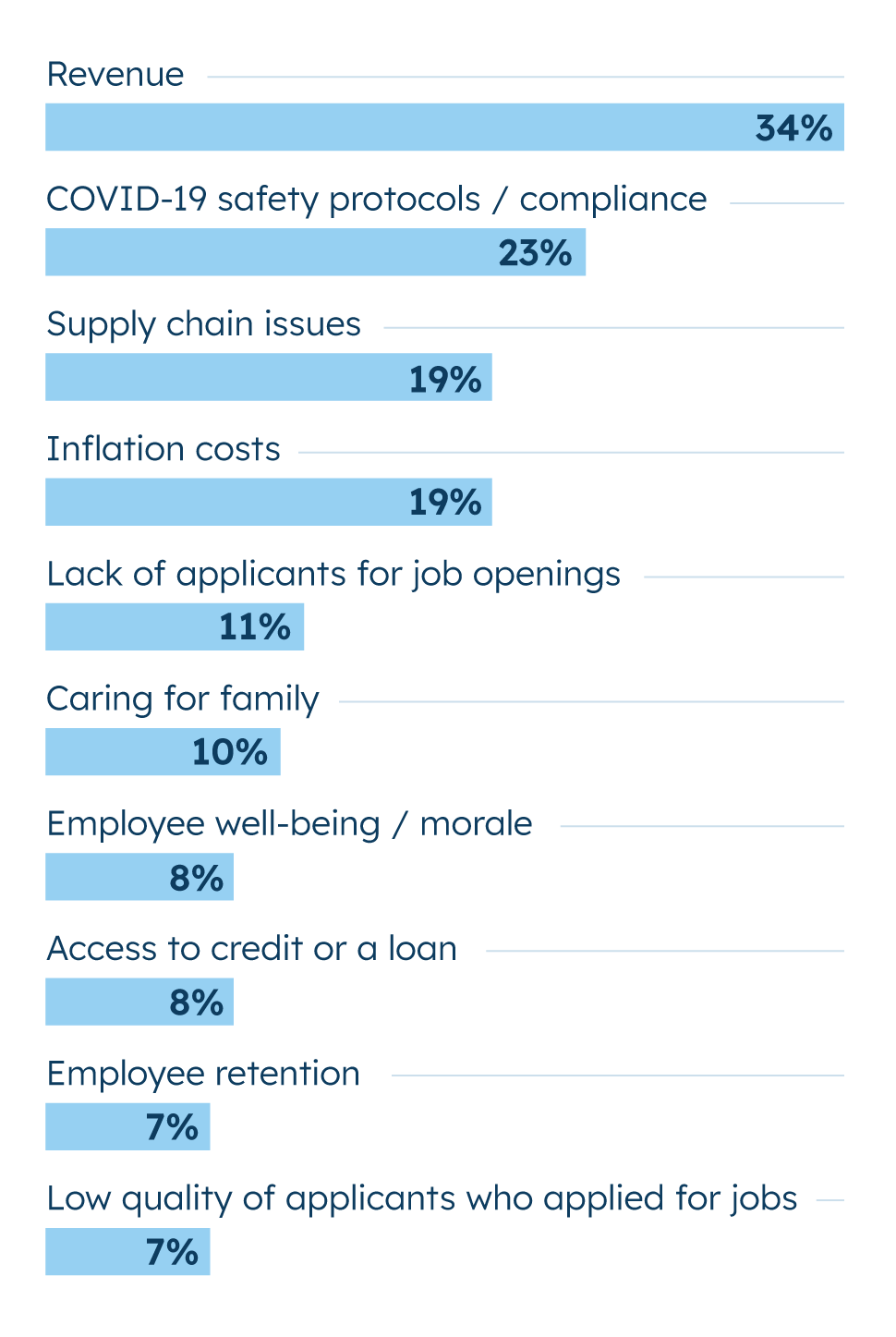

As Businesses Reopen, Revenue Is Biggest Challenge

Small businesses say their biggest challenge is generating revenue. Although 58% of small businesses expect their revenue to increase in the next year, a plurality of small business owners (34%) believe that revenue is the single biggest challenge facing small businesses emerging from the pandemic.

Revenue is the top cited challenge for small businesses across all regions and sectors, with about a third of small business owners in each region and each sector indicating this is the biggest challenge. When it comes to business size, smaller small businesses are more likely to cite revenue as the biggest challenge facing their businesses during this economic recovery. In contrast, larger small businesses are more likely to cite COVID-19 safety protocols/compliance as their top challenge. COVID-19 compliance is also a top-tier issue for small businesses in the services sector.

COVID-19 safety protocols are the second most often-noted challenge, with 23% of all small businesses noting it as a challenge. Larger small businesses (34%) and those in the services sector (33%) are more likely to say COVID-19 protocols are a challenge.

In a tie for the third most-cited challenge facing small businesses emerging from the pandemic are two issues: supply chain and inflation. One in five (19%) small business owners believe that these are the biggest challenges they face as the economy recovers. This holds true across region and company size. However, small businesses in certain sectors are more worried about this than others. Retailers are most likely to cite supply chain issues and inflation costs as their biggest challenge, followed by manufacturers.

Service sector struggles most to find workers

Today, many sectors and businesses across the country are struggling to find enough workers to fill open positions.

Today, many sectors and businesses across the country are struggling to find enough workers to fill open positions. Overall, 11% of small businesses this quarter cited the lack of applicants for open jobs as their top challenge. Data suggests that this effect is worst in the services sector where 15% said this was their biggest concern.

Seven percent of small businesses said that their top concerns were the low quality of applicants who applied for jobs and employee retention. The manufacturing sector (11% said was top concern) and the Southern region (12% said was top concern) were more likely to say that the low quality of applicants is a top concern. Larger small business (20-499 employees) were the most likely group to say that retaining employees is their top challenge with 18% saying so.

Most say higher costs are proving hard to manage

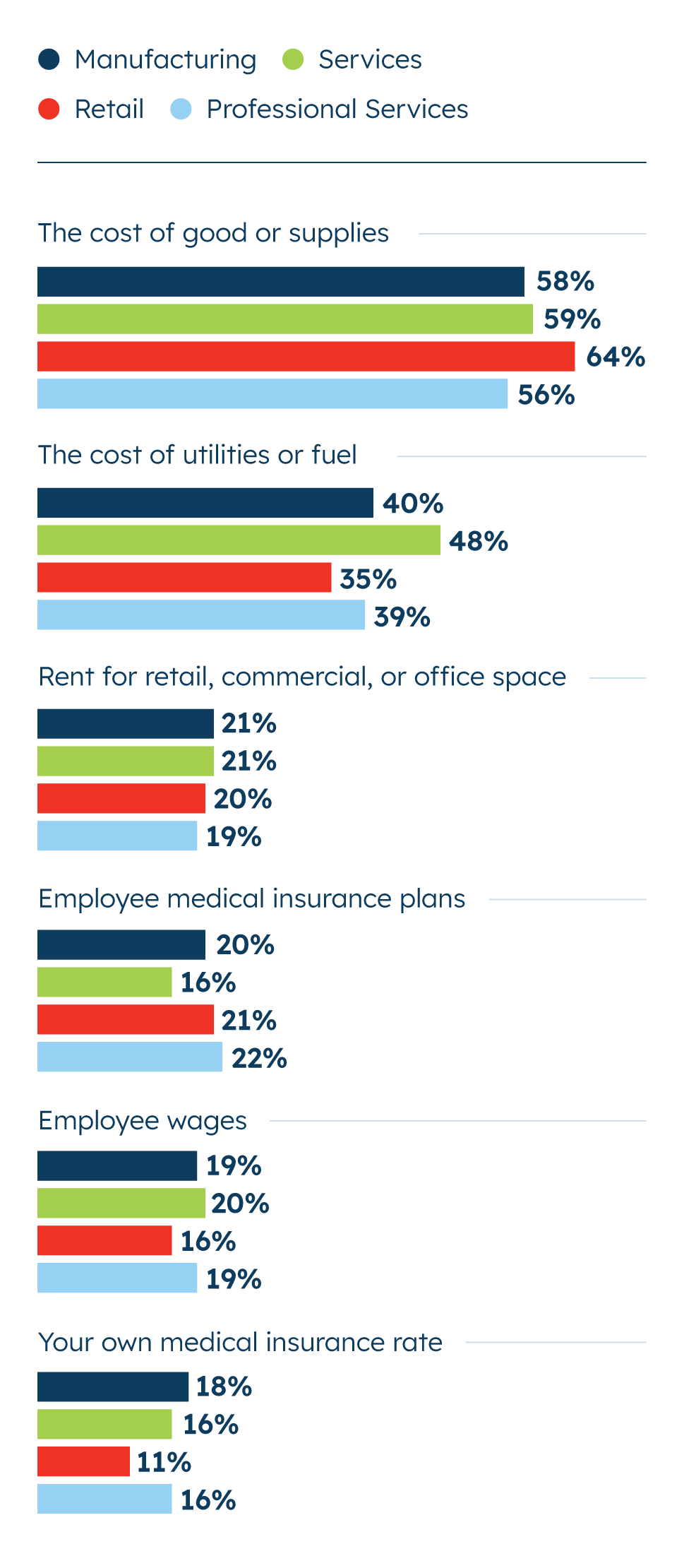

Also, about three quarters (73%) of small business owners say that rising prices have had a significant impact on their business in the past year.

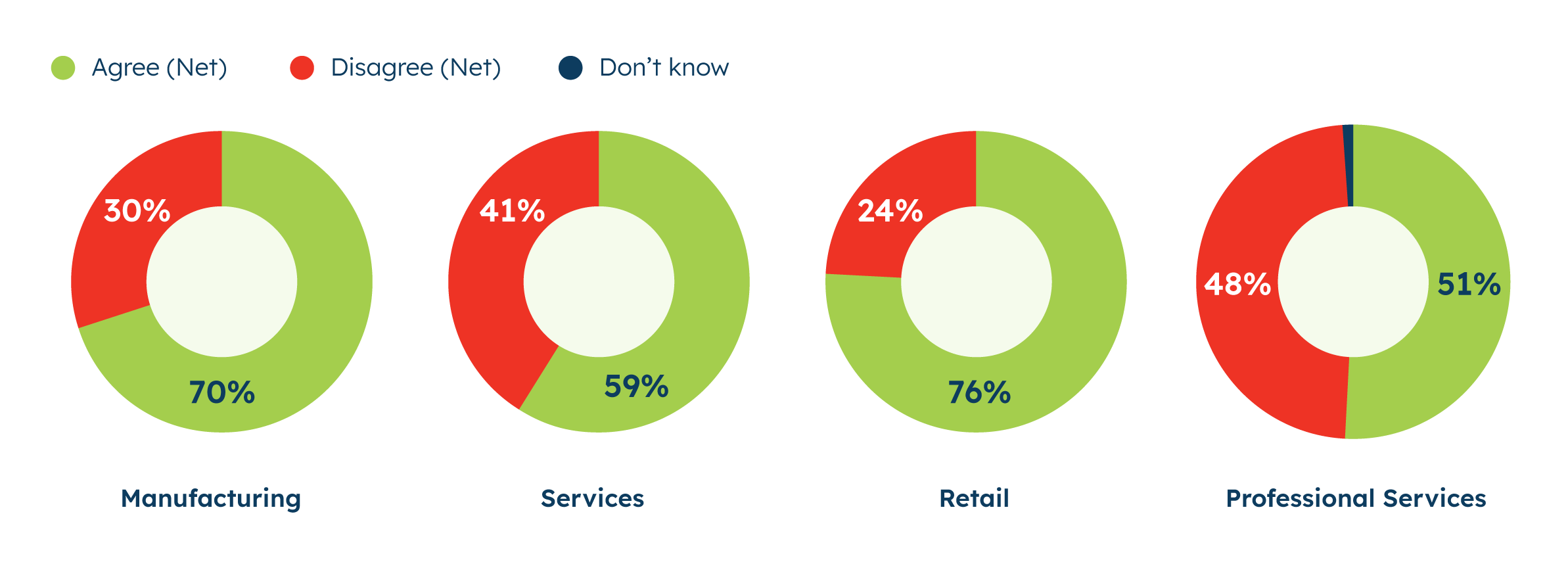

The difficulty of dealing with inflation varies by sector, with manufacturers feeling the most pressure. Manufacturers are the most likely to say (at 82%) that managing higher costs due to inflation is difficult. Three quarters of retailers and small businesses in the services sector (both 74%) agree that managing higher costs is difficult for them, while 61% of those in the professional services sector agree.

Larger small businesses struggle more than smaller ones with inflation. Among small businesses with 20-499 employees, 81% say they have a difficult time managing higher costs brought on by inflation, compared to seven in ten businesses with 1-4 employees (71%) and businesses with 5-19 employees (69%).

Across regions, there is less variability, with 69%-75% of small businesses in each region saying managing higher costs is difficult for them (this does not represent a significant difference). Among the nearly three-quarters of businesses that acknowledge the significant impact of rising prices, those in the West and the South (both 78%) are among the most likely to say this. The same is true for retailers (81%) and manufacturers (80%).

Among the small businesses who said that rising prices have had a significant impact on their business, that impact is seen most in:

- The cost of goods and supplies (60%)

- The cost of utilities or fuel (41%) and

- Rent for retail, commercial, or office space (21%)

Retailers, manufacturers struggle the most with supply chain issues

Similar to inflation, supply chain issues are a top concern behind revenue. This quarter, 61% of small business owners say it is difficult for them to manage disruptions to their supply chain, and 62% say their supply chain has been dramatically disrupted by the pandemic.

Retailers struggle the most with supply chain disruptions, with 80% of small business retailers saying it is difficult for them to manage these disruptions. Two-thirds of small business manufacturers report difficulty managing supply chain disruptions. Small businesses that provide services (and may therefore rely less on supply chains) don’t have as much difficulty, with 53% in the services sector and 50% in the professional services sector saying it is difficult for them to manage disruptions. Regionally, the differences are small, with most in all regions saying it is difficult to manage supply chain disruptions.

Founder and Owner, A Psychology Corporation

Santa Monica, California

Majority say they struggle with work/life balance

Balancing career and life has become a challenge for many during the pandemic and the same holds true for small business decision makers. About half (52%) of small business owners say they struggle with work-life balance, and 51% say they struggle to spend enough time with family outside of work.

Here, business size, the generation of the business owner, and their status as a caretaker all play a role in perceived ability to balance work and life. There is little difference between all male-owned and all female-owned businesses on the topic. Small business owners who run larger small businesses tend to struggle balancing work and life more than those who run medium-sized or smaller businesses. Seven in ten small businesses with 20-499 employees say they struggle with work-life balance, compared to 56% of businesses with 5-19 employees and 47% of small businesses with 1-4 employees.

This trend also holds true when it comes to spending time with family outside of work. Seventy-eight percent of larger small businesses report they struggle to spend time with family outside of work, while medium-sized (59%) and smaller small businesses (42%) are less likely to agree.

Small business owners from younger generations—as well as those who are parents or caregivers—also are more likely to say they struggle with work-life balance and spending time with their families outside of work. Finding workers to fill open jobs also remains a big concern for small businesses. About half of small businesses say it is difficult to recruit and hire enough employees to fill open positions (50%) and to compete for talent with other small (52%) and large (57%) businesses in their area. Larger small businesses have more difficulty with these staffing issues than medium-sized (5-19 employees) and smaller (1-4 employees) small businesses.

While 23% of small business owners think complying with COVID-19 safety protocols is the biggest challenge small businesses face coming out of the pandemic, 41% report that it is difficult for them to maintain these safety protocols. The difference here is that COVID-19 compliance is more centered around larger small businesses, rather than spread out relatively evenly across sector, size, or region, like other issues seem to be.

Despite all these challenges they face and the uncertainty of the pandemic, small businesses are optimistic about the future. While 43% of small business owners have considered closing their business in the past year, almost twice as many (79%) say they are optimistic about the future of their business.

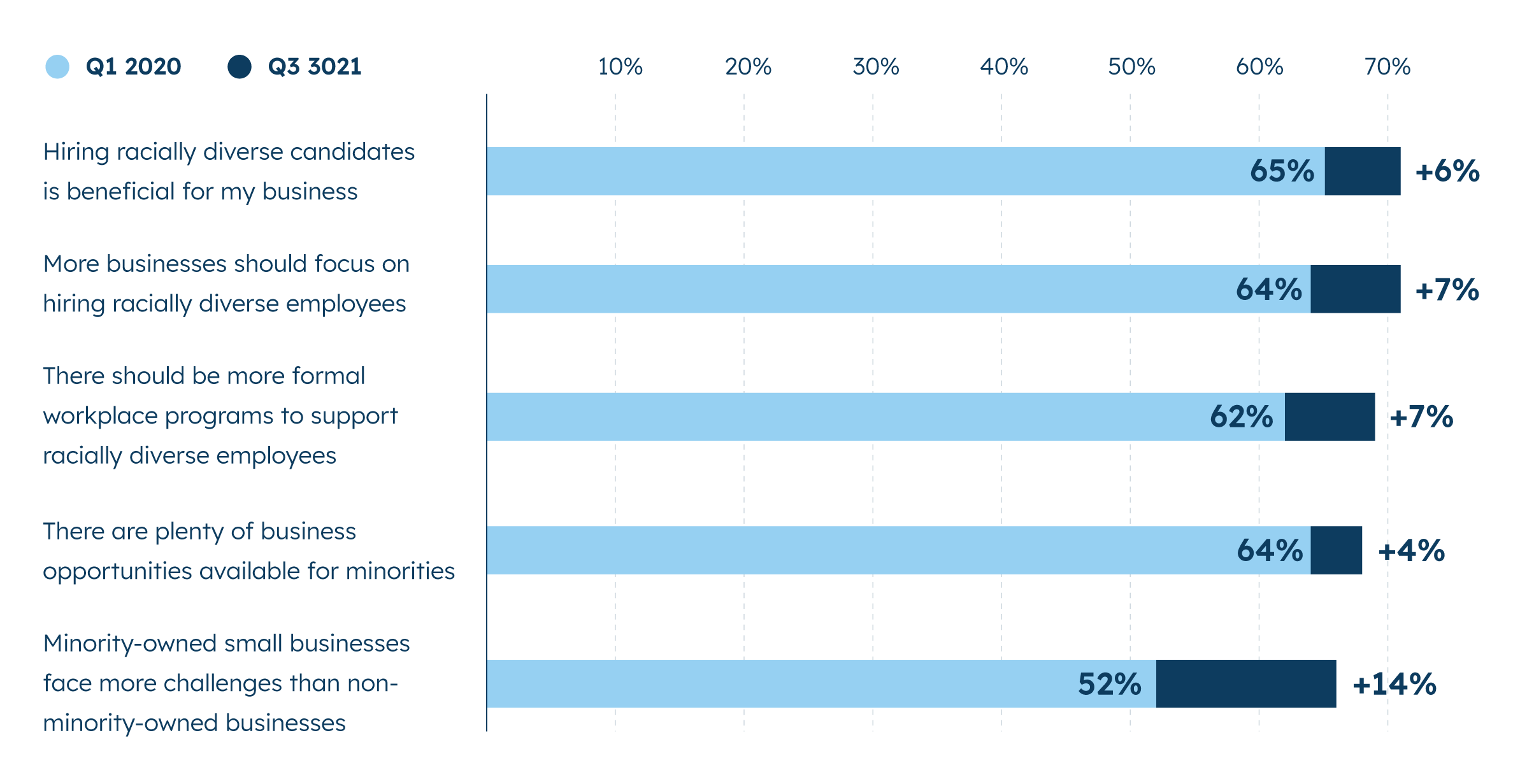

Attitudes toward minority-owned businesses shift

After a year of focus on—and investment in—diversity, equity, and inclusion initiatives in the business world, two-thirds (66%) of small businesses acknowledge that minority-owned small businesses face more challenges than non-minority-owned businesses. This is an increase of 14 percentage points (up from 52%) from when this question was first asked in Q1 2020. Additionally, most small businesses see the benefit in hiring racially-diverse candidates and want to see more training and hiring initiatives to do so.

Across regions, sectors, and size, a majority of small business owners support diversity in the workplace, though there are differences. Larger small businesses, for example, are more likely to support making investments to ensure a more diverse workplace—perhaps because they have more resources to do so. Small businesses with 20-499 employees are most likely to think more businesses should focus on hiring racially diverse employees (85%), compared to medium-sized small businesses (74%) and the smallest small businesses (67%). Nine in ten (88%) larger small business owners support formal workplace training or programs to support racially diverse employees, and 85% agree that hiring diverse candidates is beneficial.

Despite the ongoing challenges minority-owned (either racial/ethnic minority or LGBTQ) small businesses face, their mood is significantly more positive now than at the beginning of last year (Q1 2020), specifically when it comes to the benefits and resources available for them. Currently, more than three in five minority small business owners say that being a minority is beneficial for their business (64%), up from 26% in early 2020. Sixty-four percent of minority small business owners say that they are aware of the benefits available to them as minority-owned businesses, and 62% believe these minority-specific resources are adequate. In Q1 2020, fewer than half agreed with these statements. Despite these benefits, over half of minority small business owners find it difficult to find and build a relationship with a mentor who looks like them (55%).