Index up as Small Businesses Plan for More Hiring, Higher Revenue

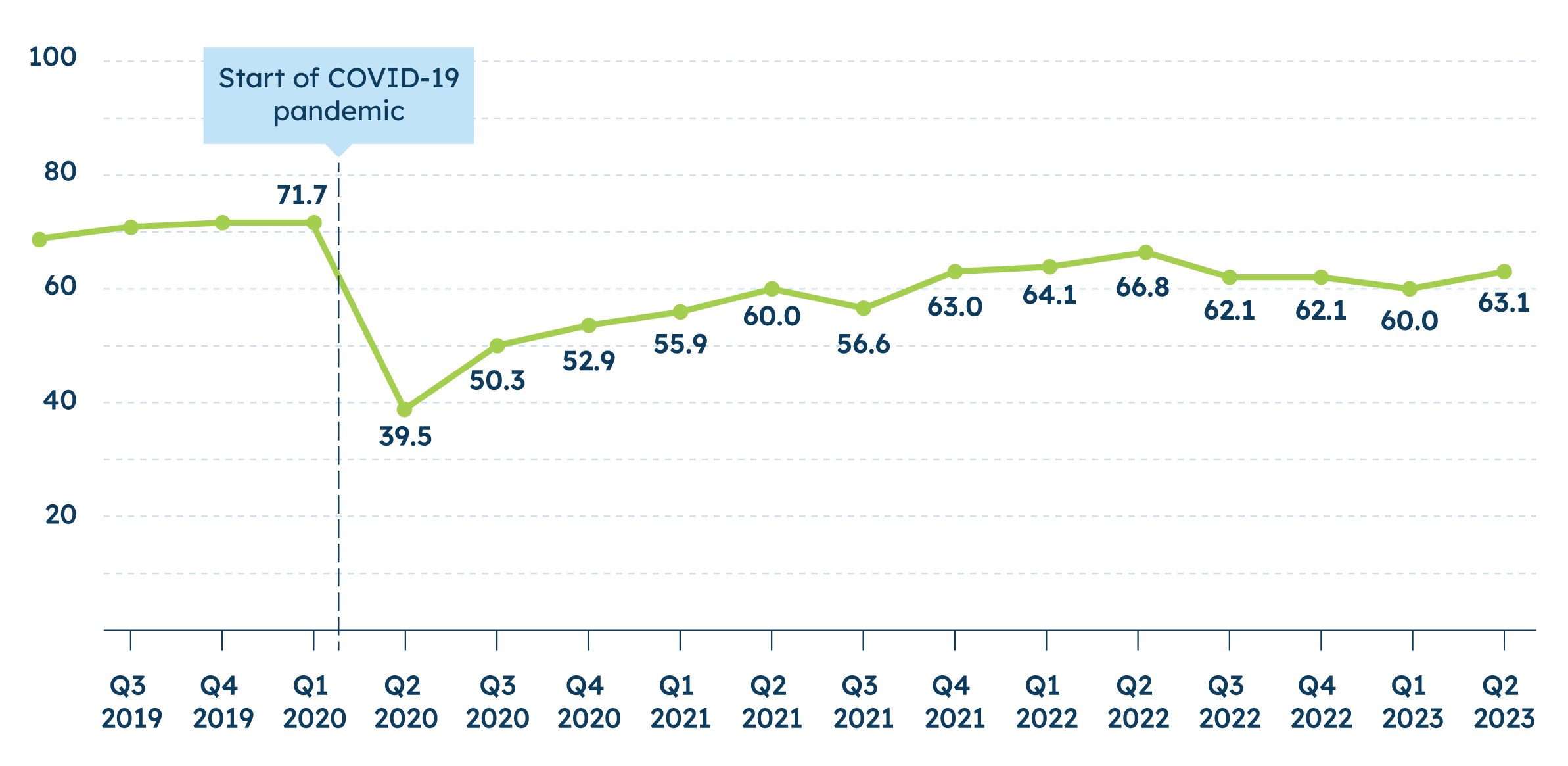

Small businesses are feeling better about the future according to the latest MetLife & U.S. Chamber of Commerce Small Business Index. Both hiring plans and revenue expectations for the next year reached the highest level ever recorded in the Index (started in Q2 2017), driving the overall score higher.

The Index rose to 63.1 this quarter, a slight increase from last quarter (60.0) and near findings in Q4 2022 (62.1). Overall, small businesses continue to feel good about the day-to-day operations of their business, including business health and cash flow, despite continued macroeconomic mixed signals.

However, most small business owners continue to see inflation as their biggest challenge by far. More than half (54%) of small business owners say inflation is their top challenge. This has remained consistent since Q3 2022 and represents a 35-percentage point increase since Q3 2021. This sentiment is widespread, and inflation is the top concern for small businesses regardless of their region, number of employees, or sector.

Small businesses say they are changing their behavior in response to interest rate hikes and have more concern about rising rates. Three in four (76%) small businesses say rising interest rates are limiting their ability to raise capital or financing for their business, a 10-percentage point increase since last quarter and a 16-percentage point increase since first asked one year ago. What’s more, half (50%) of small businesses report that they have delayed plans to grow their business in response to higher interest rates. Fully 74% of small businesses express concern about rising interest rates making it harder to pay back their current business loans (while 36% say they strongly feel rising rates will make it harder to pay them back). Seventy three percent (73%) say it’s harder to borrow money from banks for their business because banks are tightening lines of credit.

Small business owners also indicate that they are turning to more sources for capital/financing for their business. A majority report relying on their personal savings (71%), credit cards (67%), and local banks or credit unions (59%) for funding. Four in 10 (41%) small businesses say they have turned to fixed rate loans while 26% say they have used variable rate loans.

Index Highlights

The MetLife and U.S. Chamber of Commerce Small Business Index score for Q2 is 63.1. The Index score for Q1 was 60.0.