Published

July 09, 2018

After months of mounting tensions, the trade war has suddenly gotten very real.

Last week, a wave of steep retaliatory tariffs was unleashed against $75 billion of U.S. exports. These tariffs are being levied by other countries on U.S. merchandise exports in response to U.S. tariffs on steel and aluminum and, in the case of China, tariffs the United States levied on $34 billion of imports from China on July 6.

U.S. agricultural products and many manufactured goods exports are the top targets for retaliation.

The U.S. Chamber of Commerce argued strenuously against the initial U.S. tariffs. Imposing these tariffs on our best customers threatens the U.S. economy, risks alienating many of our closest allies, and does not effectively address legitimate trade concerns such as those the business community has with regard to China’s industrial policies.

And tariffs are, of course, a tax – one paid not by foreigners but by Americans.

The U.S. Chamber is working overtime to build awareness of the costs of these actions. Last week, we launched a new website – www.thewrongapproach.com – presenting state-specific data on the impact of these tariffs on American workers, farmers, and consumers.

The site compares the retaliatory tariff lists of Canada, Mexico, the EU, and China with Commerce Department data on state exports, and the results drive home the fact that the costs of a global trade war will be local.

And now, the damage reports are coming in.

As expected, U.S. agriculture is taking the first hits in the emerging trade war. Soybeans, which recently surpassed corn to become the largest U.S. crop in terms of acres planted, have already been hit hard. As Farm Journal’s AgWeb reported on July 6:

In the U.S., average cash prices fell to about $7.79 a bushel this week, the lowest in almost a decade, according to an index compiled by the Minneapolis Grain Exchange.…

Meanwhile in Brazil, exporters have been handed high times. Soybeans to be loaded in August at the nation’s Paranagua port fetched $2.21 a bushel more than Chicago futures as of Friday, the widest gap since data starts in 2014. The premium has more than tripled since the end of May, according to data from Commodity 3.

Even before the tariffs hit, the damage was evident in declining prices, according to South Dakota Senator John Thune (R), a member of the Senate’s Republican leadership.

“In fact, since March soybean prices have dropped about a dollar a bushel, which in South Dakota means about $225 million for our farmers,” Thune said.

Dairy farmers are also hurting, particularly given retaliation by Mexico, the largest export market for U.S. dairy products. As the Wall Street Journalreports:

BelGioioso Cheese Inc., a second-generation family company in Wisconsin, has seen sales to Mexico drop since officials there implemented tariffs of up to 15% in early June on most U.S. cheese. The levies were a response to tariffs the U.S. placed on Mexican steel and aluminum.

On Thursday, Mexico was slated to raise its levy on most U.S. cheese to as much as 25%, while China on Friday is implementing tariffs on $34 billion of U.S. goods, including cheese and whey, a dairy byproduct often fed to livestock.

“It’s a nightmare,” said BelGioioso President Errico Auricchio….

The trade fight comes at a bad time for the Farm Belt. Five years of big harvests and rising dairy production have pushed down prices for agricultural commodities including corn, soybeans and milk. Farm incomes have declined.…

More than 60 cheese and dairy producers wrote to the Trump administration last month, saying the trade war could cost them that foothold. “Our share of the Mexican market is in grave jeopardy,” they wrote.

Manufacturers are getting hit as well. Bloomberg reports that “Global Trade-War Threat Is Bringing Anxiety to Factory Floor”:

In the U.S., tariffs and a variety of transportation issues are dogging American manufacturers, extending lead times for production materials. While the Institute for Supply Management’s gauge of manufacturing jumped in June, the increase was largely due to a spike in the group’s supplier-deliveries gauge, which was the second-highest since 1979 and indicated slower performance.

“Demand remains robust, but the nation’s employment resources and supply chains continue to struggle,” Timothy Fiore, chairman of the U.S. ISM manufacturing survey committee, said in a statement Monday. “Respondents are overwhelmingly concerned about how tariff-related activity is and will continue to affect their business.”

ISM’s Fiore also spoke to the Wall Street Journal:

“There’s an extreme amount of activity going on to account for impacts that are driven by the aluminum and steel tariffs, and that is expanding out to other industries,” [he said]….

Mr. Fiore noted that some manufacturer representatives who responded to the survey said they were considering moving some production overseas to avoid retaliatory tariffs against the U.S. He said that could cost U.S. jobs.

“Contingency planning [for tariffs] is consuming large amounts of manpower that could be used for more productive projects,” a manufacturer told ISM. “It’s introducing a bunch of inefficiencies,” Mr. Fiore added.

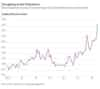

Steel and aluminum prices have spiked this year due to the U.S. tariffs, with U.S. benchmarks (e.g., hot rolled band steel, below) for steel up more than 50% and now at least 50% higher than prices prevailing in Europe. These soaring prices have hammered American steel-consuming industries: Manufacturers of nails, lockers, kegs, and boats have all been hit hard.

Tariffs have also hit the construction sector. According to the USG+U.S. Chamber of Commerce Commercial Construction Index, contractors in the second quarter of 2018 worried about “the impact of material price fluctuations on their businesses. Steel tops the list of materials concerns, with 86% of respondents expecting to see at least moderate to severe impacts on their business in the next three years from recently imposed tariffs.”

The forecast for small manufacturers is especially tough. Smaller firms in sectors such as auto parts manufacturing indicate they can only bear these high input costs for another 60 days before layoffs will become a necessity.

These are the fruits of a trade war: Lower prices and lost markets for U.S. exporters, and higher input prices for American manufacturers. For consumers, it all spells higher prices.

It’s time for the administration to carve a new path for its trade policy – one that emphasizes growth and abandons the blunt instrument of tariffs.

About the author

John G. Murphy

John Murphy directs the U.S. Chamber’s advocacy relating to international trade and investment policy and regularly represents the Chamber before Congress, the administration, foreign governments, and the World Trade Organization.