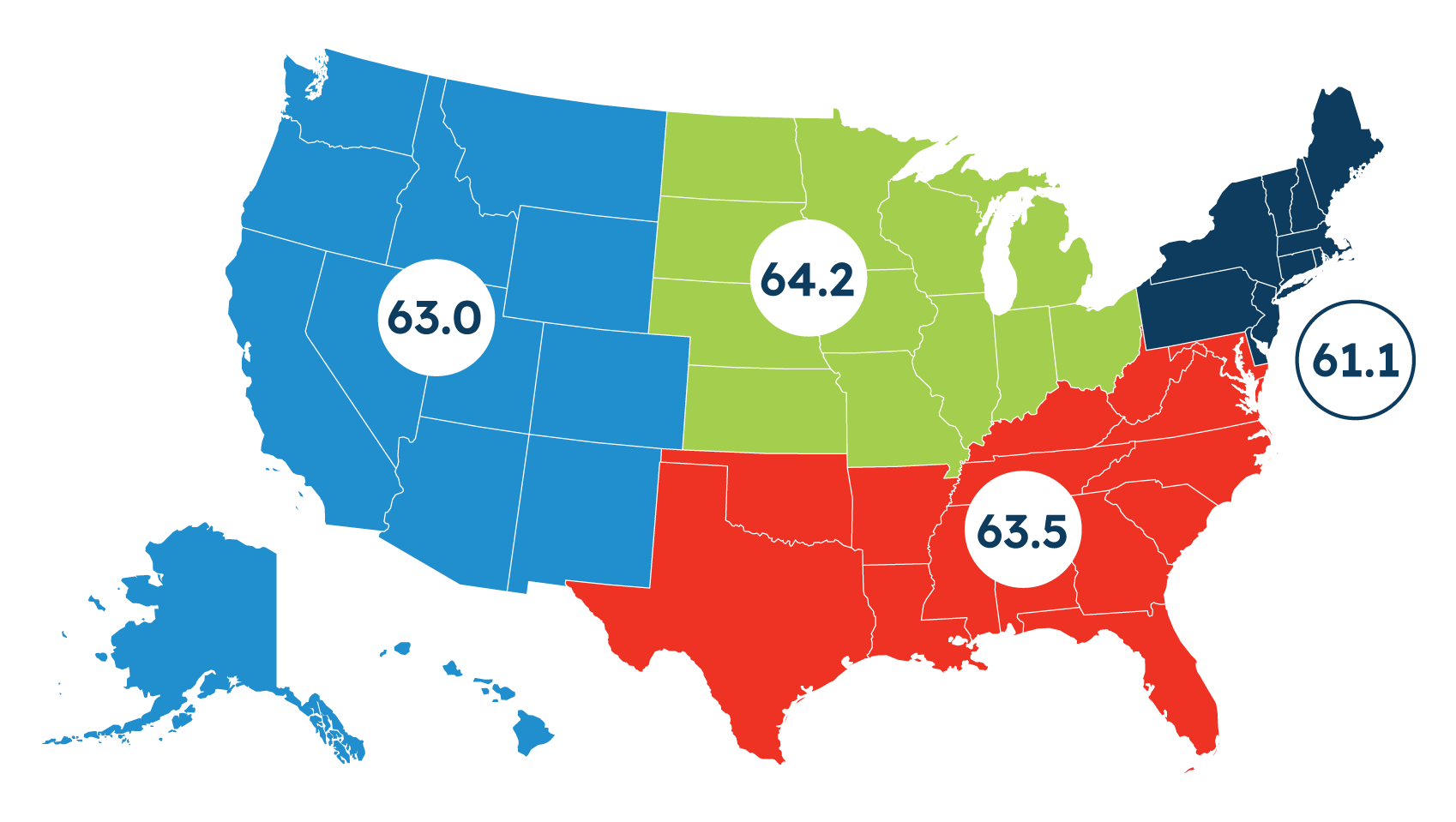

Regional Scores

National Score 63.1

South

West

Midwest

Northeast

Northeast (63.1)

About half (51%) of small businesses in the Northeast say their business is in good health, declining by 14 percentage points since Q1 2023 (65%). A majority (62%) say they are comfortable with their cash flow, down 12 percentage points from last quarter (74%). More also report reducing staff in the past six months (up to 20% from 7% in Q1). However, they are significantly more likely to plan to increase staff (53% vs. 29%) this quarter.

South (63.5)

Attitudes of small businesses in the South are more stable than other regions this quarter. Overall, there have been slight, but not significant, positive shifts in many measures, such as increased competition, more comfort with cash flow, and plans to increase staff. However, their attitudes track quite closely to the broader national outlook, likely explaining the increase in the Southern regional score this quarter.

Midwest (64.2)

Views on overall business operations hold steady this quarter in the Midwest. About two-thirds of Midwestern small businesses report their business is in good health (65%) and that they are comfortable with cash flow (68%). Alongside the national trend of increased optimism about the future, Midwestern small businesses are more likely to say they plan to increase investment (42%) and predict higher revenue (68%) this quarter, increasing by about 10 percentage points each since last quarter.

West (63)

Western small businesses’ perceptions of the economic climate are improving. Nearly half of Western small businesses say that they plan to hire more staff in the next year (49% vs. 38% in Q1). Attitudes toward the U.S. economy have also improved this quarter, following a 12-percentage point drop in Q1. Nearly three in ten (29%) regional small businesses say the U.S. economy is in good health, compared to 35% in Q2 2022.