‘Hopeful’ business owners see better economy, expect rising revenue

As more Americans get vaccinated and communities reopen, small businesses are becoming more hopeful about the future—especially when it comes to their views about the potential for rising revenue—according to the latest MetLife & U.S. Chamber of Commerce Small Business Index. Also, concerns about COVID-19 are declining with a majority of small business owners believing the worst of the pandemic is behind us and describing their dominant emotion as “hopeful.”

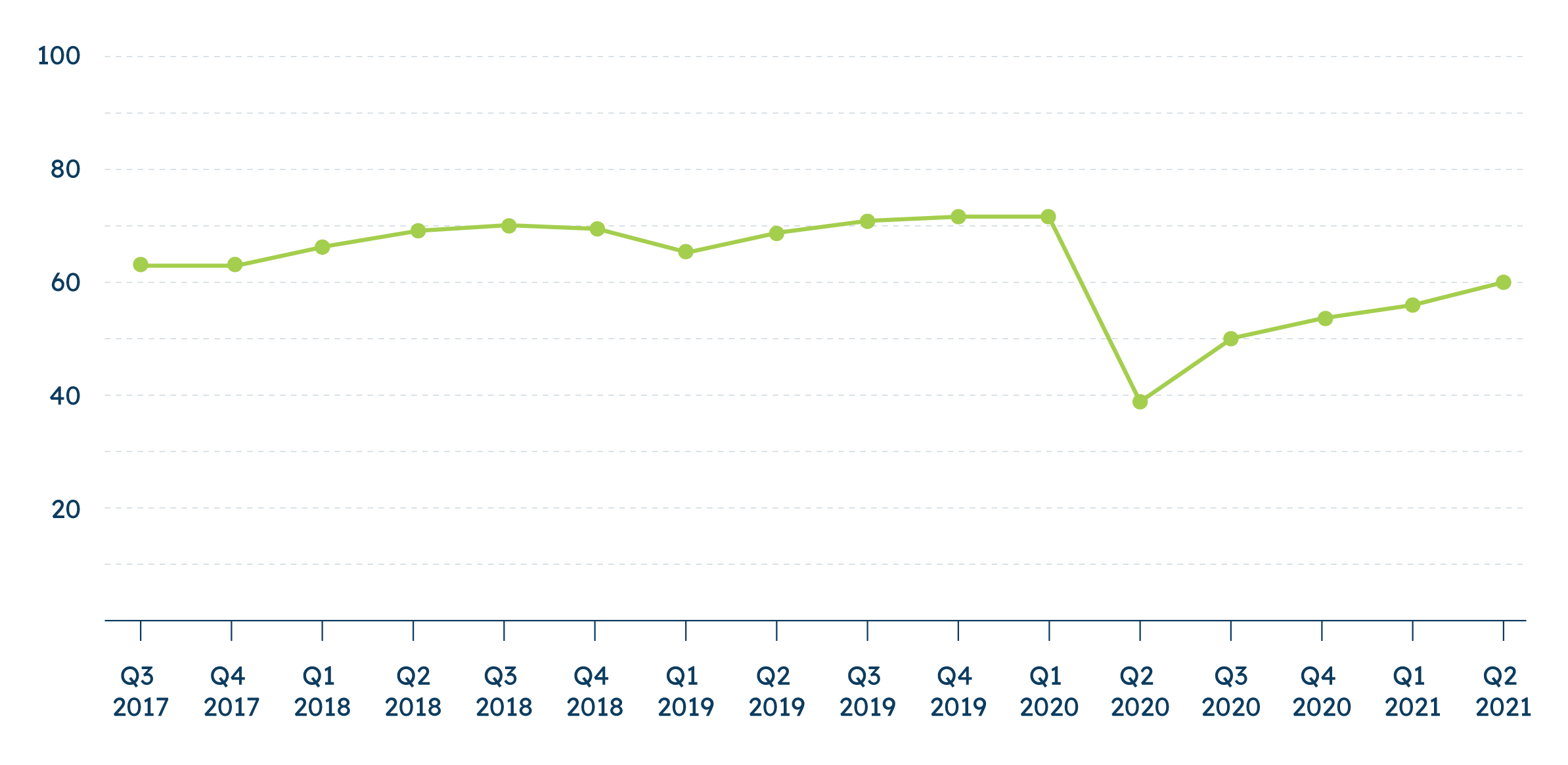

This quarter, the current Small Business Index score is 60.0 (an increase of 4.1 points from 55.9 in Q1).1 Nevertheless, the new score remains below findings before the pandemic: the Index score was 71.7 in Q1 of 2020 based on data collected before the full economic impact of the coronavirus became apparent. The Index reached an all-time low of 39.5 in Q2 2020 and the Index is now up a substantial 20.5 points since then.

The survey—fielded between April 21 – May 6, 2021—revealed rosier sentiments among small business owners toward the economy driven by improving revenue expectations for the coming year. Over half (57%) of small businesses anticipate their revenue increasing this year, up 10 percentage points compared to last quarter. This marks the most positive outlook on this metric to date during the pandemic.

In fact, the percentage of small businesses anticipating higher revenue is edging close to pre-pandemic levels (60% expected revenue to increase in Q1 2020). By region, small businesses in the Northeast and West are most likely to expect their revenue to increase.

Fewer small businesses see a poor national economy. Overall, 27% of small businesses rate the U.S. economy as good, up from 21% who said the same in Q1 2021. Additionally, fewer small businesses see a weak national economy: 46% rate the economy as poor, the first time this measure has fallen below 50% during the pandemic

There are improvements in perceptions of local economic health as well. Currently, 33% rate their local economy as good, 28% said their local economy was good in Q1 of this year. There is also a transition away from more pessimistic views about local economies: fewer (29%) say their local economy is in poor health (down 14 points from Q1). The shift away from a pessimistic outlook is consistent across regions. Those rating their local economic health as poor fell at least 10 points since last quarter in each region. Women-owned businesses, and businesses owned by people of color, are slightly more likely than small businesses overall to see poor local economies. One third of women-owned small businesses say their local economies are poor (27% of male-owned say the same). Thirty-four percent of minority-owned small businesses2 say their local economies are poor (28% of businesses not owned by racial/ethnic minorities say the same; a slight, but not significant, difference).

Overall, other small business views toward their current operations are largely unchanged. Fifty-two percent of small businesses rate their overall business health as good, unchanged from last quarter. This measure has stayed consistent since May 2020. More than six in ten small businesses are comfortable with their current cash flow (64% now, similar to Q1’s 62%). Currently, 33% of small businesses plan to increase investment in the upcoming year, on par with last quarter’s 35%. As for staffing plans, most small businesses continue to anticipate retaining the same staffing level (52% now, 49% in Q1 2021), and 32% plan to increase staffing (same as last quarter). Around one in ten (11%) plan to decrease staffing over the next year.

Small Businesses Get More Optimistic, But Don’t See Full Pandemic Recovery Yet

Overall, nearly two-thirds (64%) of small businesses remain concerned about the impact of the novel coronavirus on their business. However, this represents a 12-percentage point decline from last quarter and 21 points from this time last year. Most of this change is due to the fact that fewer business owners now say they are very concerned about COVID-19 (this quarter 24% said they are very concerned, in April of last year 53% said they were very concerned).

Moreover, a majority (65%) now believe that the worst is behind us when it comes to the pandemic, up a staggering 21 points from Q4 2020 (when we first asked). Significantly, the dominant emotion small business owners are feeling about their current operating or reopening strategy is “hopeful” (44%) followed by “comfortable” at 31%.

A majority of small businesses support proof of vaccination for customers and their own workers. Nearly two-thirds (64%) support requiring customers to show proof of vaccination for entry or service to shops, restaurants, offices, and other businesses in their area. Support is strongest among small businesses that are minority-owned (78%), in the Northeast (76%), and millennial-owned (74%).

Fifty-nine percent are likely to support requiring their employees get the COVID-19 vaccine once it’s available to them. Regionally there is variation: the highest support for this is among businesses in the Northeast (67%) and lowest with businesses in the Midwest (49%).

All businesses, regardless of operating status are eager to get back to normal. Around eight in ten report they either opened their business fully as soon as their state allowed it (if already open), or plan to do so as soon as it is allowed (if partially open or temporarily closed). Still, most (54%) see six months to a year before the small business climate returns to normal, and this is up eight points from March 2020 with now more expecting a longer timeframe for a return to normalcy. Three-quarters (76%) intend to keep all COVID-19 safety precautions in place until the coronavirus pandemic ends.

Small businesses say that easing COVID-19 restrictions and ramping up vaccinations are the keys to their success in 2021. Twenty-nine percent say decreases in current COVID-19 restrictions from state or local governments is critical to their success and 28% say the same about widespread distribution of COVID-19 vaccinations in their area.