Small Business Concerns Over Inflation Grow Even Higher

Most say inflation will persist and get worse

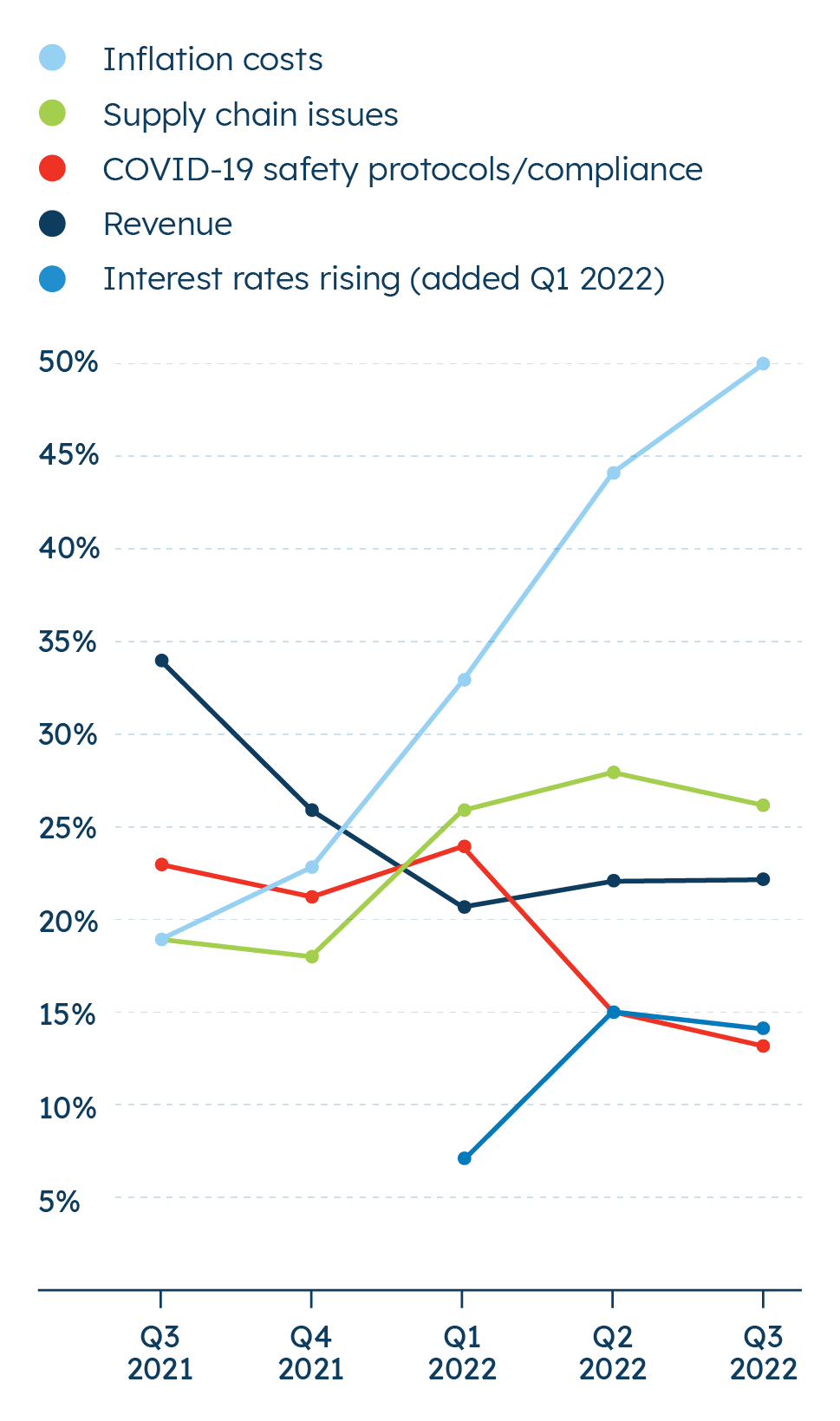

With five consecutive quarters of mounting concern, half (50%) of small businesses now say inflation is the top challenge facing the small business community. This marks a drastic 31-point increase since this time last year.

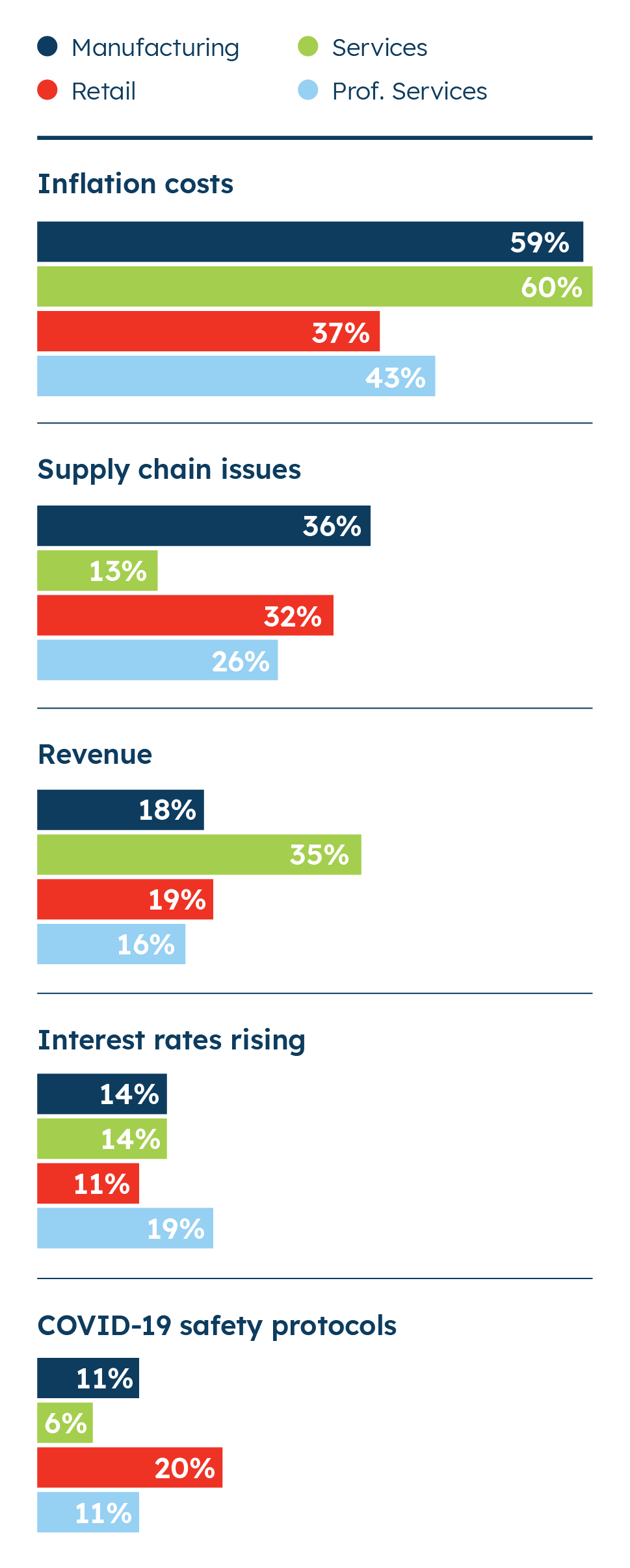

Inflation is the top concern for small businesses across the country, regardless of their number of employees or the sector they work in. Inflation has become more of a concern for small businesses with 5-19 employees (up 18 percentage points) and 20-500 employees (up 14 points). By sector, small businesses in the manufacturing (up 19 points) and services (up 16 points) industries have more inflation concerns compared to last quarter. Inflation is also increasingly a concern for women-, veteran-, or people of color-owned small businesses (54% compared to 41% last quarter).

Small businesses' intensity of concern about inflation also increased this quarter. Nine in ten (88%) small businesses say they are concerned about inflation, with a majority (54%) now saying they are very concerned about it, up from 49% last quarter and 31% in Q4 2021.

Midvale, Utah

Many see inflation impact in rising costs of goods, fuel, and utilities

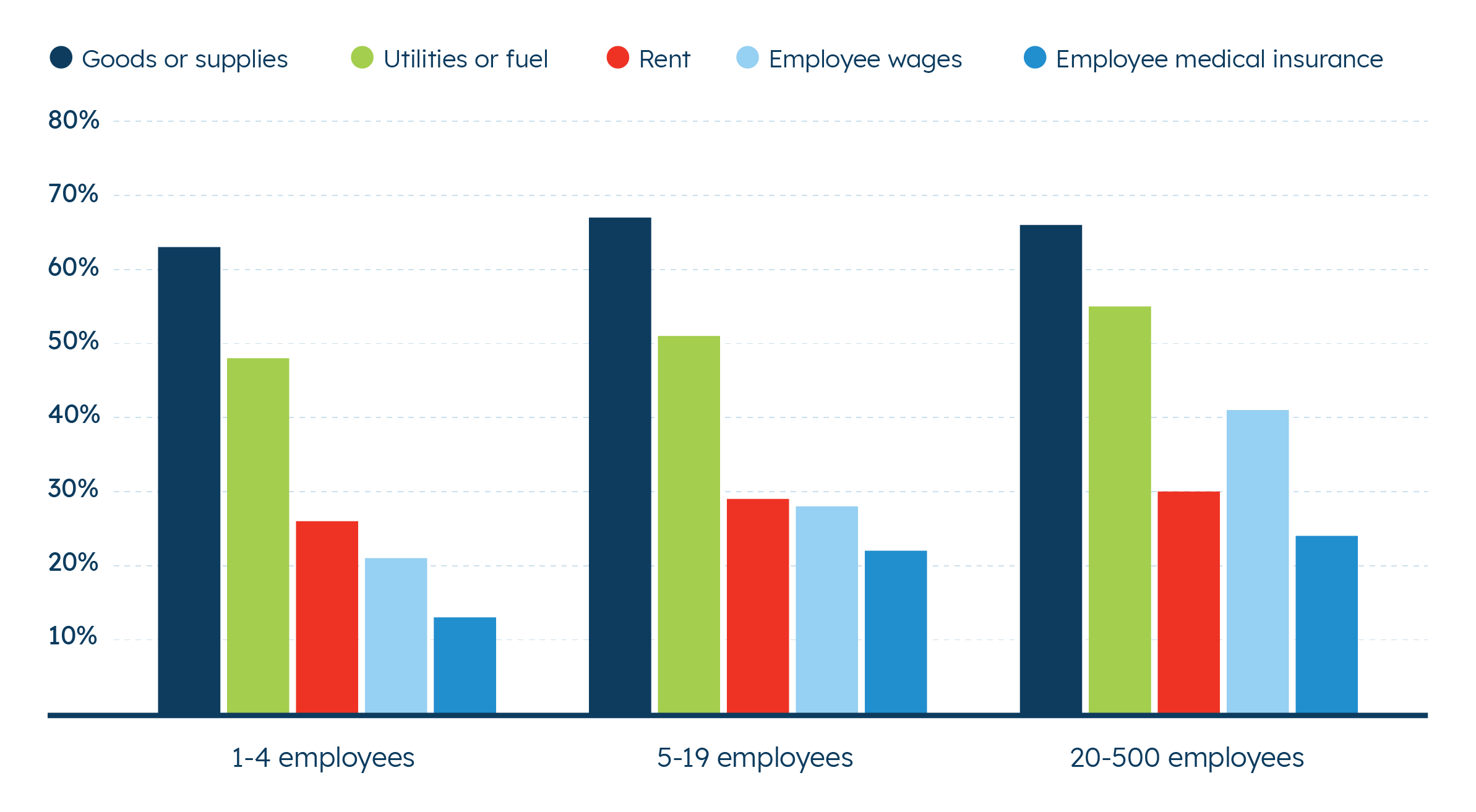

Among small business owners that agree rising prices have had a significant impact on their business (83% of respondents), most cite the cost of goods and supplies (65%) and utilities or fuel (50%) as where they have seen the most impact. This marks a significant increase in the share saying their business has felt the largest impact of rising prices in utilities or fuel since Q4 2021 (up 11 points). In contrast, of these respondents, 27% said they were seeing an impact from rent (for office space or their place of business) and 25% said they were seeing an impact from employee wages.

Overall, the share of small business owners that say rising prices have had an impact on their business continues to trend upward, up from 71% in Q4 2021 to 83% now.

Inflation impacts vary based on business size and sector. For example, larger businesses are more likely to feel an impact of rising prices when it comes to employee wages (though the cost of goods or supplies remains at the top of the list for this group). Professional services businesses are also more likely to say they’ve felt an impact in a number of different ways, whereas other sectors are more concentrated around the cost of goods/supplies or utilities/fuel.

Small Businesses Cope with Inflation by Raising Prices of Goods, Services.

More and more small businesses are forced to charge more for the goods and services they offer in order to cover their own costs. Significantly fewer report taking out loans, reducing staff, or reducing the quality of their goods to offset inflation’s impact.

In response to inflationary pressures, 70% of small businesses report having raised their prices (on par with last quarter at 69%). Another 40% indicate they have taken out a loan (down from 46% in Q2 2022), while 37% say they have reduced staff. Thirty-one percent say they have reduced the quality of their products or services, and just 27% say they are using lower quality materials to combat rising costs.

Despite widespread concern over inflation, differences in how small businesses are reacting exist by sector. Retailers (shops and restaurants) seem to be most highly impacted by rising inflation: retailers (82%) report raising their prices more than those in the services (58%) and professional services (66%) sectors. Half of the retailers also report reducing staff due to inflation, more than any other sector. Finally, retail (44%) and professional service (38%) small businesses are more likely to say they have reduced the quality of their products or services as a result of inflation than manufacturing (24%) and services (22%) small businesses.

Most small businesses see worse inflation coming.

The vast majority of small businesses see inflation continuing and getting worse. They also say policymakers should prioritize combating inflation over avoiding an economic downturn.

In line with their increasingly pessimistic expectations, 71% of small businesses believe that when it comes to inflation and price increases, the worst is still to come, versus 29% who believe the worst is behind us. In light of this, when forced to choose, 59% of small business owners believe the priority should be reducing inflation as opposed to avoiding an economic downturn (41%).

Small businesses plan for higher interest rates to stick around

More small business owners are not only responding to higher inflation, they’re also planning for high interest rates to persist.

Fourteen percent of small business owners cite rising interest rates as a top concern for the small business community, in line with last quarter but double the number who said this in Q1 2022 (7%). While this puts interest rates well behind inflation in terms of the most pressing issue facing small business owners, a separate question shows their intensity of concern continues to increase. This quarter, 40% of small businesses say they are very concerned about the impact of interest rates rising on their business (up 11 percentage points from Q1 2022).

In response, roughly half say they are budgeting for higher borrowing costs (51%) and planning for fewer sales (48%) over the next year due to rising interest rates.

By sector, fewer small businesses in services (39%) report budgeting for higher borrowing costs than those in professional services (58%), manufacturing (57%), and retail (54%). Retail (60%) and manufacturing (57%) small businesses are more likely to say they are planning for fewer sales due to rising interest rates than services and professional services (both 42%).

Sidney, MT

Majority say economy more turbulent than in past

Most small businesses surveyed said they expect an economic downturn within the coming year and say that the economic environment is more turbulent now than it was in the past.

Nearly nine in ten (88%) small businesses are concerned about the U.S. entering an economic downturn in the next year. In fact, 54% say they are very concerned about this. These concerns are widespread. Over eight in ten are at least somewhat concerned regardless of region, sector, and number of employees in their small business.

More than six in ten small businesses (61%) think the economy changes more quickly these days than it did in the past. In light of this, 76% say they have a plan to adapt to a changing economy. Larger small businesses tend to have a plan to adapt compared to the smallest businesses. More small businesses with 5-19 employees (82%) and 20-500 employees (81%) say they have a plan to adapt to a changing economy than those with 1-4 employees (73%).

Most say they have relied more on local suppliers

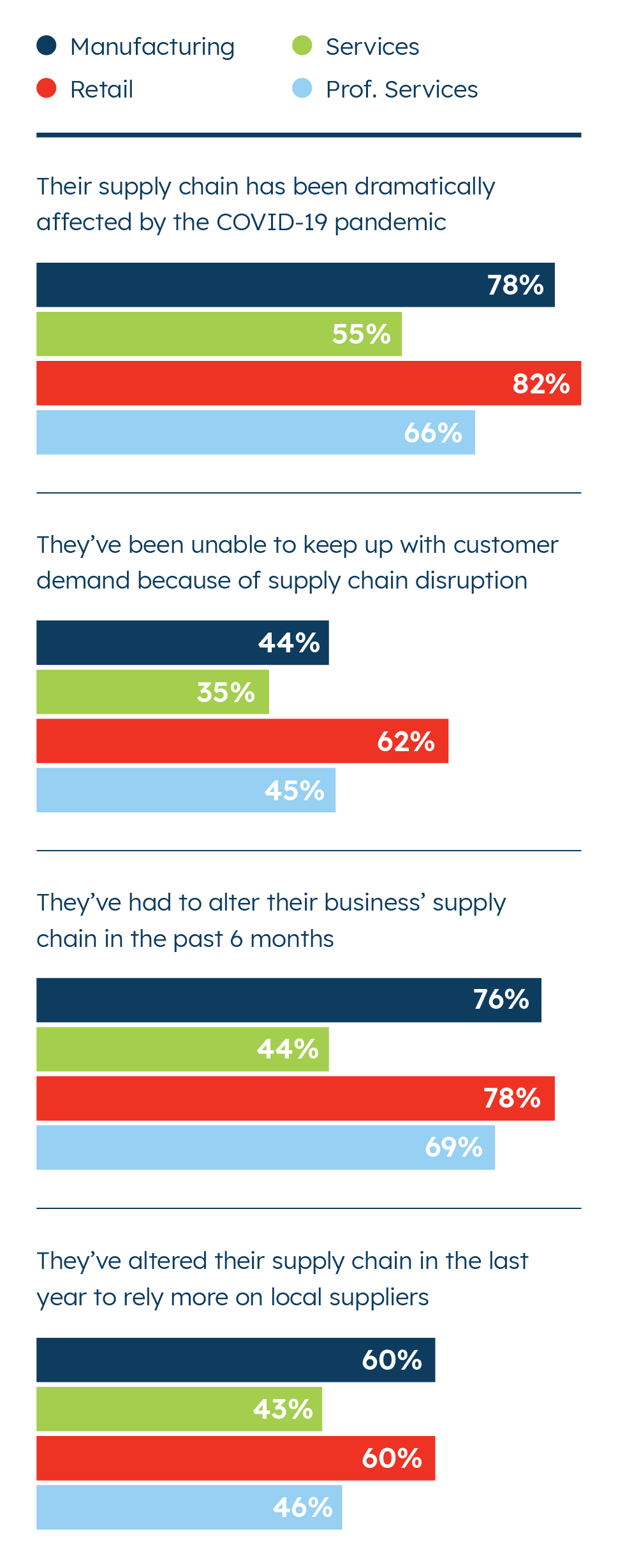

Still, supply chain issues are not as paramount as they were earlier in the pandemic. Although the share of small businesses that report supply chain issues as a top concern (26%) has plateaued, it remains a second-tier concern along with revenue (22%) for the third consecutive quarter. Both measures are now well below concerns over inflation (50%).

Over time, while concerns over supply chain have held steady (and inflation and interest rate concerns have grown), concerns over COVID-19 have leveled off. In Q1 2022, 24% said COVID safety protocols were a top concern. This quarter, 13% said the same.

Generally, the share of small businesses that consider supply chain issues a top concern for the small business community is consistent across region and business size. However, when rating their standalone level of concern, manufacturing and retail small businesses are more concerned than those in services and professional services about their supply chain. Also, fewer in services (13%) consider supply chain a top concern than in manufacturing (36%), retail (32%), and professional services (26%).