Operations, Environment & Expectations

Small Business Operations

Over a year since the pandemic’s full impact was felt, most small businesses say their business health, cash flow, and headcount are now steady, with little change from last quarter.

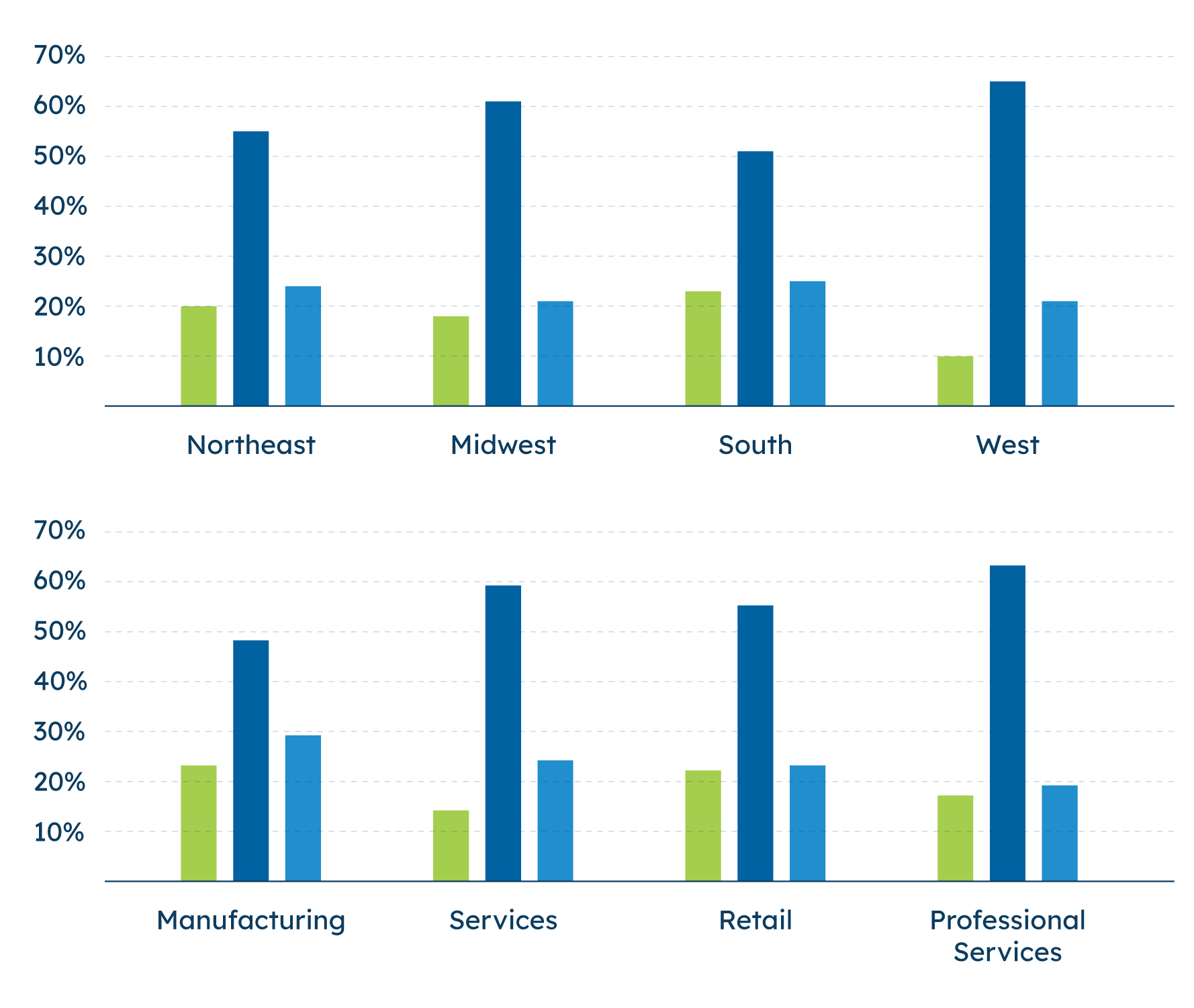

Fifty-two percent of small businesses rate their overall business health as good, unchanged from last quarter. This measure has stayed consistent since May 2020. There is some difference based on the gender of business owners: 55% of male-owned small businesses say their business health is good, but 48% of women-owned business owners say the same. Across regions, small businesses in the Midwest are least likely to report good business health (45% vs. 53-55% in other regions). Similar to trends throughout the pandemic, professional services are generally more optimistic about business health, while retailers and manufacturers are less optimistic. A slim majority of service businesses (53%) and professional services (58%) firms say their business is in good health, while fewer than half of retailers (45%) and manufacturers (48%) agree.

Over the past year would you say you have:

More than six in ten small businesses are comfortable with their current cash flow (64% now, similar to Q1’s 62%). As we see with overall business health, the smallest businesses are least likely to report comfort with cash flow. Overall, most small businesses continue to report they have retained the same size staff over the past year (57%), while 18% have increased staff and 23% have reduced staff. Interestingly, the number of small businesses who say they have reduced staff remains higher than in 2020, a shift first noticed last quarter.

Though reported headcount has not changed overall since earlier this year, there are some subtle shifts under the surface. For example, Midwestern businesses are more likely now to say they have retained the same size staff than last quarter (up nine points). Across sectors, those in the service industry say in larger numbers (up eight points this quarter) that they have increased staff, while manufacturers report being less likely to reduce staff, with 29% reporting they reduced staff (compared to 42% who said the same in Q1).

Small Business Environment

Small businesses are seeing slightly improved national and local economies which may be helping to drive their more hopeful views.

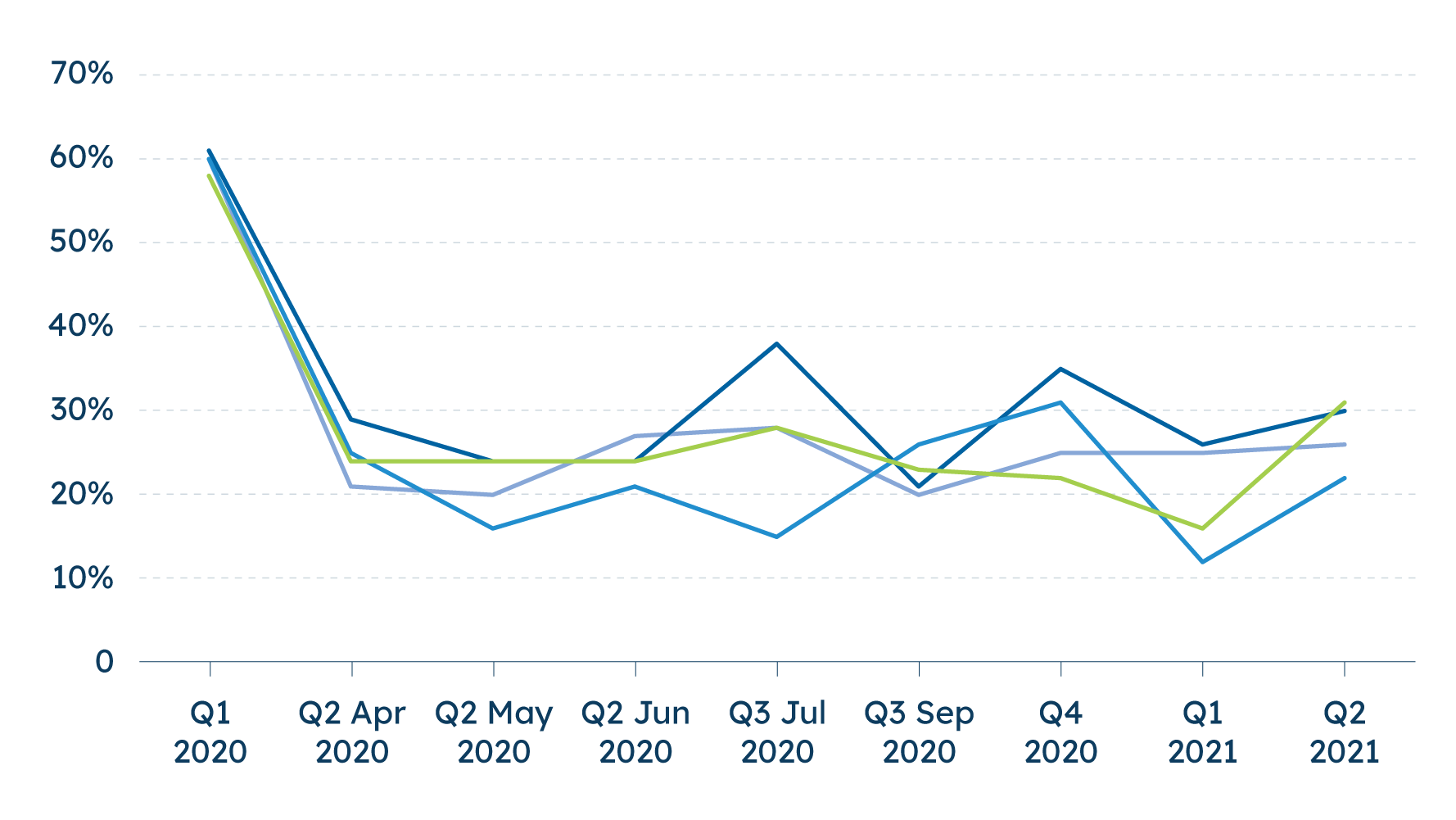

Currently, 27% of small businesses rate the overall U.S. economy as good, up from 21% who said the same in Q1. But this is far below pre-pandemic levels: 60% saw the national economy as good in Q1 of 2020. However, what is really driving things is that fewer small businesses are seeing the economy as poor. While 46% continue to say the national economy is poor, this is the first time this measure has fallen below 50% during the pandemic. Just last quarter, fully 59% of small businesses said the economy was poor (a drop of 13 points in one quarter).

Small businesses in the South and Northeast are more likely to feel positively toward the national economy than those in the Midwest and West, though Midwestern small businesses feel more positive than last quarter.

In Q1 2021, just 6% of those in the services industry said the U.S. economy was in good health; this sentiment has more than tripled, now at 21%. Despite this gain, a majority of service-related small businesses rate the U.S. economy as poor (54%), more than any other sector.

How would you rate the overall health of the United States economy? Net (Good)

A growing number of small businesses rate their local economy’s health as good. Currently, 33% rate their local economy as good, 36% rate it as average, and 29% rate it as poor. This marks a transition away from predominantly pessimistic views about local economic conditions, as fewer now say their local economy is poor (down 13 points from Q1).

This shift away from a pessimistic outlook is consistent across regions: those rating their local economic health as poor fell at least 10 points across each region (down 10-18 points this quarter). Across sectors, the same can be seen among manufacturers, retailers and professional services firms. Small businesses aren’t yet feeling bullish about their local economy—not all of the movement is from poor to good—but they are less pessimistic this quarter.

Finally, a majority of small businesses say that local competition (51%) and time spent on compliance (57%) remains the same compared to six months ago.

Small Business Expectations

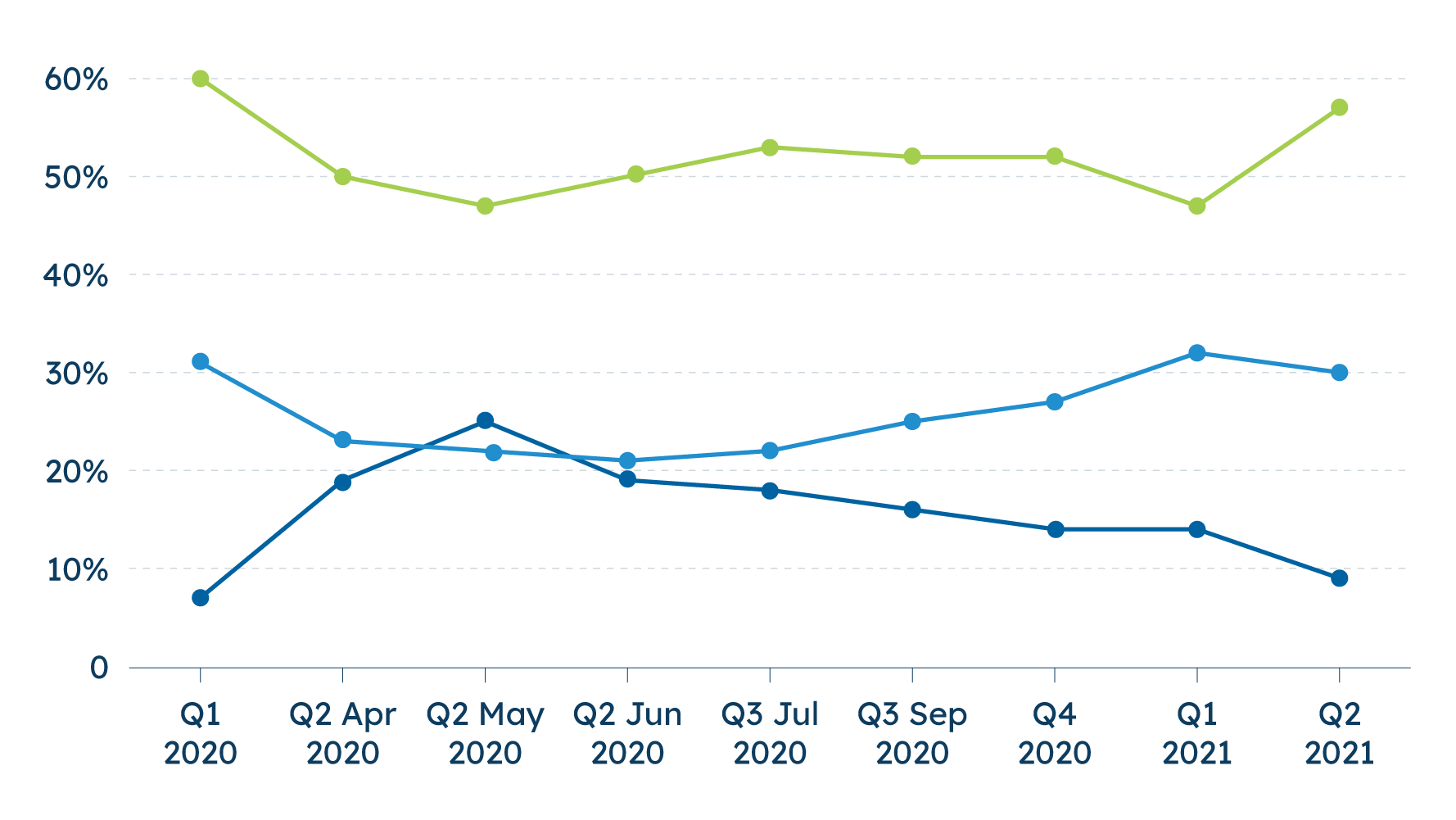

Small businesses revenue expectations improved significantly this quarter, driven upward by a large bump in revenue expectations. Currently, 57% of small businesses anticipate their revenue increasing this year, a 10-point increase in revenue expectations from last quarter. Only 9% expect a decline in revenue (25% expected a decline in May 2020). Furthermore, the current reading is just three points shy of revenue expectations before the pandemic struck (60% in Q1 2020).

Currently, 27% of small businesses rate the overall U.S. economy as good, up from 21% who said the same in Q1. But this is far below pre-pandemic levels: 60% saw the national economy as good in Q1 of 2020. However, what is really driving things is that less small businesses are seeing the economy as bad. While 46% continue to say the national economy is poor, this is the first time this measure has fallen below 50% during the pandemic. Just last quarter, fully 60% of small businesses said the economy was poor (a drop of 14 points in one quarter).

Small businesses in the South and Northeast are more likely to feel positively toward the national economy than those in the Midwest and West, though Midwestern small businesses feel more positive than last quarter.

In Q1 2021, just 6% of those in the services industry said the U.S. economy was in good health; this sentiment has more than tripled, now at 21%. Despite this gain, a majority of service-related small businesses rate the U.S. economy as poor (54%), more than any other sector.

Looking forward one year, do you expect next year’s revenue to:

The most significant positive shifts from last quarter at the regional level come from small businesses in the West (an 18-point gain in those expecting next year’s revenues to increase) and the South (a 13-point increase). Across sectors, a majority of services (at 60%), professional services (an 11-point increase, at 56%), retail (56%), and manufacturers (a 13-point increase at 52%), expect a boost in next year’s revenues.

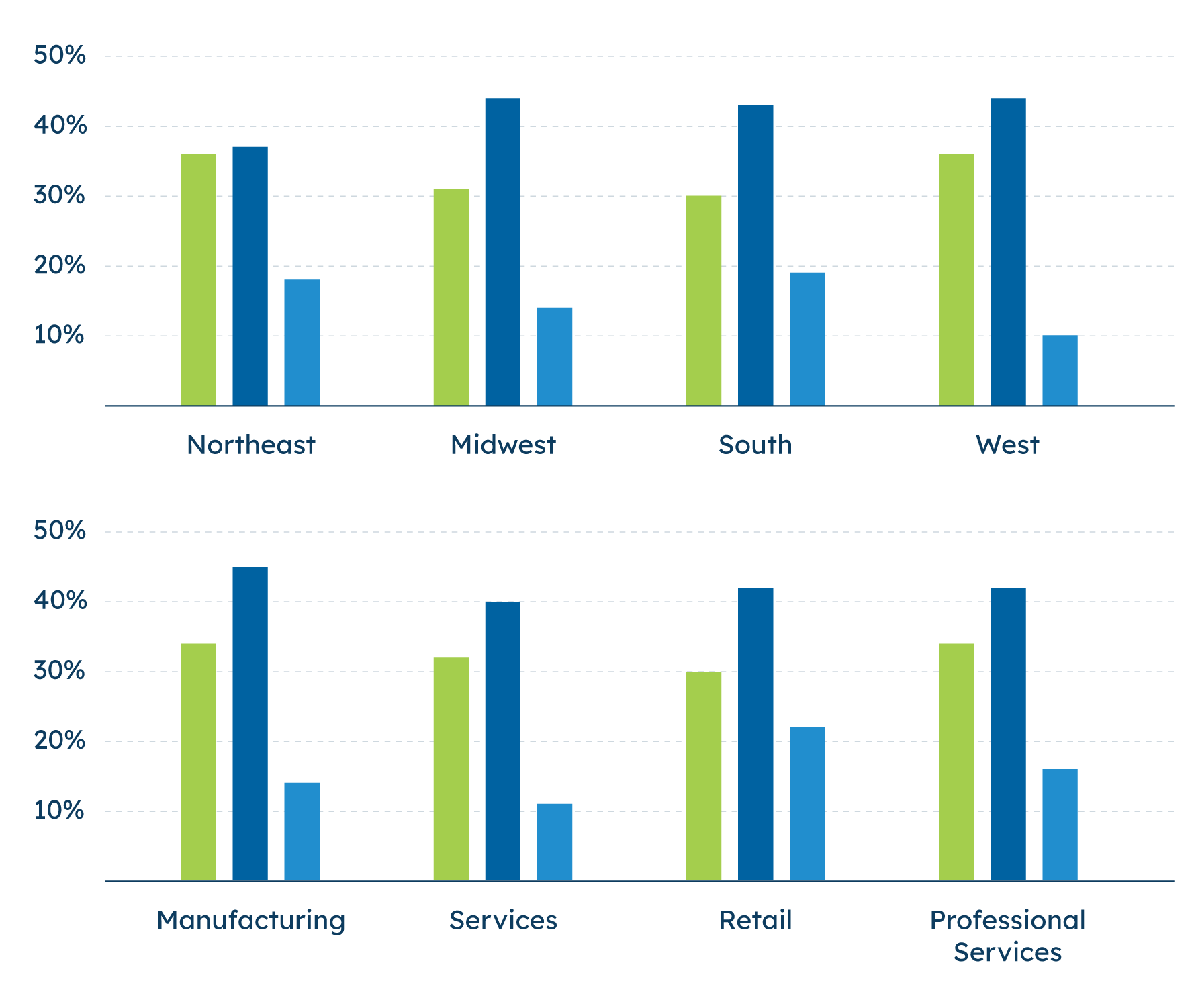

Currently, 33% of small businesses plan to increase investment in the upcoming year, on par with last quarter’s 35%. Another 16% expect to reduce investments, while 42% plan to maintain the same investment level.

Similar to reported headcount changes, plans to increase investment have shifted at the sector level. Most strikingly this quarter, fewer retailers are planning to increase investment (30% plan to increase, down from 42% in Q1) and manufacturers are less likely to reduce investment (only 14% plan to reduce investment, compared to 24% who planned to do so in Q1). Across regions, the Northeast and West are slightly more likely, but not significantly, to plan to increase investment (36% each). The South is the least likely to plan to increase investment (30%) and most likely to plan to reduce investment (19%).

The largest small businesses (with 20 or more employees) are the most likely to plan an investment increase over the coming year. Forty-three percent of the largest firms think they will increase investment over the next year, compared to just 30% of the smallest firms with less than five employees and 34% of mid-sized firms with 5-19 employees.

For the upcoming year, do you plan to:

Most small businesses continue to anticipate retaining the same staffing level (52% now, 49% in Q1 2021) this quarter. 32% plan to increase staffing (same as Q1) and around one in ten (11%) plan to decrease staffing over the next year.

The largest small businesses are most likely to report plans to increase their headcount (51%), while smaller businesses are more likely to say their staffing levels will stay the same. Across regions, staffing intentions are relatively consistent. In each region, most say they plan to retain the same staffing level (49-59%), with around a third reporting plans to hire (28-35%). Northeastern small businesses are most likely to say they plan to reduce staff (18%), while those in the West are least likely (5%).

Sector-based staffing plans are relatively in line with plans overall. This quarter, a majority of retailers (54%) plan to retain the same size staff (a 12-point increase from Q1) and those in the services industry have moved from retaining staff, reporting more plans to increase and decrease staff. These trends illustrate the remaining uncertainty small businesses face as the country’s collective reemergence gathers momentum.