Operations, Environment & Expectations

Small Business Operations

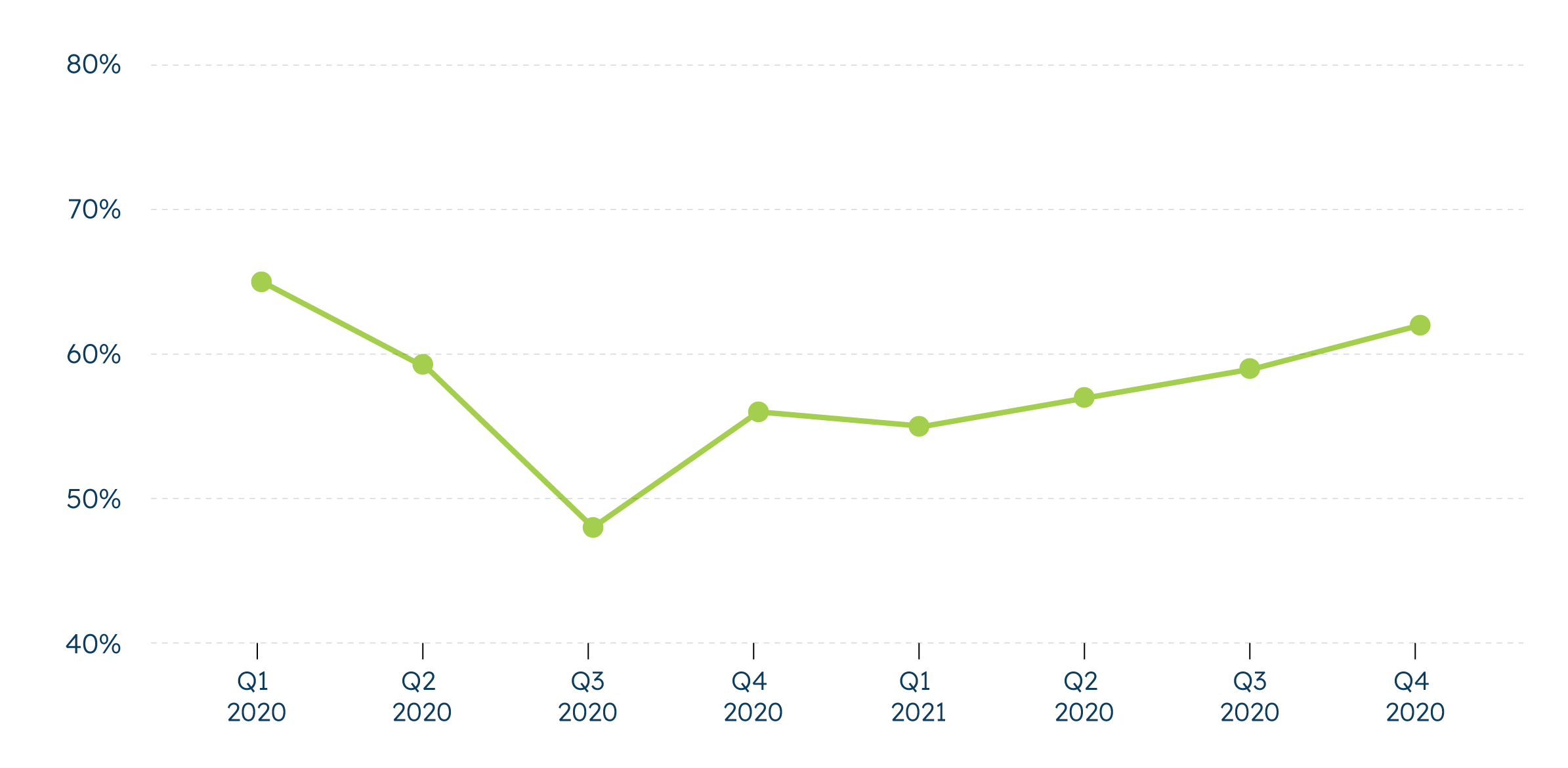

Small business operations are statistically similar to last quarter, but small changes are adding up: small business comfort with cash flow is a few points off levels seen before the pandemic began.

Comfort with cash flow sits at 62% overall, statistically in line with last quarter’s 59%. Comfort with cash flow is close across all small business sectors (60-65%) and all are nearing or above their pre-pandemic readings in Q1 2020 (was 65% total then). Significantly, retailers (65%) experienced a significant eight-point increase from Q4 2020 and are the only sector to surpass its reading one year ago (58% in Q1 2020).

Across generations, Millennial business owners report the highest degree of comfort with cash flow at 74%, compared to 56% among Generation X and 59% among Baby Boomers.

Over half of small businesses (52%) say their business is in good overall health, in line with sentiments through the last ten months. Regionally, Northeastern small businesses saw a notable upward trend this quarter, with those rating their business’s overall health as good up 12 points from Q4. This quarter, 50% of small businesses in the Northeast are comfortable with the health of their business. In the West, small businesses reported a seven-point drop in overall business health, falling from 56% in Q4 2020 to 49% now. Small businesses across the Northeast, Midwest and West are now approximately on par (ranging from 48% to 50%), while Southern small businesses are most likely to report their business in good health (56%).

Despite a tough 2020, most small businesses report retaining the same size staff over the last year. However, more report reducing staff than increasing staff numbers. This quarter, fewer small businesses report retaining the same level of staff over the past year (55% in Q1 2021 vs. 64% Q4 2020). More say they reduced staff over the past year this quarter (27% in Q1 2021 vs. 18% in Q4 2020). However, only 16% said they had reduced staff over the past year in Q1 2020. This change in sentiment may reflect small businesses taking stock of the impact of the virus as we come up to the one-year mark and thinking more about changes to their business.

This quarter’s shift in having retained staff to having reduced staff over the last year can be seen across most regions and sectors, particularly across the Midwest and among manufacturers. This quarter, 17% of small businesses report increasing staff over the past year (exactly the same number who reported they had increased staff in Q1 2020).

Small Business Environment

Currently, a majority of small businesses (59%) rate the overall U.S. economy as poor, bringing overall views down nine points from the optimism of Q4 2020 when 50% saw the national economy as poor. For comparison, before the pandemic (in Q1 2020) only 12% of small businesses said the national economy was poor, representing a 47-point increase from then compared to this quarter.

This more pessimistic view of the national economy is generally true across regions and sectors. Overall, most regions’ views of the U.S. economy fell back, except in the West (25% view the overall health of the economy as good, same as Q4 2020.) The sharpest drop occurred in the Midwest (12% vs. 31% in Q4 2020). Manufacturers, retailers and professional services firms all have roughly equivalent views on the economy (between 25% and 27% believe that it is in good health). However, just 6% of those in the services industry say the U.S. economy is in good health, down from 24% in Q4 2020. In contrast, minority-owned firms are more likely to see a good national economy: 29% characterize the national economy as good (compared to 19% of non-minority-owned businesses).

A growing number of small businesses also rate their local economy’s overall health as poor (up from 32% in Q4 2020 to 43% now). While views on the local economy look fairly similar across regions (40-46% say it is poor), pessimistic outlooks grew most noticeably in the Midwest and South (up 14 and 16 points, respectively) from last quarter. In comparison, those saying their local economy is poor in the Northeast and West increased just three and five points, respectively. Meanwhile, minority-owned small businesses tend to see better local economies: 38% say their local economy is good while 24% of non-minority-owned small businesses say their local economy is good.

Small Business Expectations

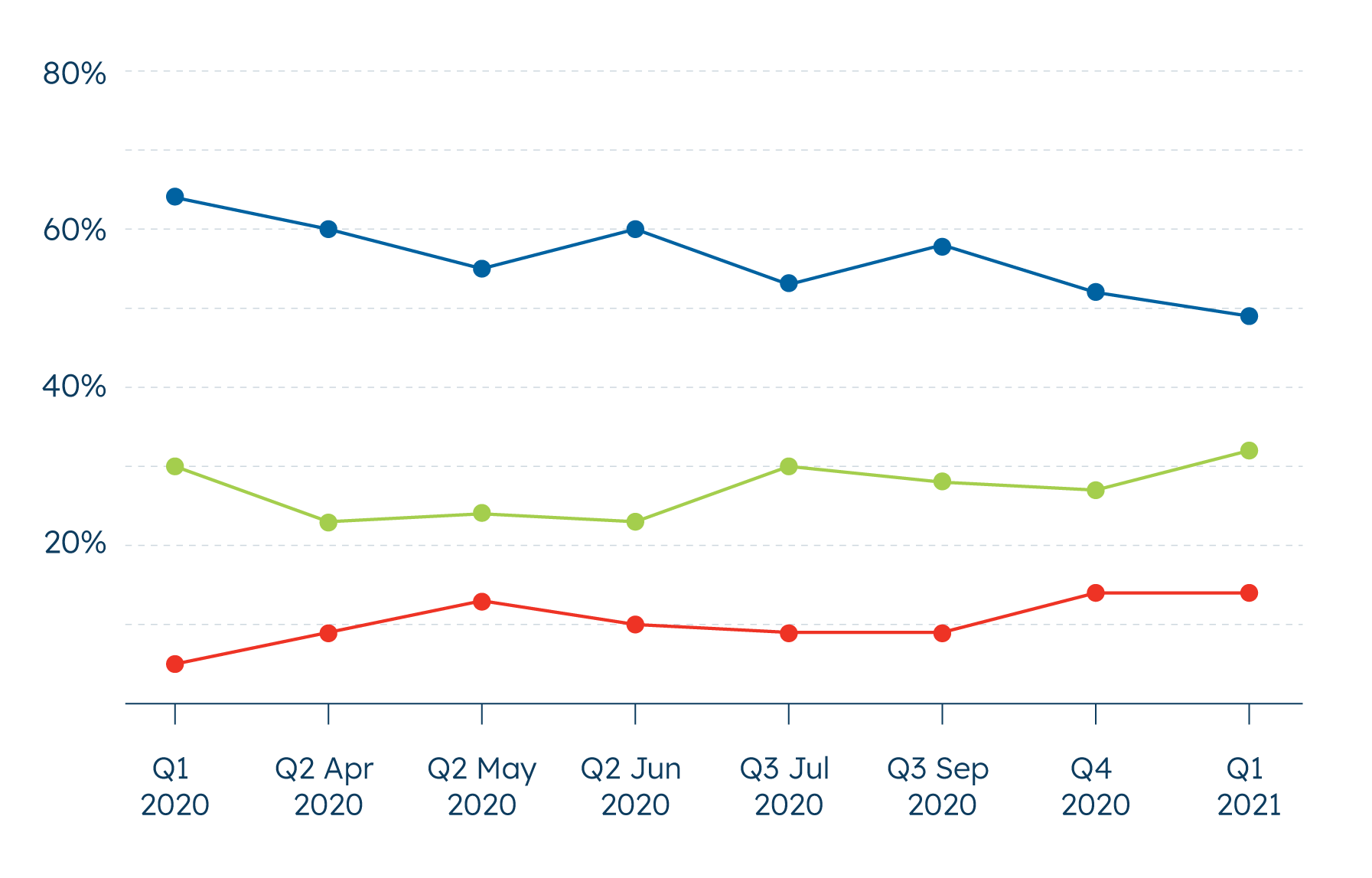

This quarter, more small businesses expect to increase staff in the coming year, but investment and revenue expectations hold mostly steady.

While almost half (49%) of small businesses plan on retaining their current staff size over the next year, 32% plan to increase staff (up from 27% saying they would do so in Q4). 14% of small businesses plan to decrease headcount over the coming year (unchanged from Q4). Even as the share of small businesses growing their teams returns to pre-pandemic levels (30% planned a staff increase in Q1 2020), the number of companies reducing their staff remains significantly higher than before the pandemic (14% this quarter vs. 5% in Q1 2020).

In the next year do you anticipate…

Staffing intentions across sectors remain in line with the overall findings this quarter. Small businesses in services are least likely to increase headcount (24% vs. 33-38% across other sectors), but are more likely to retain the same size staff (66% vs. 37-48% across other sectors). Fewer small businesses in services (4%) and professional services (13%) report plans to reduce staff over the next year when compared to manufacturing (22%) and retail (20%).

Thirty-five percent of small businesses report plans to increase investment in the upcoming year, statistically similar to last quarter’s 31%. Eighteen percent plan to reduce their investment, and another 37% plan to maintain their same investment level. Across sectors, retailers (42%) and professional services (41%) firms are far more likely than manufacturers (34%) and services (26%) firms to plan an increase in investments this year.

Nearly twice as many small businesses in professional services (41%) now say they will increase investments in the upcoming year when compared to Q4 2020 (22%). In contrast, manufacturing companies are less optimistic about investments. This quarter, there was a nine-point drop in the share of manufacturers planning on increasing their investment this year (34% in Q1 2021 vs. 43% in Q4 2020). Firms in this sector are now more likely to plan to reduce their investments (25% in Q1 2021 vs. 17% in Q4 2020).

Overall, 47% of small businesses anticipate their revenue increasing this year, on par with sentiments during the pandemic. Another 14% expect it to decrease, while 32% think their revenues will stay the same.

Manufacturing small businesses are revising their revenue expectations this quarter. In Q4 2020, 58% of manufacturing small businesses expected their revenues to increase by the end of 2021. This quarter, that number dropped by 19 points to just 39%. On the other hand, those in retail (51%), services (55%), and professional services (45%) sectors express unchanged revenue expectations when compared to Q4 2020.