Worries About Attracting, Retaining Talent Steadily Grow Over Past Year

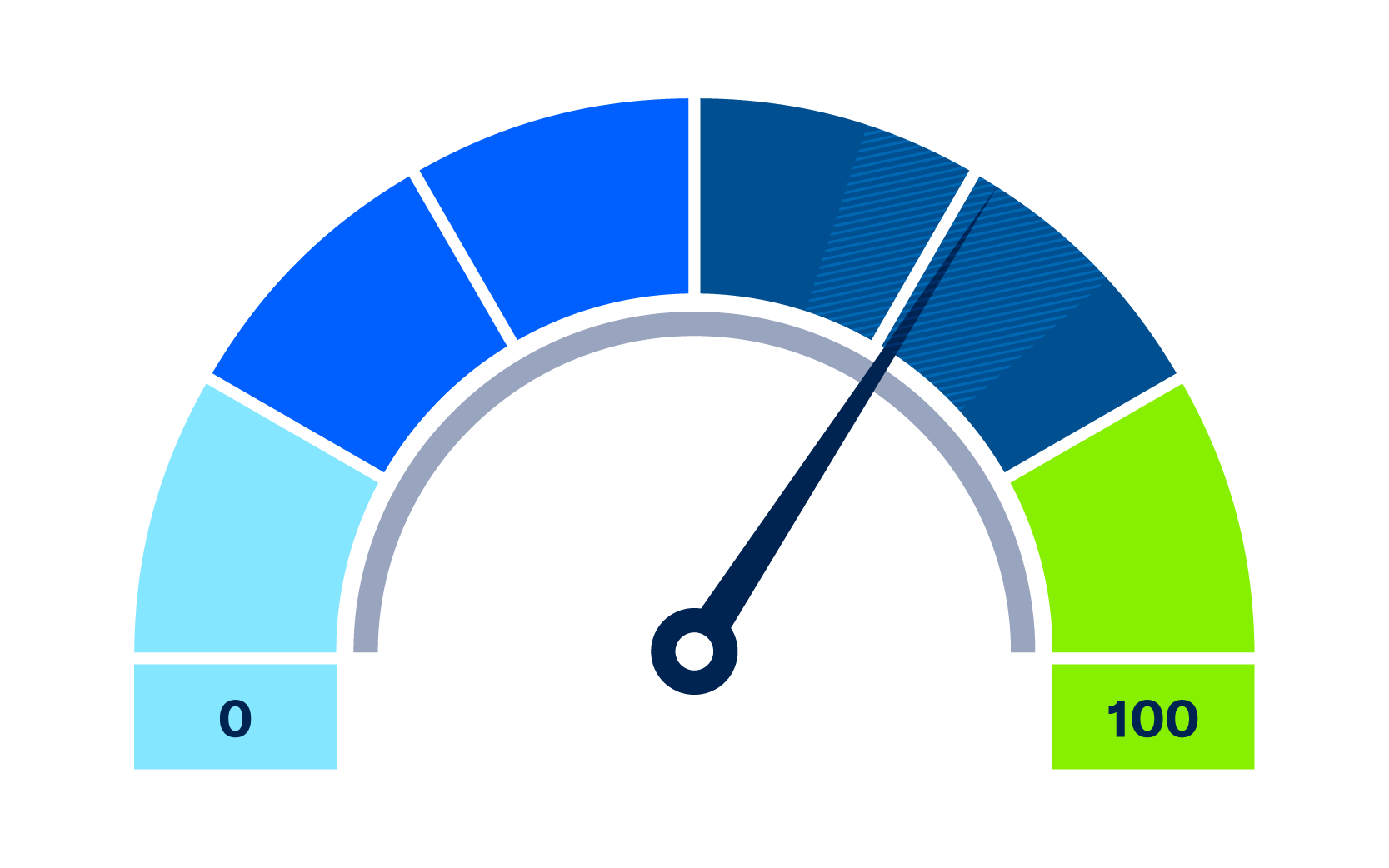

The MetLife & U.S. Chamber of Commerce Small Business Index is 68.4 this quarter, down from last quarter (72.0) and similar to Q4 2024 (69.1).

Most measures this quarter do not show a significant decline, however, there is a slight softening across some key measures, including comfort with cash flow and future hiring/investment expectations.

Notably, fewer small businesses report being very comfortable with their current cash flow this quarter. Additionally, views of their local economy have declined slightly, with two in five (43%) small businesses saying that their local economy is in good health. At the same time, views of the national economy are stable: 38% say the same of the U.S. economy, similar to last quarter. Longer term, outlooks for both the national and local economies are more optimistic compared to this time last year.

This quarter, inflation continues to be the biggest challenge facing small business owners, but these inflation concerns have remained stable for the past two quarters. However, more small businesses are reporting increased challenges for both revenue and employee retention. Slightly more small businesses cite employee retention (17%) as a challenge this quarter (was 12% in Q4 2024). In the same vein, compared to this time last year, concerns about attracting talent have more than doubled. This quarter, 14% said attracting talent was a top challenge (up from 6% in Q4 2024).

Inflation is set to play a role this holiday season for small businesses. A majority of small businesses expect to raise prices (58%) and have less revenue (52%) than usual due to inflation, though at a lower level when compared to Q4 2022, when inflation was at its peak (and when 69% expected to raise prices and 61% expected to have less revenue).

While the holiday season is always important for small businesses—this year it’s more vital than usual. Nearly four in five small businesses say that the holiday season is important for their overall profit this year, an increase from this same time last year. More plan to hire seasonal employees, as well as offer seasonal discounts and extend regular business hours, compared to Q4 2024. Lastly, a majority (64%) of small businesses report donating to local charities this past year and most (65%) plan to do the same this holiday season.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q4 is 68.4. The Q3 2025 Index score was 72.0.