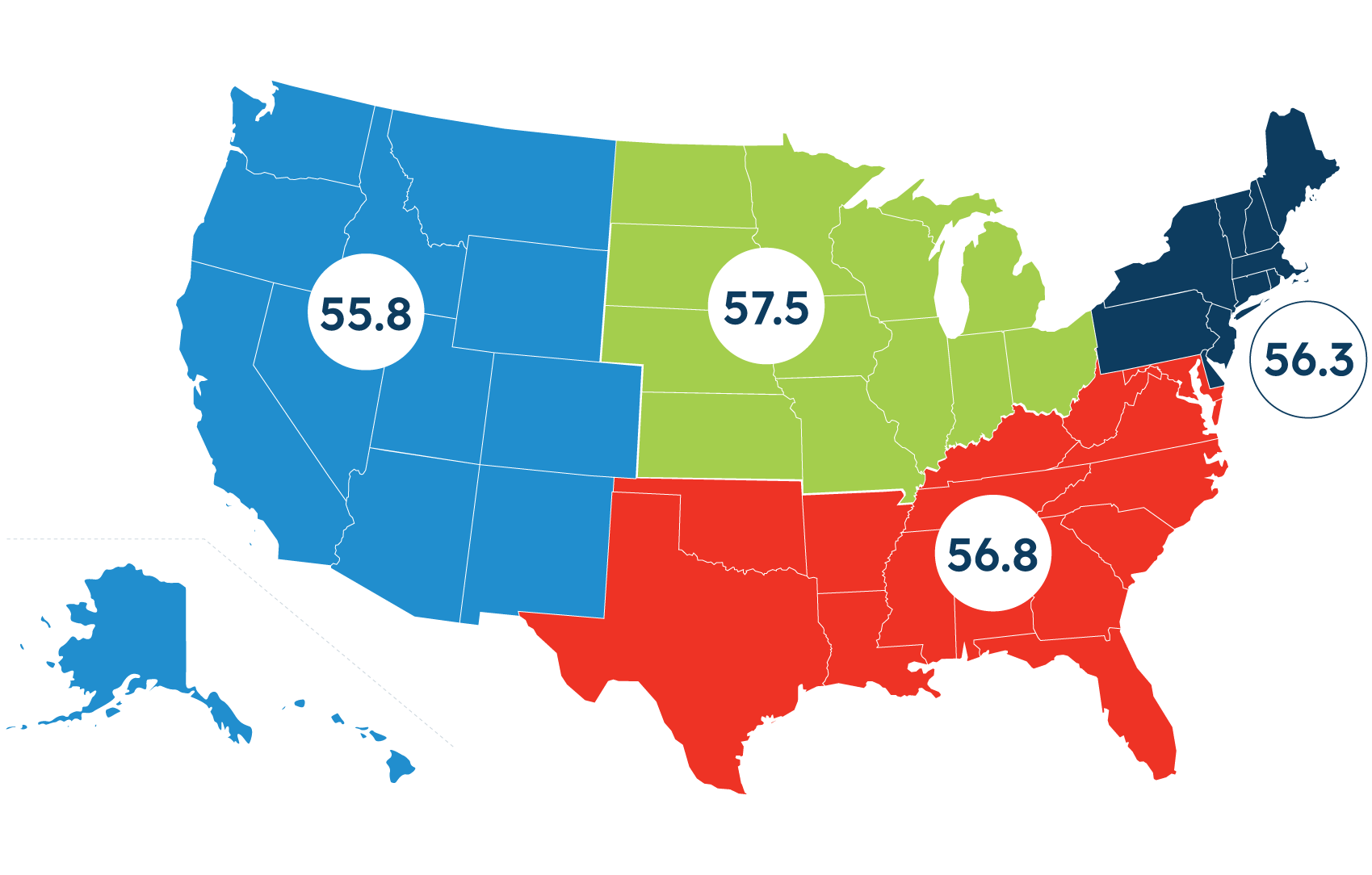

Regional Scores

National Score 56.6

South

West

Midwest

Northeast

Northeast (56.3)

This quarter, 30% of small businesses in the Northeast plan to increase investment, trailing only the South. This marks a slight, but not significant, drop from the previous quarter (36%). Slightly fewer Northeastern businesses report plans to increase staff (24%, down from 32%) and they lag behind the Midwest in terms of revenue and investment expectations. However, a majority of small businesses in the Northeast report good overall business health (56%) and comfort with cash flow (65%), similar to last quarter.

South (57.5)

Sixty-one percent of small businesses in the South are comfortable with their cash flow, making them the least confident across regions. However, Southern small businesses are the most likely to plan on investing more in the next year: 35% plan to increase investment, and 39% plan to invest the same amount. They are also most likely to report an increase in expected revenues in the next year (62% now, 53% in Q2, 40% in Q1).

Midwest (57.5)

Nearly three in five (59%) Midwestern small businesses feel positively about their overall business health and are the only region to see a significant increase from Q2 2021 (45%). Midwestern small businesses are not as confident about the health of their local economy (32% say it is good, 14-17 points behind the South and West). More than other regions, Midwestern small businesses plan to increase staff in the next year (39%, compared to 24-27% in other regions).

West (55.8)

Western small business health (53%) and comfort with cashflow (64%) are on par with small businesses across the country. Western small businesses are more likely than those in the Northeast or South to have retained the same size staff over the past year and a majority plan to do so over the next year. 62% of Western small businesses predict higher revenue over the next year, compared to 44% in Q1.