarter.

West (69.3)

The Index score in the West shows the smallest drop among all regions. Sixty-five percent of small businesses there say their business is in good health, and 71% say they are comfortable with their cash flow, both in line with last quarter. Forty-two percent feel their local economy is in good health, a slight improvement from Q3 (36%). However, 30% report seeing more competition from local businesses, down eight percentage points from last quarter (38%).