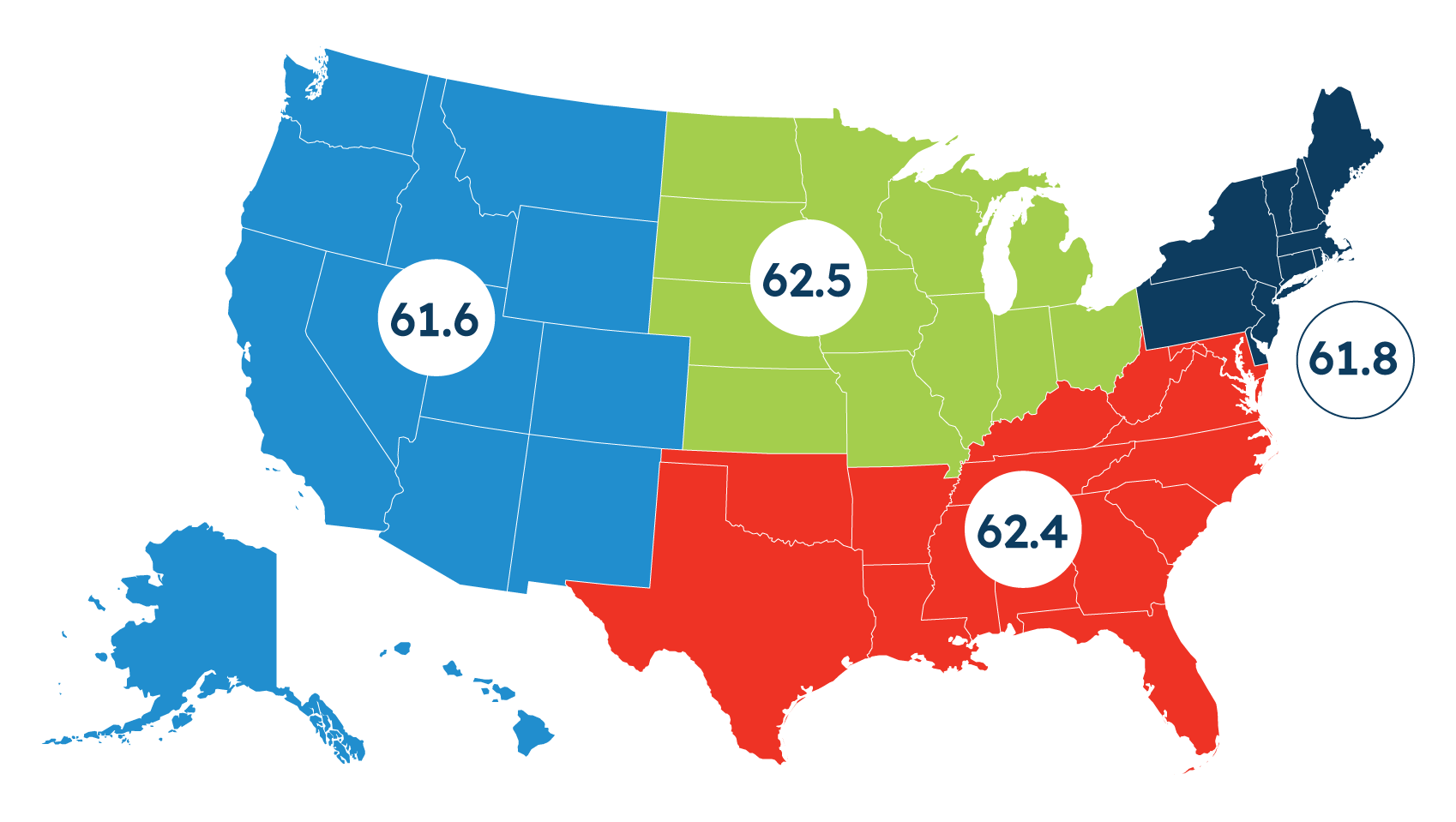

Regional Scores

National Score 62.1

South

West

Midwest

Northeast

Northeast (61.8)

Small businesses in the Northeast report similar perceptions of their economic environment as they did last quarter. Roughly three in ten (28%) believe their local economy is good, unchanged from last quarter (27%), and roughly two-thirds continue to report spending the same amount of time, or less, on regulatory compliance (63% this quarter and last).

South (62.4)

Perceptions among small business owners in the South largely remain similar to those in Q3. One-third consider their local economy good, on par with Q3 (33% vs. 36%). However, fewer Southern small businesses now report that their business is in very good health than last quarter (28% vs. 41%), with more saying it is in somewhat good or average health.

Midwest (62.5)

Midwestern small businesses report very similar perceptions of their operations, the business environment, and future expectations as they did in Q3. However, fewer Midwestern small businesses now rate their local economy as very or somewhat good compared to last quarter (23% vs. 33%). Also, fewer now say that the health of their business is somewhat or very poor compared to last quarter (7% vs. 20%)—with more feeling mostly average about their own health.

West (61.6)

Small businesses in the West have very similar perceptions of the state of their business operations and future expectations as compared to last quarter. However, nearly half (49%) say they spend more time on completing licensing, compliance, or other government requirements than six months ago. This is the highest of any region and marks a 14-percentage-point increase from last quarter.