Operations, Environment & Expectations

Small Business Operations: Business Health, Cash Flow Comfort Increase

This quarter, almost seven in ten small businesses (69%) say their business is in good health, up from last quarter (63%). Additionally, nearly three in four (73%) now say they are comfortable with their cash flow, up from last quarter (66%) and matching comfort from Q2 2024 (73%).

Keeping with historical patterns recorded from the start of the study in Q2 2017*, small businesses with more employees are more likely to report good business health or comfort with cash flow than those with fewer employees. By sector, small businesses in services are less likely to report that their business is in good health.

Similar to last quarter, comfort with cash flow varies greatly. Small businesses in services (58%) are less likely than those in manufacturing (83%), professional services (77%), and retail (76%) to say that they are comfortable with their cash flow. Those in services are also less likely than other sectors to report they have increased staff in the past year (11% vs. 30-39%, respectively).

Unlike the past two quarters, there are significant differences in reported business health by length of business operation. Those in operation for 21+ years are less likely to report that their business is in good health. Additionally, continuing a trend over a year in length, small businesses in operation for 10 years or less are more likely than those in operation for 21+ years to say they have increased staff in the past year (33% vs. 9%).

Small businesses owned by Gen Z or Millennials are significantly more likely than those owned by Gen Xers and Baby Boomers and older generations to report that their business is in good health (79% vs. 64% and 53%, respectively), have comfort with their cash flow (80% vs. 71% and 61%), and report that they have increased staff in the past year (42% vs. 23% and 11%).

Lastly, more small businesses are reporting an increase in staff in the past year. Twenty-eight percent say they have increased staff in the past year, up from both last quarter (20%) and this time last year (22%).

* Beginning in Q2 2020, an online approach was used in place of the typical phone methodology. This change in mode may be responsible for some of the shifts in the data after Q1 2020.

Small Business Environment: View of the National Economy Improves Slightly

Small businesses’ perceptions of the economic environment have improved slightly this quarter. Thirty-four percent of small businesses say the U.S. economy is in good health, up from last quarter (29%) and in line with this time last year (36%). However, businesses are now reporting spending more time on compliance.

In addition, 41% now say their local economy is in good health, in line with last quarter (37%) and at levels similar to where it was throughout 2024.

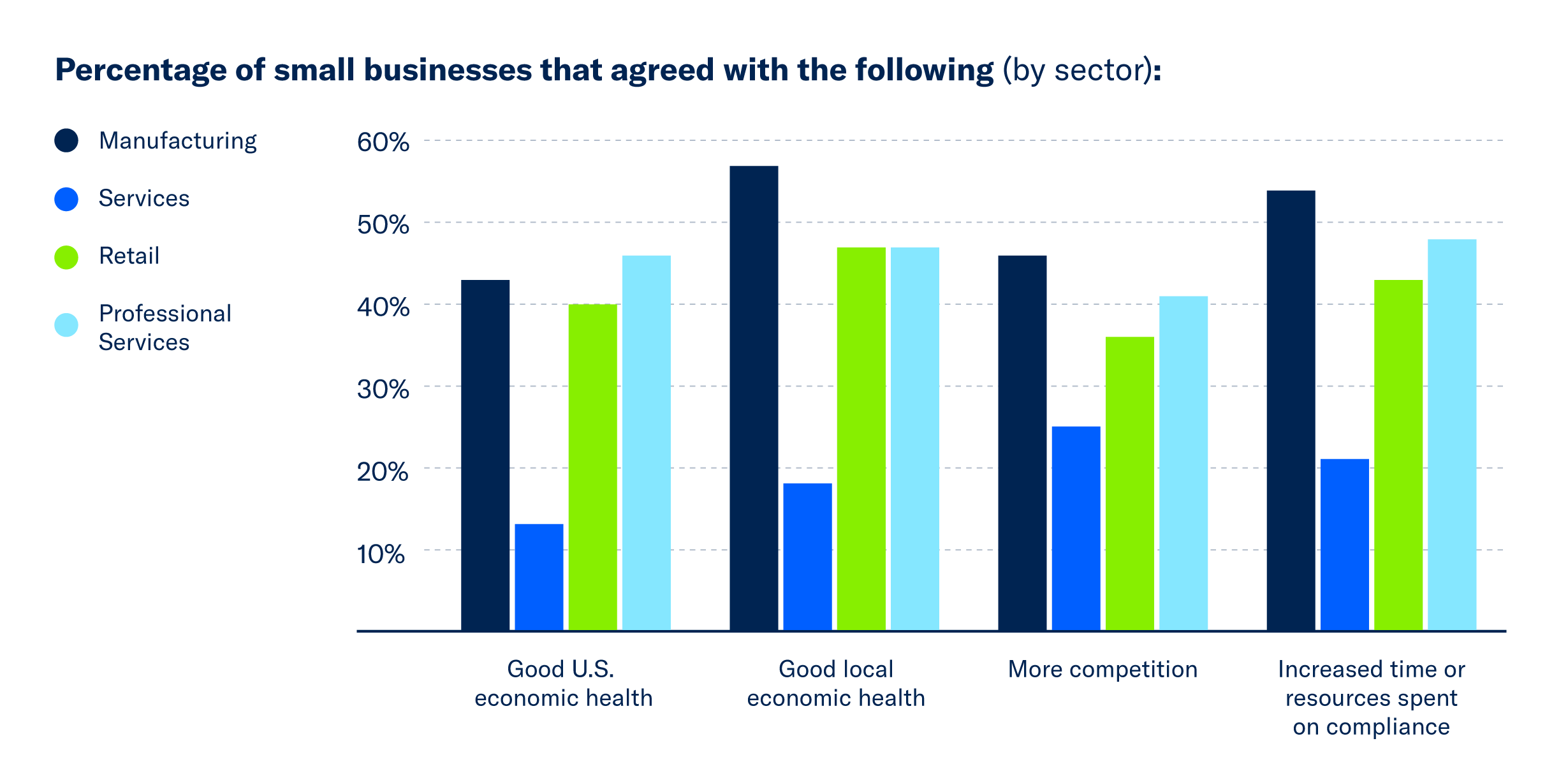

The generation of owner, gender of owner, and sector all affect perceptions of the economy. By sector, those in services are significantly less likely than other industries to say that the national economy and their local economy are in good health. Continuing a now more than year-long trend, male-owned small businesses are more likely than those owned by women to say the national and local economies are in good health. Small businesses owned by Gen Zers or Millennials are significantly more likely than those owned by Gen Xers and Baby Boomers or older to say the U.S. and local economies are in good health, and that they are spending increased time on compliance. Additionally, small businesses owned by Baby Boomers and older generations are less likely to report that they are seeing increased competition.

This quarter, 40% of small businesses are now reporting spending more time on compliance, up seven percentage points from last quarter (33%).

Also, small businesses are reporting more competition from local businesses this quarter. Thirty-six percent say competition from smaller or local companies has increased compared to six months ago, up from last quarter (29%) and in line with Q2 2024 (35%).

Small Business Expectations: Mixed Signals

About two in three (65%) small businesses say they expect revenue to increase in the next year, in line with last quarter (69%) but down from Q2 2024 (73%). In contrast, 42% of small businesses now expect to increase hiring in the next year, up from last quarter (37%) and in line with this time last year (41%).

Nearly half (47%) of small businesses expect to increase investment in the next year, in line with both last quarter (43%) and this time last year (46%).

Small businesses in services are less likely than those in other sectors to expect increases in revenue, staff, or investment in the next year. In the same vein, small businesses with fewer than five employees are less likely than their counterparts to say they expect to increase staff or expect revenue to increase in the next year.

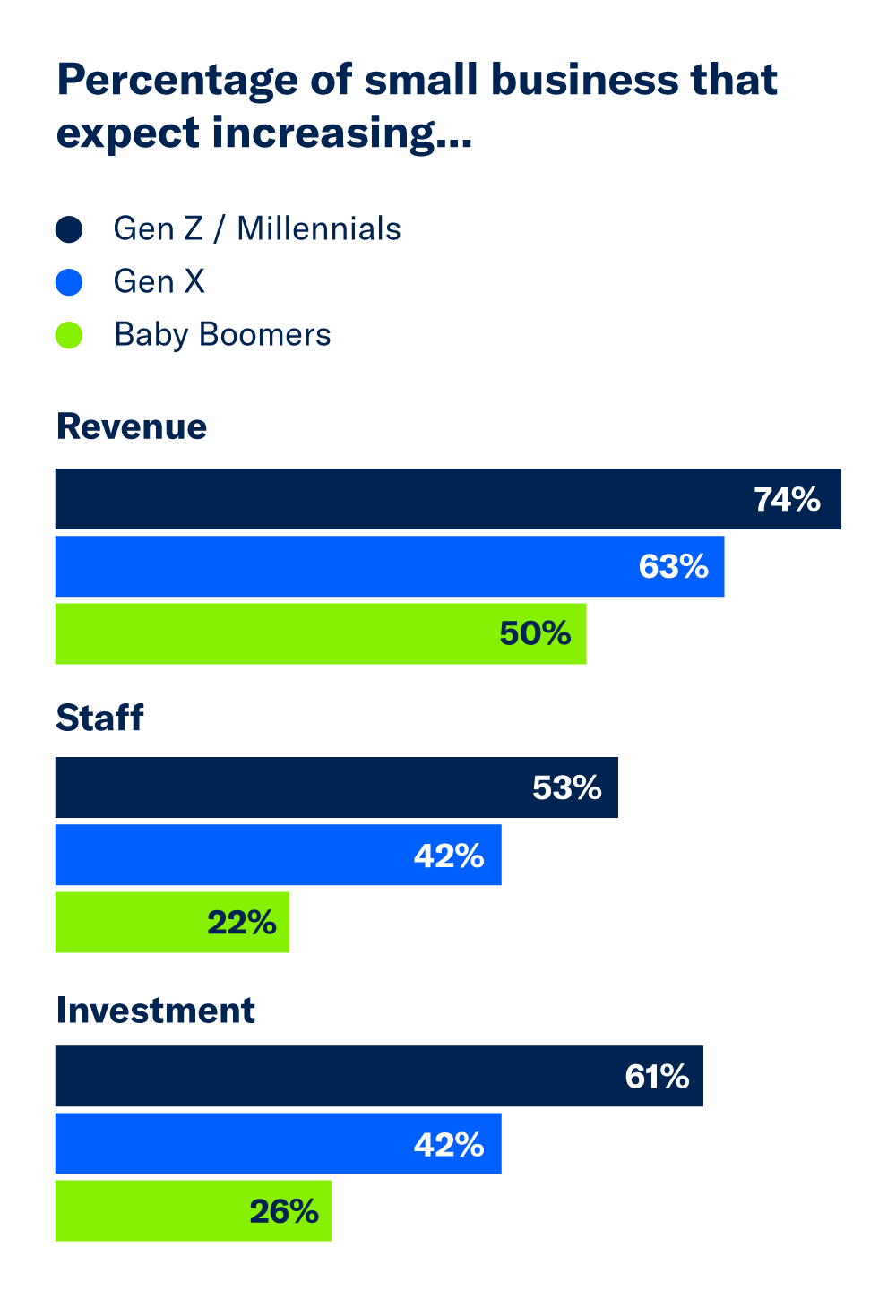

Each measure of business expectations—future increases in revenue, hiring, and investment—continues to vary significantly by gender of owner and generation of owner. Male-owned small businesses are more optimistic about increases in investment, staffing, and revenue. Along these lines, small businesses owned by Gen Zers or Millennials and Gen Xers are significantly more likely to expect future increases in investment, hiring, and revenue compared to their Baby Boomer and older counterparts.