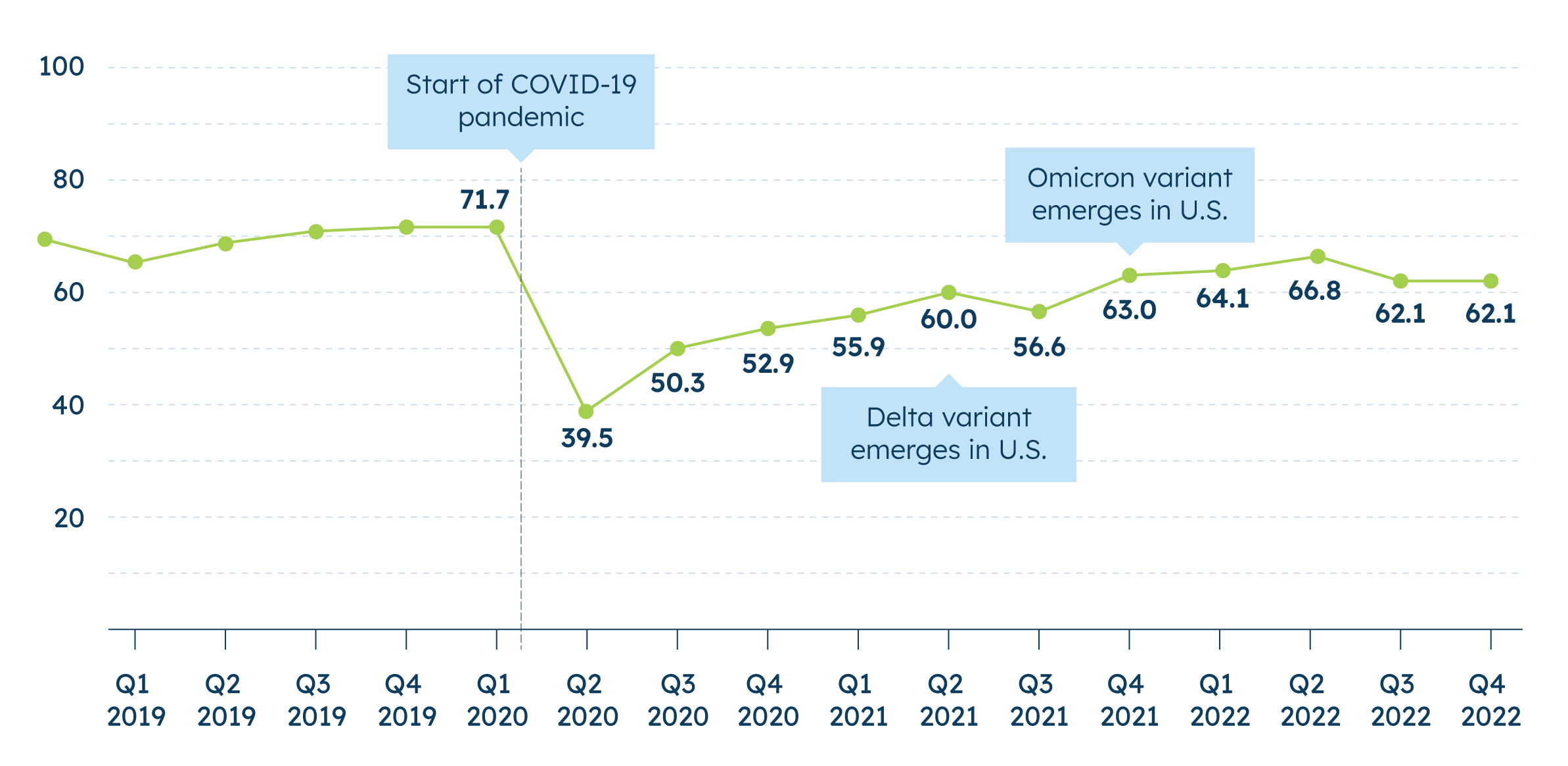

Index Steady as Small Businesses Say High Inflation Still Top Concern

This quarter, small businesses’ concern over inflation remained at record highs as small businesses enter a crucial holiday season according to the latest MetLife & U.S. Chamber of Commerce Small Business Index. This quarter’s score of 62.1 matches last quarter’s score, which marked the largest quarterly drop since the Index plummeted at the start of the pandemic.

Overall, the survey—conducted between October 11-27, 2022—shows a remarkable consistency with findings last quarter across nearly all the questions that comprise the Index. This consistency reflects continued feelings of uncertainty about the broader economic environment that small business owners face.

Small business owners say inflation remains the top challenge (53%) for the fourth consecutive quarter, having jumped 30 percentage points since this time last year. Additionally, roughly four in five say rising prices have had a significant impact on their business this year, a consistent share for the third consecutive quarter. Meanwhile, concerns over supply chain issues have slightly cooled, shifting six percentage points down from last quarter (20% vs. 26%, respectively).

The upcoming holiday season is increasingly pivotal for small businesses’ overall profit, but there may be increased anxiety about it, especially for retailers. About eight in ten small businesses say the upcoming holiday season is important for their overall profit, a nine-percentage-point increase compared to this time last year (Q4 2021). Three in five say they expect less revenue than usual this holiday season.

Finally, most small businesses report giving back to their local communities. Two-thirds of small businesses (66%) say they have donated to local charities over the past year. While over half say they have encouraged employees to shop at local small businesses (70%), sponsored or donated goods/services to local events (64%), or offered discounts to certain groups within the community (56%). Furthermore, nine in ten say businesses should give back to their local communities, and four in five say they have a clearly defined mission that includes giving back. Likewise, about nine in ten (93%) report having taken at least one step to engage with their community in the past year.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q4 is 62.1. The Index score for Q3 2022 was also 62.1. At the start of the pandemic in Q2 2020, it reached an all-time low of 39.5.1