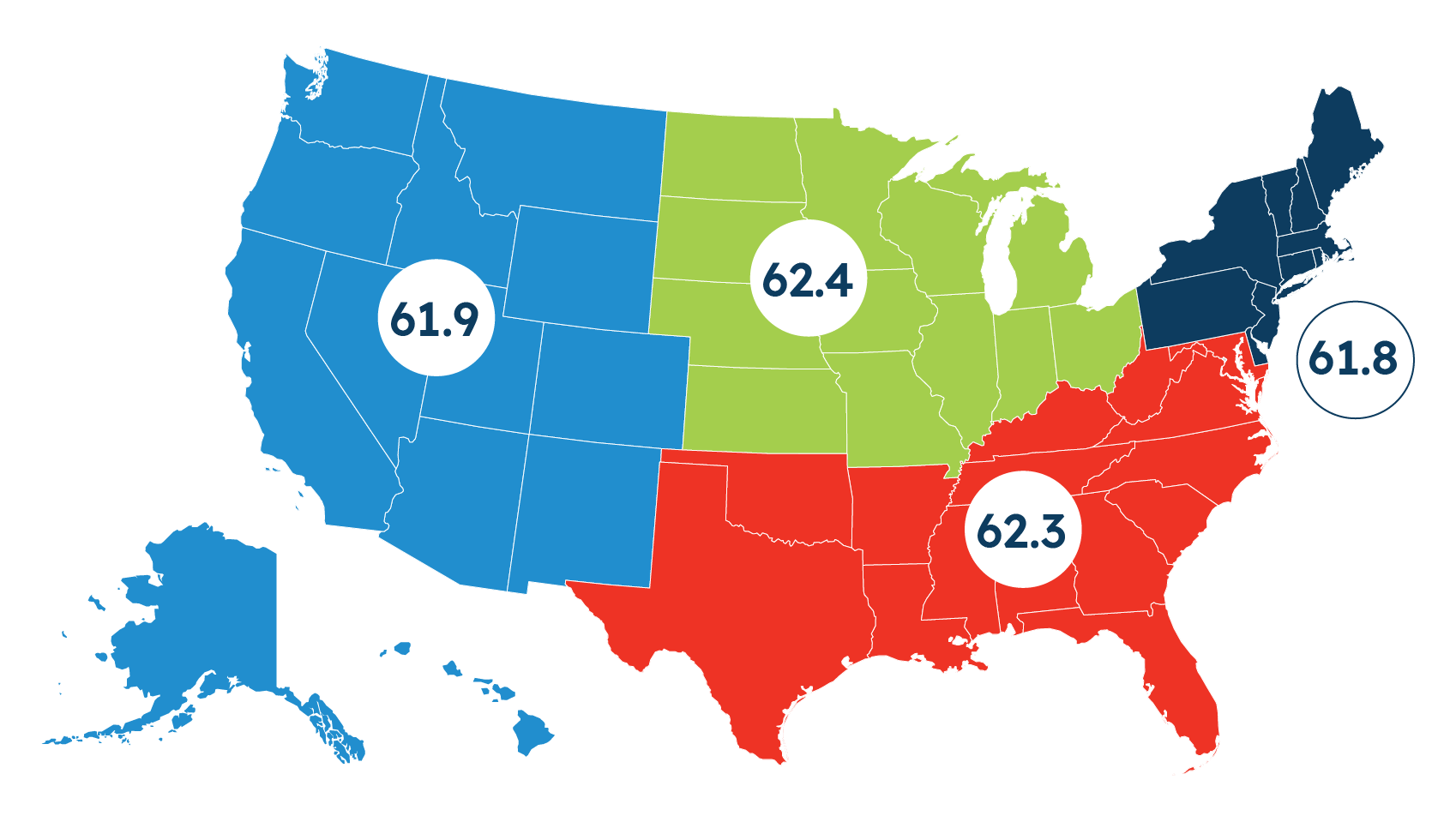

Regional Scores

National Score 62.1

South

West

Midwest

Northeast

Northeast (61.8)

In the Northeast, small businesses are significantly less confident in the U.S. and local economies. Only one in five (21%) rate the U.S. economy as good, dropping 19 points this quarter. Similarly, just under three in ten (27%) rate their local economy as good, dropping 18 points since last quarter. They also say they are less comfortable with cash flow (down 12 points) this quarter, and fewer say they have increased staff in the past year (down 11 points).

South (62.3)

Unlike other regions, Southern small businesses’ attitudes toward the U.S. economy have actually improved since last quarter (a 10-percentage point increase in those saying it is in good health). Yet, half still say the U.S. economy is in poor health. Four in ten Southern small businesses rate their local economy as poor, a slight, but insignificant five-point decline from last quarter.

Midwest (62.4)

Midwestern small businesses report relatively stable perceptions of their overall business health, the U.S. economy, and their local economy since the second quarter. However, their views toward the economy remain largely negative. While their plans to increase investment in the next year are essentially unchanged from last quarter, respondents in this region have reported marginal declines in plans to increase staff and achieve increased revenues in the next year (both dropping by nine points).

West (61.9)

Western small businesses’ perceptions of U.S. (25%) and local (27%) economic health have worsened this quarter. Compared to last quarter, Western small businesses also report that they are less comfortable with their cash flow (60% vs. 73%). In contrast to Q2 2022, fewer say they have increased staff (18% vs. 29%), plan to increase staff in the next year (33% vs. 48%), or plan for their revenue to increase in the next year (61% vs. 72%).