Methodology

These are the findings of an Ipsos poll conducted between May 8-24, 2023. For this survey, a sample of 752 small business owners and operators age 18+ from the continental U.S., Alaska, and Hawaii was interviewed online in English.

The sample was randomly drawn from partner online panel sources that specialize in B2B sample and does not rely on a population frame in the traditional sense. Ipsos uses fixed sample targets, unique to the study, in drawing sample. Small businesses are defined in this study as companies with 500 or fewer employees that are not sole proprietorships. This sample calibrates respondent characteristics to be representative of the U.S. small business population using standard procedures such as raking-ratio adjustments. The source of these population targets is U.S. Census 2019 Statistics of U.S. Businesses dataset. The sample drawn for this study reflects fixed sample targets on firmographics. Post-hoc weights were made to the population characteristics on region, industry sector and size of business. Additional post-hoc weights were made to the population characteristics on the gender of the business’s owner and whether the business is minority-owned or not.

Statistical margins of error are not applicable to online non-probability polls. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error and measurement error. Where figures do not sum to 100, this is due to the effects of rounding. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll has a credibility interval of plus or minus 4.4 percentage points for all respondents. Ipsos calculates a design effect (DEFF) for each study based on the variation of the weights, following the formula of Kish (1965). This study had a credibility interval adjusted for design effect of the following (n=752, DEFF=1.5, adjusted Confidence Interval=+/-5.9 percentage points).

Starting with the March 2020 survey, small business decision makers are reached via an online survey, in place of the typical phone-based approach. This methodological shift is in response to lower anticipated response rates in dialing owners at their businesses as a result of mandated closures related to the COVID-19 outbreak. While significant changes in data points can largely be attributed to the recent economic environment, switching from a phone to online approach may have also generated a mode effect.

Index Methodology

To construct national, regional, employee size, and broad industry group level estimates of the health of small businesses in the U.S., a sequence of statistical techniques were applied to the survey results, including elastic net for variable selection and multilevel regression with post stratification (MRP) from the survey data.

Since each business may report the state of its health by different standards, Ipsos uses the core survey questions to construct a stable, consistent definition of small business status. Each business is then classified into one of three categories: poor, neutral, or good. Once each business is measured on a consistent scale, the survey results are fed into a multilevel regression model to generalize our results to a broader set of businesses enabling us to measure the health of businesses not just nationally but also at the level of state, industry, and business size. The model uses employee size, industry type, and location as individual level predictors, as well as data from the BLS on job change by industry.

Next, to ensure that our model results are reflective of the small business population in the U.S., we adjust our estimates using the number of businesses in the over 5,000 possible combinations of state, industry, and firm-size categories to ensure that the model of business health represents the U.S. population of small businesses.

The process used is known as post-stratification, something which was not possible with the original sample due to sample-size limitations. The population estimates for employee size, industry, and location were obtained from the U.S. Census 2019 Statistics of U.S. Businesses dataset.

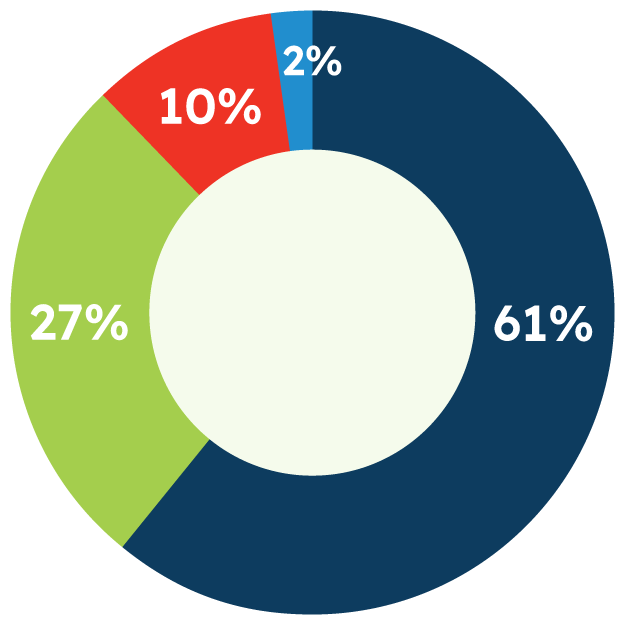

Small businesses are categorized into four industry sectors, using the NAICS sector definitions from the U.S. Census.

Retail: Wholesale Trade; Retail Trade; or Accommodation and Food Services

Manufacturing:Agriculture, Forestry, Fishing and Hunting; Mining, Quarrying, and Oil and Gas Extraction; Utilities; Construction; Manufacturing; or Transportation and Warehousing

Services: Educational Services; Health Care and Social Assistance; Arts, Entertainment, and Recreation; or Other Services

Professional Services: Information; Finance and Insurance; Real Estate and Rental and Leasing; Professional, Scientific, and Technical Services; Management of Companies and Enterprises; or Administrative and Support and Waste Management and Remediation Services

Sector

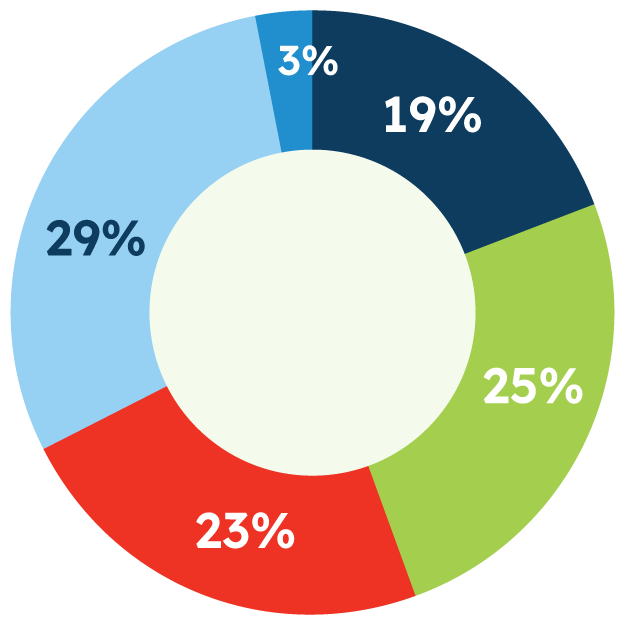

Employee Size

Region