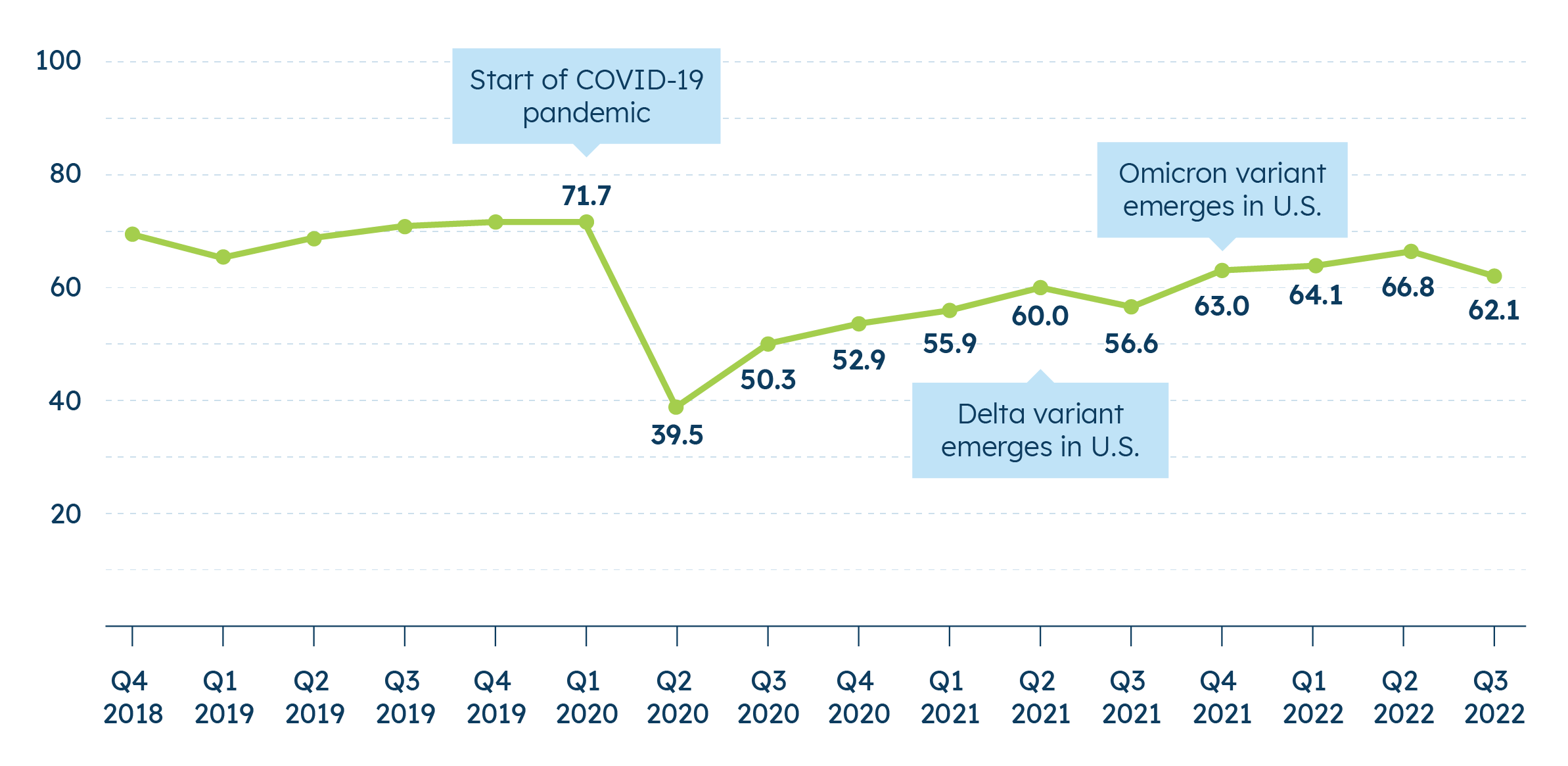

Index Dips As Small Businesses See High Inflation Persisting

This quarter, small businesses’ concern over inflation reached a new high as more brace for an uncertain future according to the latest MetLife & U.S. Chamber of Commerce Small Business Index. This quarter’s score of 62.1 represents the largest drop since the start of the pandemic. Increased pessimism about the broader economic environment and subdued future expectations both contributed to this downward shift. Small businesses also say they are now less confident in both the U.S. economy and their local economic environment and are less comfortable with their current cash flow.

The survey—conducted between July 21-August 8, 2022—found that inflation is small businesses’ single top concern by far. It also found that this concern has only grown from recent highs reported last quarter. Currently, half (50%) of respondents say inflation is the biggest challenge. This represents the fifth consecutive quarter of increasing concern over inflation, and it marks a drastic 31-point increase since this time last year. Furthermore, a strong majority (71%) of small business owners believe the worst is still to come with regards to inflation.

At the same time, small businesses’ perceptions of the economy are somewhat more negative. A majority of small businesses now say the U.S. economy is in somewhat or very poor health, up 10 percentage points from last quarter. The number of small business owners and decision makers saying the economy is in poor health is now more than twice as much as those saying it’s in good health. A similar, but less extreme pattern, emerges for perceptions of their local economy, where there has been a small shift from “good” to “poor” this quarter.

Small businesses also have less comfort with their cash flow, as well as slightly more downbeat expectations about future staffing and revenue. While two-thirds (66%) say they are comfortable with their current cash flow, this marks a seven-percentage point decline from last quarter—the first significant decline in this measure since mid-2020. Also falling slightly this quarter is the percentage of small businesses who expect to increase staff, and those predicting increased revenues in the next year, though these shifts are smaller and not statistically significant.

Respondents also view the current economy as more temperamental than in years past and express growing concerns over the economy. Three in five think the economy changes more quickly these days than it did in the past. Nearly nine in ten (88%) are concerned about the U.S. entering an economic downturn in the next year – and over half are very concerned.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q3 is 62.1. The Index score for Q2 2022 was 66.8. At the start of the pandemic in Q2 2020, it reached an all-time low of 39.5.1