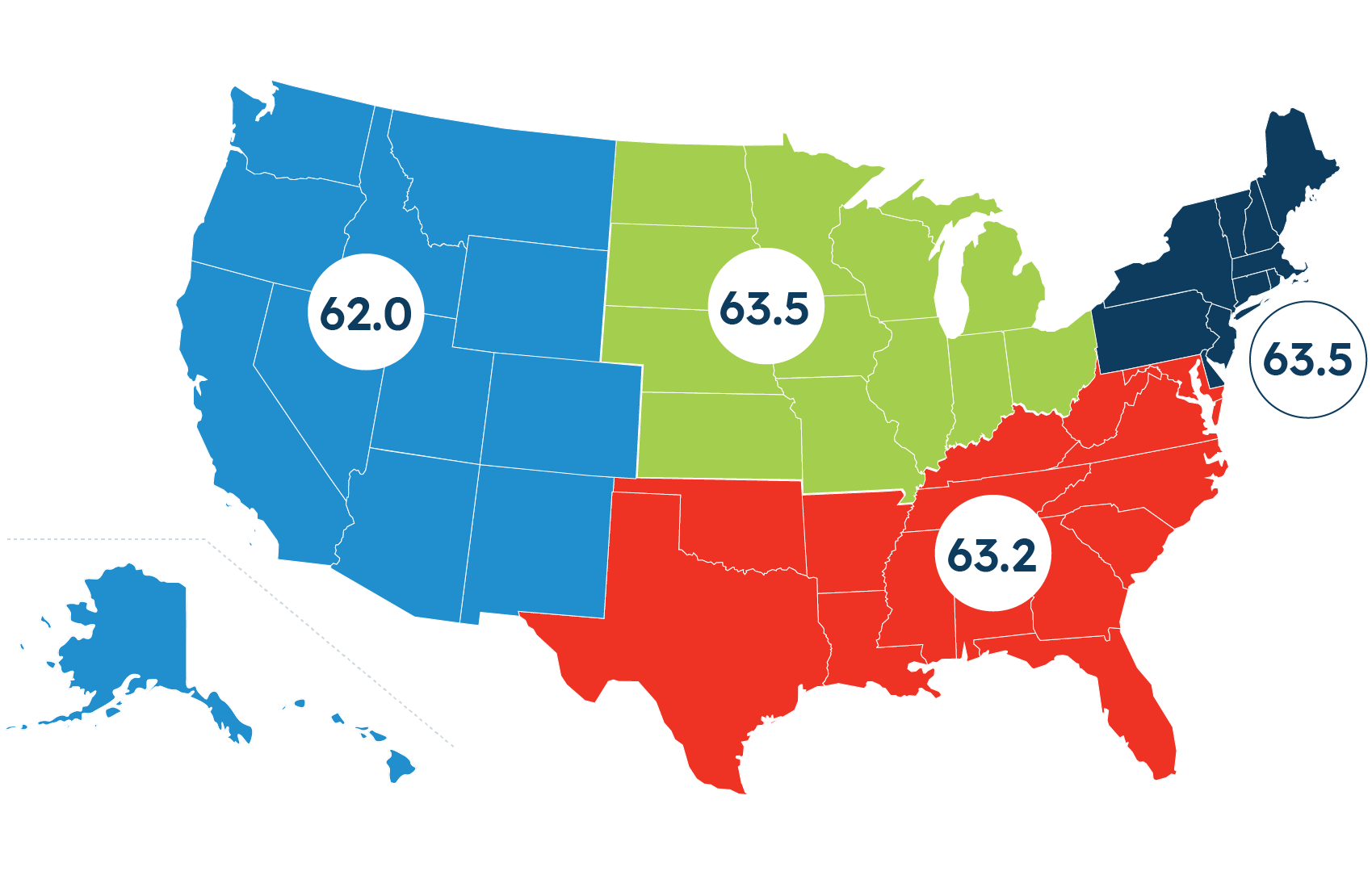

Regional Scores

National Score 63

South

West

Midwest

Northeast

Northeast (63.5)

In the Northeast, perceptions of their own business health have increased this year, reaching 65% this quarter, a level not seen since before the pandemic. Nearly a third of small businesses in the Northeast plan to increase investment (34%) and hire more employees (30%) in the coming year. While there is a slight increase in the percentage of Northeastern small business planning to hire more in 2022, the majority (60%) plan on retaining the same amount of staff.

South (63.2)

Southern small businesses are slightly more optimistic about their health now (62%) than in Q3 (53%). They also have the most confidence in the U.S. economy out of any region (40% vs. 26-30% in other regions). About half (51%) of Southern small businesses plan to increase investment in the coming year, a 16 percentage point increase from Q3 (35%) and more than in any other region. Many more plan to increase staffing levels in 2022 (45% in Q4 vs. 27% in Q3).

Midwest (63.5)

Nearly three in five Midwestern small businesses feel positively about their overall business health (59%), but their confidence in the U.S. (30%) and their local (32%) economies remain muted. About two in five (41%) plan to invest more in the coming year, on par with small businesses in general (42%), and significantly higher than in Q3 (28%). A similar number (39%) also plan to hire more in 2022, which is unchanged from Q3 (39%).

West (62)

Western small businesses are hopeful. More small business owners in the West plan to increase investment (37%) and staff levels (36%) compared to Q3 (22% and 24%, respectively). Just over half (53%) also expect their revenue to grow in 2022, which is on par with the previous quarter (55%). Small businesses in the West are on par with small businesses overall when it comes to the health of their business (60% vs. 62%) and their local economy (41% vs. 39%).