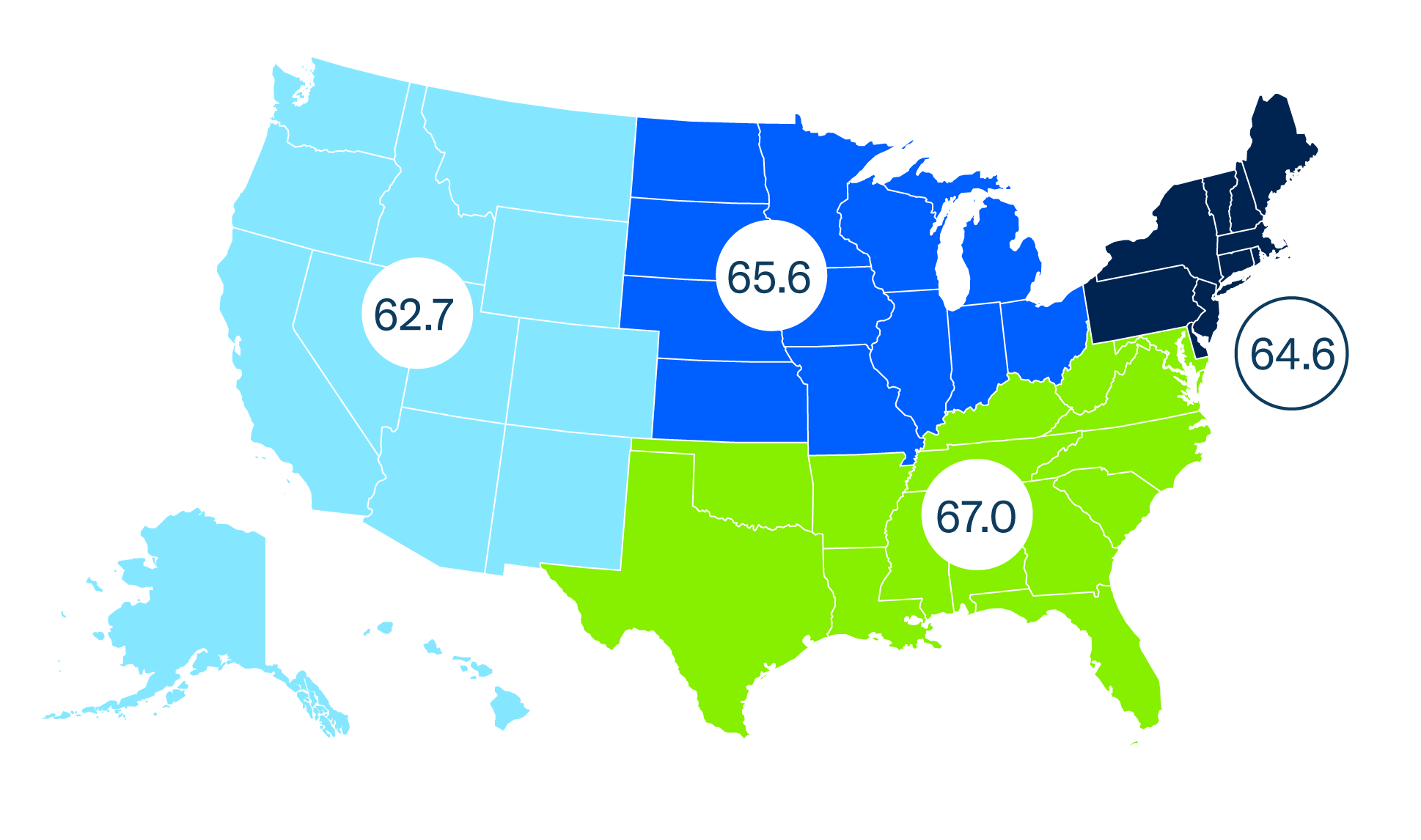

Regional Scores

National Score 65.2

South

West

Midwest

Northeast

Northeast (64.6)

Similar to the national Index, the Northeast score is up slightly this quarter. Forty-six percent plan to increase investment in the next year (39% in Q1), and 40% plan to increase staff (34% in Q1). Additionally, 36% report seeing increased competition compared to six months ago (29% in Q1). Most other measures, including business health (66%) and comfort with cash flow (72%), are stable.

South (67.0)

Notably, Southern small businesses are significantly more optimistic than other regions. Four in five (80%) small businesses in the South report that their business is in good health, up fourteen percentage points from Q1 (66%). A similar percentage (86%) are also comfortable with their cash flow, up significantly from last quarter. Nearly half (48%) say that the national economy is in good health, and 56% say the same of their local economy.

Midwest (65.6)

The Midwest score is up slightly this quarter, largely due to increased optimism about the future. Two in five (39%) now plan to increase staff in the next year, up eleven percentage points from last quarter (28%). Also, 44% plan to increase investment and 62% expect their revenue to increase. Beyond future expectations, most measures for Midwestern small businesses this quarter are stable.

West (62.7)

The index score in the West is stable this quarter. Three in five small businesses in the West say their business is currently in good health and that they are comfortable with their cash flow (59% each). Twenty-five percent feel that the national economy is in good health, and 29% say the same of their local economy. Sixty-one percent expect to increase revenue in the next year, down fourteen percentage points from last quarter (75%).