Small Businesses’ Health Improves as Economic Concerns Linger

Most small businesses see their own business health as good despite seeing a worsening economy according to the latest MetLife & U.S. Chamber of Commerce Small Business Index. A majority also see the distribution of coronavirus vaccines as a positive step for the business climate, but see six months to a year before the business climate returns to normal.

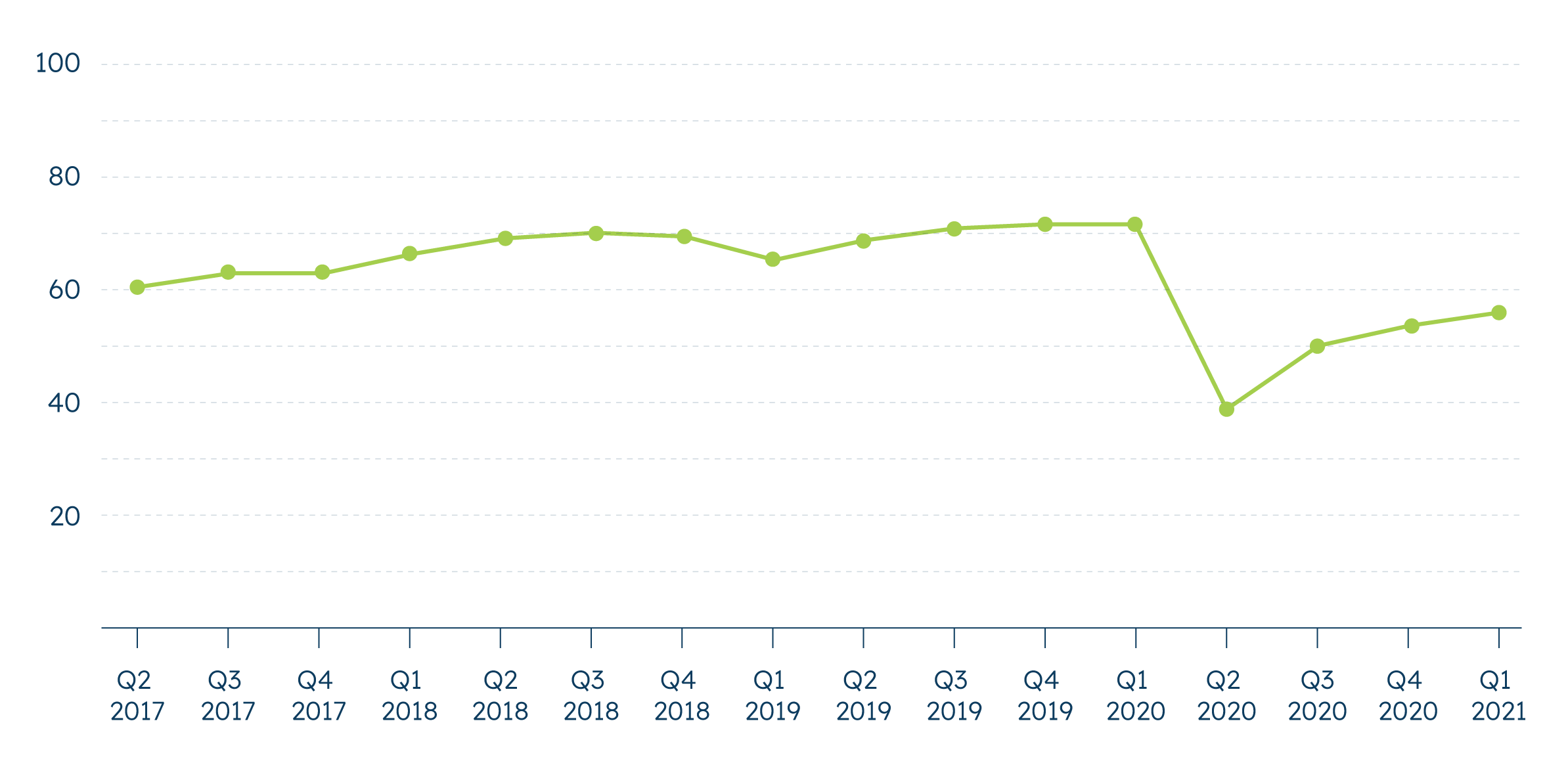

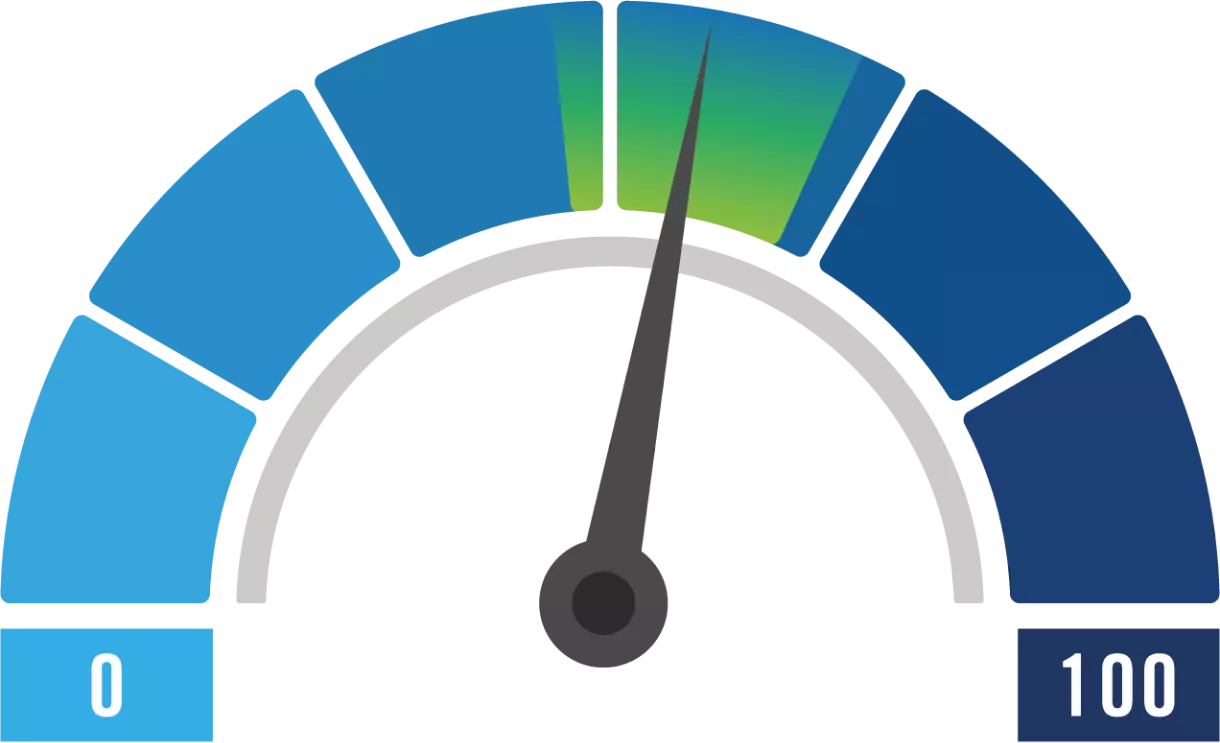

The current Small Business Index score is 55.9 (a slight increase of three points from 52.9 in Q4 2020. However, the new score remains substantially below findings before the pandemic: the Index score was 71.7 in Q1 of 2020 based on data collected before the full economic impact of the coronavirus became apparent.1 The Index reached an all-time low of 39.5 in Q2 2020.

The survey—fielded between January 14 -27, 2021—found that small businesses have subdued views of the future despite the promise of new vaccines and recently-passed coronavirus stimulus measures. As more Americans receive their COVID-19 vaccines, a majority of small business owners remain just as concerned as in Q4 2020 about the pandemic’s impact on their business, their health, and the economy.Three-quarters of small businesses are concerned about the virus’s impact on their business (75% said the same in Q4 2020 vs. 76% this quarter). Despite this, the distribution of the vaccine does appear to be lifting spirits. More than half of small business owners say that the vaccine makes them more optimistic about the future of their business (54%) and the business climate across the country and in their state (59% each).

Minority-owned businesses continue to appear harder hit by the pandemic. 86% of minority-owned small businesses are concerned about the impact of the pandemic on their business’s future (versus 72% of non-minority-owned small businesses who are concerned). This is consistent with previous quarterly findings.

As the pandemic continues, small businesses are paying attention to their employees’ mental health. With 67% of small business owners concerned about employee morale and another 70% concerned about employees’ mental health, a majority (60%) say their business is actively addressing employee mental health as a priority right now. Minority-owned small businesses are more likely to be concerned about employee morale and mental health (76% and 82%, respectively) and, in turn, are more likely to be prioritizing employee mental health (70% vs. 57% non-minority-owned). Minority business owners are also nearly three times more likely to provide employees with mental health and wellbeing resources.

The survey also found that half of small business owners are likely to require employee vaccination when they become widely available. As a firm’s employee size increases, so too does the likelihood that the business will require them to be vaccinated. Of those that plan to require employee vaccination, many say they will do so because they want their staff to be healthy (53%) or because it’s the right thing to do (43%). Personally for themselves, seven in ten small business owners plan to get the COVID-19 vaccine as soon as it is made available to them. Northeastern small business owners are most likely to plan to get the vaccine (81%) and those in the Midwest are least likely (65%).

Economically, small business owners are a mixed bag this quarter with half seeing their business health as good amid a backdrop of a worsening economy. Half of small businesses (52%) say their business is in good overall health, in line with sentiments across the last ten months, but down 14 points from Q1 2020 before the impacts of the pandemic had been felt. In contrast, fewer small business owners rate the U.S. economy as “somewhat good,” down nine points from Q4 2020 and the percentage saying the country’s economy is in poor health is up nine points from Q4.

It is important to note that the survey was fielded from January 14-27, 2021, during which national unrest surged and a presidential inauguration occurred. Adding to this, there was uncertainty around future federal stimulus packages, all of which could have contributed to pessimistic outlooks about the economy. Year over year, those calling the U.S. economy poor has increased 47 points from 12% in Q1 2020 to 59% in Q1 2021.

Perceptions of the local economy fell in lockstep with those of the national economy: those who believe their local economy is somewhat good is down seven points, while more say their local economy is in poor health (up 11 points). Year over year, those calling their local economy poor has increased 26 points from 17% in Q1 2020 to 43% in Q1 2021. Other economic measures hold relatively steady this quarter. There has been little overall change in business operations, competition, and future expectations.