Small Businesses are Showing Increasing Caution

With new variants causing a rise in COVID-19 cases, the latest MetLife & U.S. Chamber of Commerce Small Business Index finds that small businesses are showing increasing caution about the current and future economic climate.

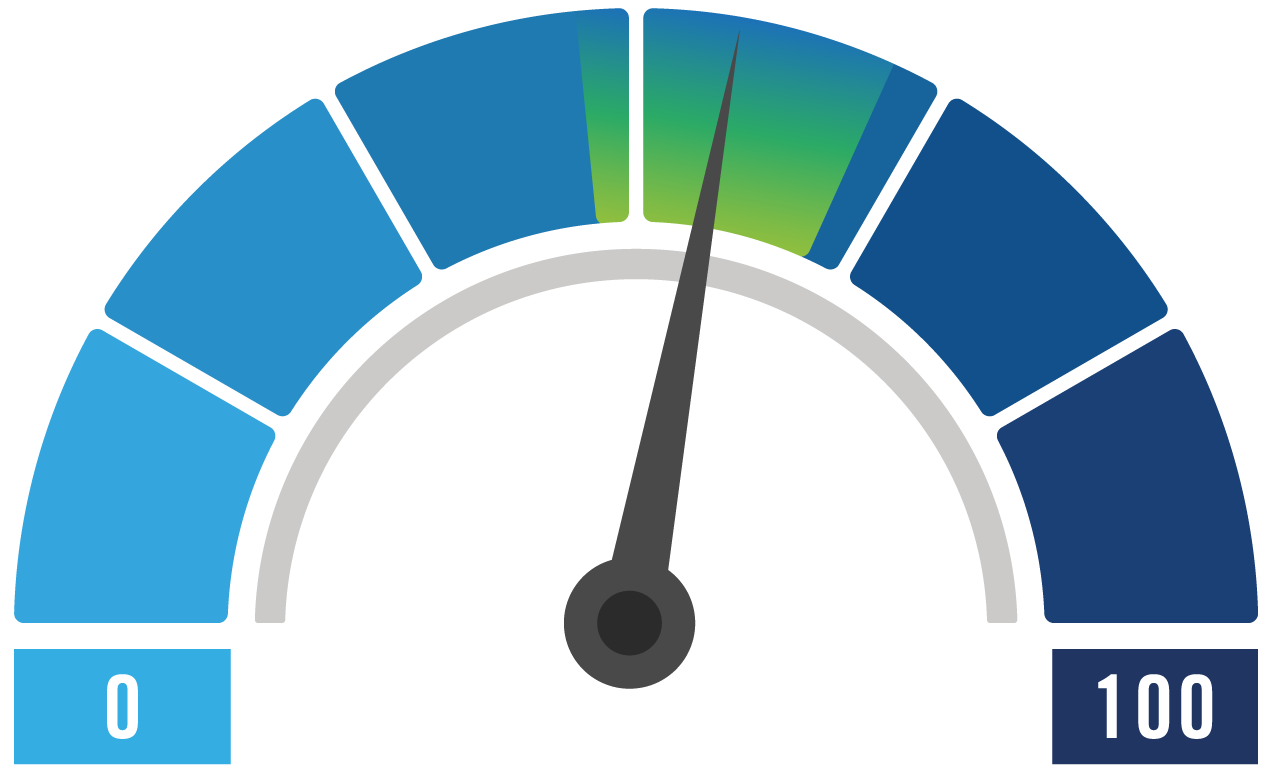

This quarter’s Small Business Index score is 56.6, down from last quarter (60.0 in Q2), but in line with the beginning of the year (55.9 in Q1 2021).1 The survey—conducted between July 16 – 30, 2021 as the Delta variant began to spread rapidly across the country—shows signs that small business staffing and investments (both current and future) may be hitting a plateau.

However, overall views of their own business’s health and cash flow remain stable this quarter. Separate from the Index score, there are broad concerns about revenue, inflation, and the impact of rising costs generally. The survey also found that more small business owners, from every background, agree that minority-owned small businesses face more challenges than non-minority-owned businesses.

Small businesses grow more cautious

A big theme from this quarter’s survey is the growing caution of small businesses when it comes to future hiring and investment. There is evidence of this caution across a number of different metrics.

Compared with the past year, fewer businesses (29%) report plans to increase investment in their business over the next year (was 35% in Q1). This quarter 48% said they plan to invest the same amount over the next year (up from 42% last quarter and up from 37% in Q1).

Most small businesses report retaining the same amount of staff over the last year. Around three in five (68%) small business decision makers say they have retained the same size staff over the past year, while 17% said they had reduced staff over that time. A majority (62%) anticipate retaining the same size staff next year (28% anticipate increasing staff) and 6% plan reducing staff. This contrasts with last quarter when fewer reported retaining the same amount of staff. Then, 57% reported retaining the same size staff over the last year and 23% percent reported they reduced staff. Additionally, 52% said they planned to retain the same size staff and 11% said they planned to reduce staff over the next year.

However, overall current business health and cash flow remain unchanged, with most businesses feeling generally optimistic. More than half (55%) of small business owners believe the health of their business is good and two-thirds (66%) believe their cash flow situation is good. Both of these measures remain statistically unchanged from the previous quarter and had been steadily climbing back to pre-pandemic levels—but have yet to reach them. (65% said the overall health of their business was good in Q1 2020, 80% were comfortable with their cash flow in Q1 2020).

While most small businesses are increasingly cautious, they do recognize modest improvements to the country’s economy. This quarter, around one in three (34% of) small business owners say the U.S. economy is in good health: higher than any point since the pandemic began. However, very few (just 7%) say the economy is in “very good” health. Instead, the improving views of the national economy come from more businesses saying the country’s economy is “somewhat good.” A similar pattern emerges regarding the economy in their local area: 31% see an average local economy, 14% say it is “very good,” and 26% say the local economy is poor.

Small businesses see revenue (or the lack thereof) as their single biggest post-COVID challenge. Although most (58% of) small businesses expect their revenue to increase in the next year (on par with last quarter), 34% of small business owners believe that revenue is the biggest challenge facing small businesses coming out of the pandemic. This is followed by: compliance with COVID-19 safety protocols (23%), supply chain issues (19%) and inflation costs (19%).

Growing concerns over inflation, supply chain constraints

The vast majority of small businesses (72%) are finding it difficult to manage higher costs due to inflation, as they work to recover from the pandemic.

About three quarters (73%) of small business owners also say that rising prices have had a significant impact on their business in the past year.

As with inflation, supply chain issues are also giving businesses concern. 61% of small business owners say it is difficult for them to manage disruptions to their supply chain and 62% say their supply chain has been dramatically disrupted by the pandemic.

More positive attitudes toward minority-owned small businesses

A significant majority (66%) of small business owners, regardless of sector, area of the country, or racial/ethnic background, agree that minority-owned small businesses face more challenges than non-minority-owned businesses.

After a year that sparked diversity, equity, and inclusion initiatives throughout the workforce, more small businesses now believe this to be true when compared to early 2020 when they were last surveyed on this topic (when 52% said minority-owned small businesses faced more challenges).