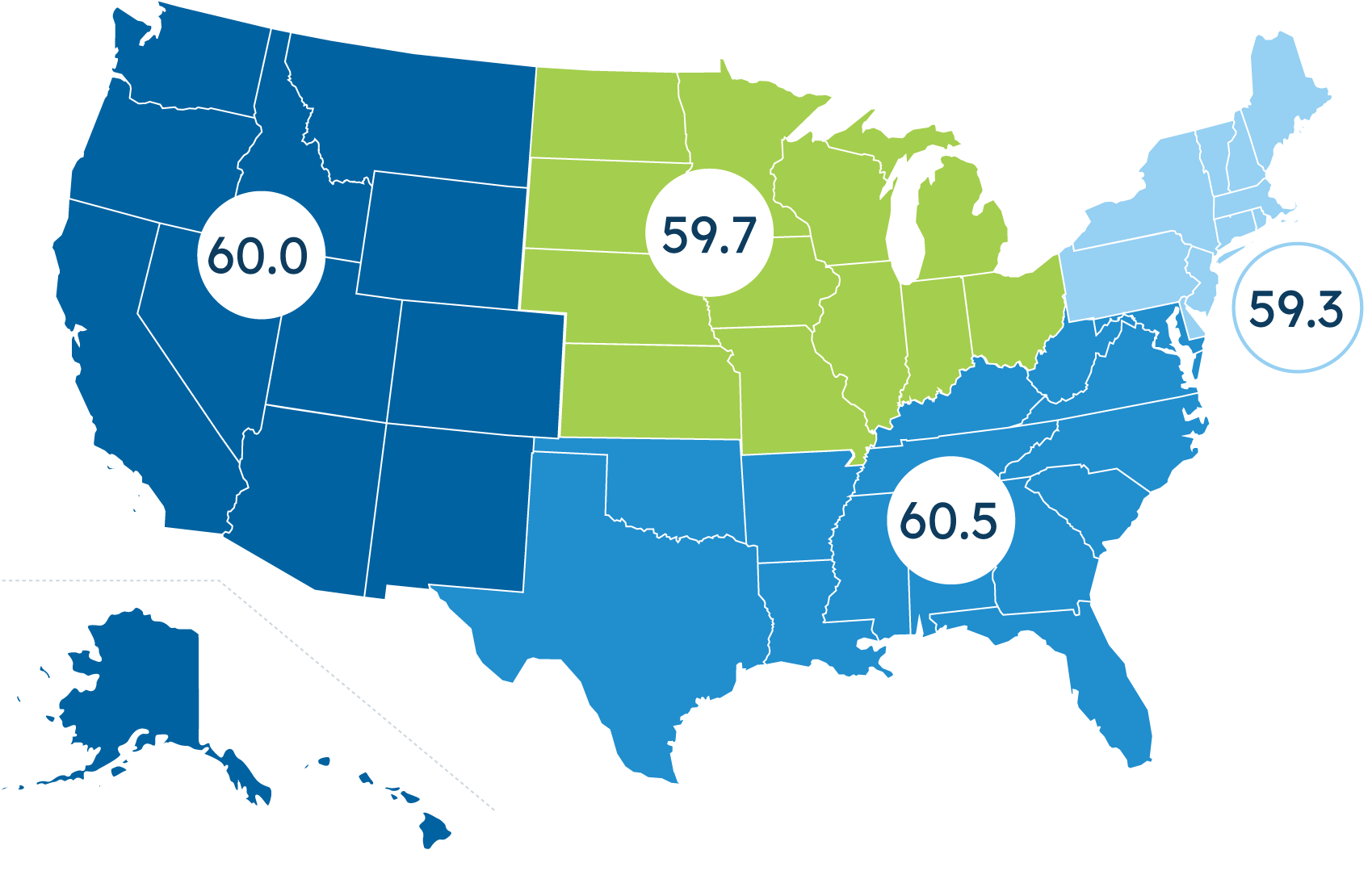

Regional Scores

National Score 60

South

West

Midwest

Northeast

Northeast (59.3)

This quarter, a majority of Northeastern small businesses report good overall business health (54%) and comfort with cash flow (64%), retaining the significant gains seen earlier this year. At the same time, those in the Northeast are most likely across regions to anticipate reducing staff in the next year (18% vs. 5-12% across other regions). Nonetheless, a strong majority continue to expect their revenue to increase in the coming year (61%).

South (60.5)

55% of small businesses in the South report good business health and 64% are comfortable with their current cash flow. Across regions, Southern small businesses are most likely to report an increase in staffing levels (23%) and good local economic health (36%). While fewer plan to increase investments when compared to last quarter (30% now, 38% in Q1), more now foresee an increase in revenues (53% now, 40% in Q1).

Midwest (59.7)

Midwestern small businesses report less confidence about their overall business health, yet their Index score is bolstered by growing confidence in other metrics. 45% of Midwestern small businesses report good business health, the lowest percentage across regions. At the same time, more than three in five report being comfortable with their cash flow (up eight points from Q1). National economic outlooks in this region are also more positive than last quarter (a 10-point increase).

West (60)

Western small business health (53%) and comfort with cashflow (64%) are on par with small businesses across the country. Western small businesses are more likely than those in the Northeast or South to have retained the same size staff over the past year and a majority plan to do so over the next year. 62% of Western small businesses predict higher revenue over the next year, compared to 44% in Q1.