Index Reaches Pandemic-Era High, as Many See Brighter Future

The MetLife & U.S. Chamber of Commerce Small Business Index reaches a pandemic-era high this quarter as many small businesses report seeing a brighter future. As they begin to catch a glimpse of a post-pandemic world, small business owners are showing higher optimism for the year ahead, especially when it comes to their staffing and investment plans. However, while expectations for the future are higher, concerns about increasing inflation, supply chain constraints, and talent shortages show things are a long way from returning to normal.

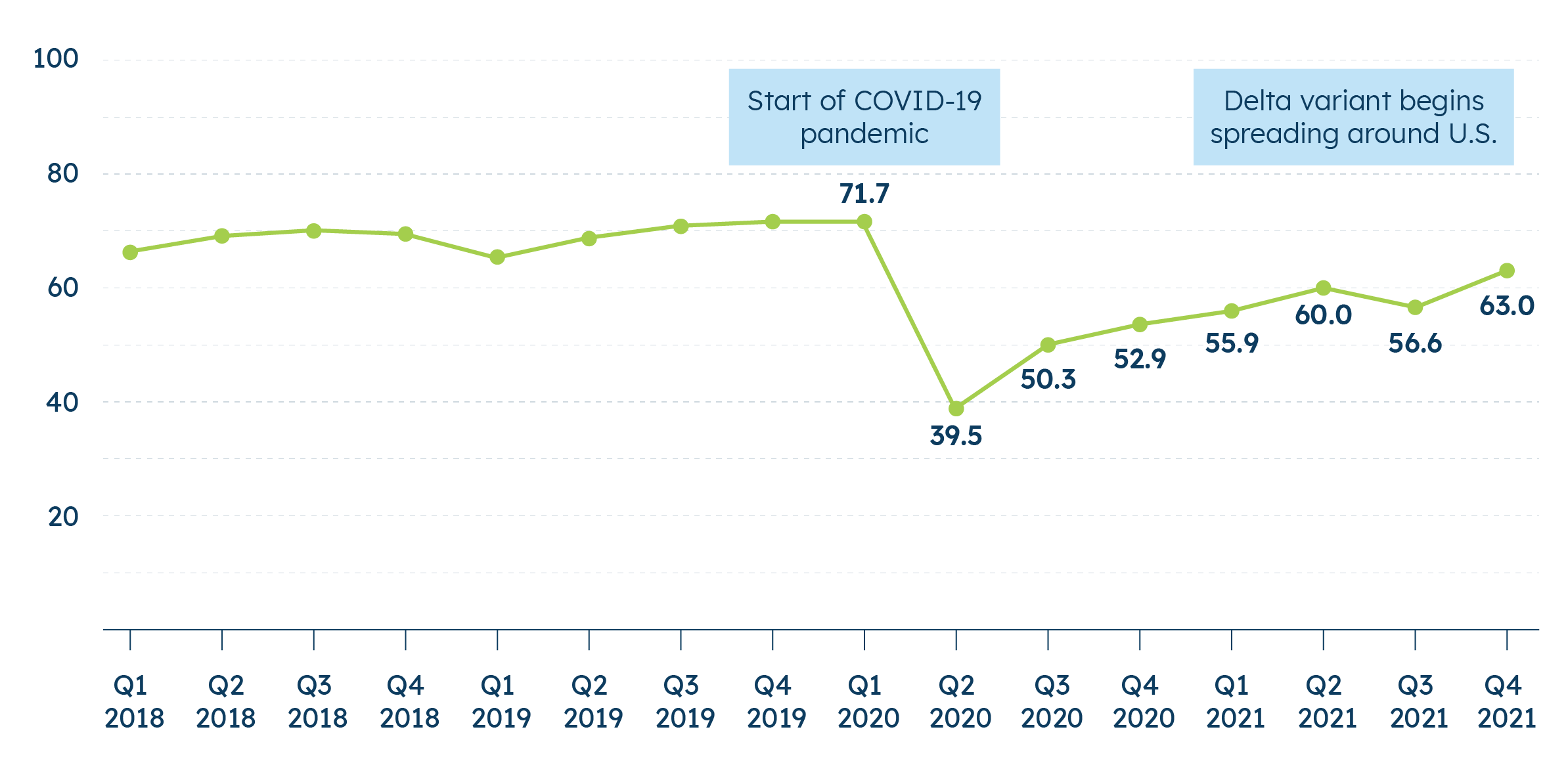

This quarter’s Small Business Index score is 63.0, the highest score since the start of the pandemic. This score is up from last quarter’s score of 56.6 and the nadir of the pandemic in 2020 Q2 when the score reached a record low of 39.5. The survey—conducted between October 13 – 27, 2021 as COVID-19 cases began receding nationally—reflects both higher optimism about next year and slightly better outlooks on overall business health. However, small business owners’ sentiment and the Index score have fluctuated more than usual throughout 2021, indicating that small businesses continue to face uncertainty as they try to navigate the evolving pandemic situation and plan for the future.

Hiring and investment plans, in particular, reveal small businesses’ growing optimism. About two in five (38%) small business owners say they plan to increase staffing levels, while 42% say they plan to invest in their business in the coming year—increases of 10 and 13 percentage points, respectively, from 2021 Q3.

As small businesses face the future, they see many challenges. A quarter (26%) of small business owners say the biggest challenge they expect to face in a post-pandemic world is revenue, with inflation (23%) and COVID-19 compliance (21%) seen as other top issues.

Most small businesses say inflation is a concern and that their most common way of dealing with inflation is raising the prices they charge customers. Three in four (74%) small business owners are concerned about the impact of inflation on their business, and about as many (71%) say rising prices have had a significant impact on their business in the past year. Those who feel the impact of rising prices see this impact most on the costs of goods and supplies (62%). To manage higher costs caused by inflation, three in five (63%) small businesses say they have increased the prices of their products or services in the past year. Although raising prices is popular, nearly half (45%) have taken out a loan, while 41% say they have decreased staff.

Most small businesses say their supply chains have been disrupted by the pandemic and worker shortages. Sixty-one percent of small businesses say the COVID-19 pandemic has dramatically disrupted their supply chain and 55% say worker shortages have done the same. As a result, 63% say they have had to alter their supply chains in the past six months and nearly half (47%) say these disruptions make it difficult to keep up with customer demand.

A strong majority of small businesses see the holiday season as important for their bottom line, but persistent labor shortages and supply chain issues cloud the picture. Seven in ten (70%) say the upcoming holiday season is important for their business’ yearly profits. This quarter, almost half (46%) of small businesses say they have faced a worker shortage, and 60% expect supply chain disruptions to make managing the holiday season difficult.

While an increase in the SBI score reflects increased optimism, small business owners’ sentiments have fluctuated from quarter to quarter throughout 2021. This indicates that small business owners, while more optimistic, are doing their best to navigate an ever-changing situation.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q4 is 63.0. The Index score for Q3 2021 was 56.6. In Q2 2020 it reached an all-time low of 39.5.1