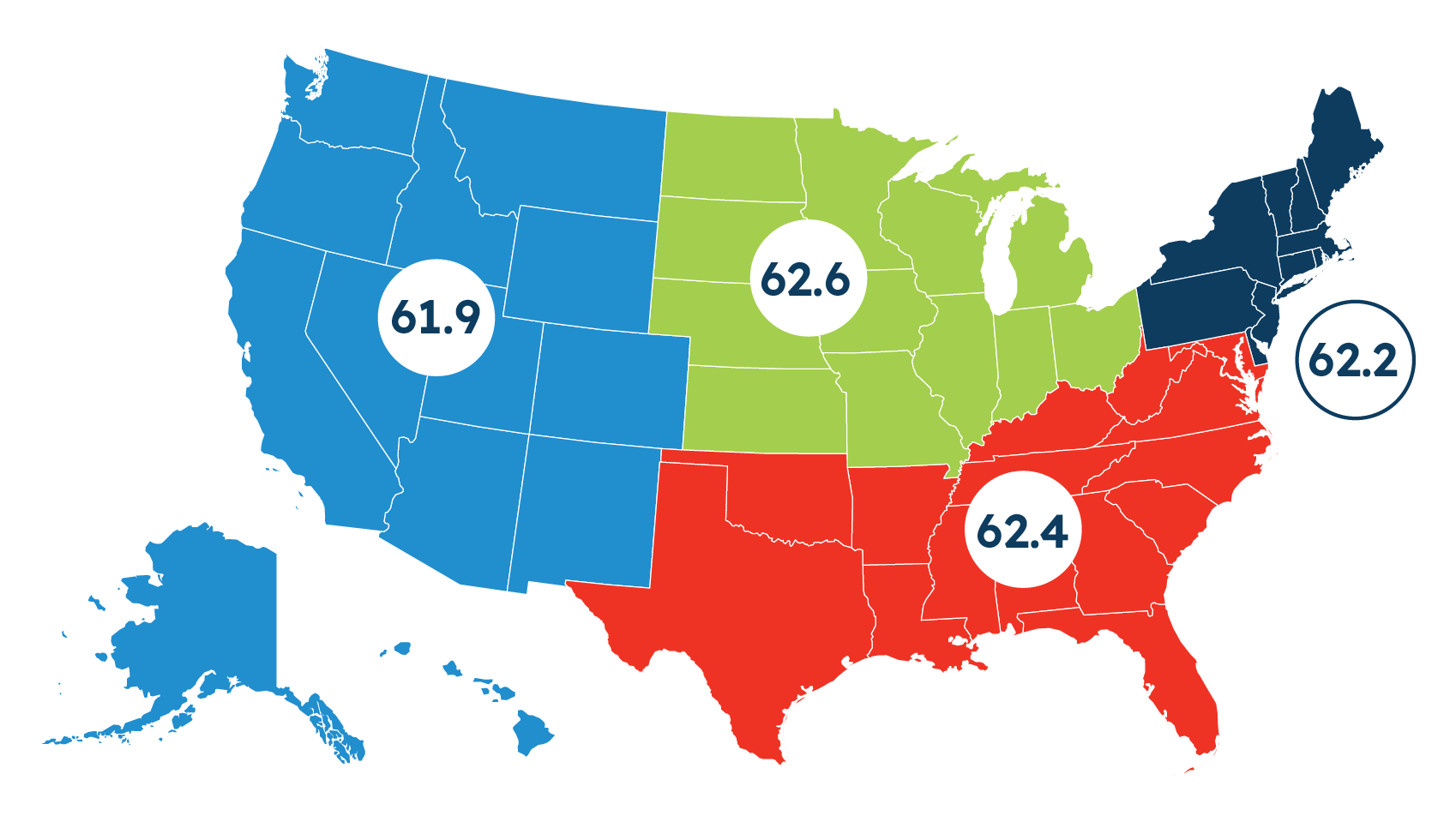

Regional Scores

National Score 62.3

South

West

Midwest

Northeast

Northeast (62.2)

Small businesses in the Northeast have a more positive outlook on national economic health this quarter: 39% say the U.S. economy is in good health, a 13-percentage point increase from last quarter. Northeastern small businesses’ plans to increase staff or revenue in the next year have increased from this time last year. Forty percent now say they plan to increase staff, and 68% say they plan for increased revenue.

South (62.4)

Currently, about one-third (32%) of Southern small businesses say the national economy is in good health, and two in five (40%) say their local economy is in good health. Each of these measures has improved by more than 10 percentage points from this time last year. About one-third of Southern small businesses say they plan to increase their staff (32%) or increase their investments (35%), down 13 and 12 percentage points, respectively.

Midwest (62.6)

Since last quarter, small businesses in the Midwest report no significant changes in measures of perceived business operations, environment, and expectations. For the third consecutive quarter, about one-fourth (26%) of Midwestern small businesses report that the U.S. economy is in good health. While consistent quarter-over-quarter, slightly more Midwestern small businesses now say the U.S. economy is in good health compared to this time last year, when just 16% said the same.

West (61.9)

Western small businesses perceptions of the business environment have slightly improved since the end of 2023. One-third of small businesses in the West now say the U.S. is in good economic health, up by 10 percentage points from Q4 2023 (23%). However, compared to their counterparts in the Northeast and Midwest, they are also more likely to report experiencing an increase in local competition.