NERA Mergers and Innovation Feb 2023

Sean Heather

Sean Heather

Senior Vice President, International Regulatory Affairs & Antitrust, U.S. Chamber of Commerce

Published

February 07, 2023

What is going on?

The Federal Trade Commission and the Antitrust Division of the Department of Justice have embarked on the process of updating its merger guidelines and that process is expected to conclude in the very near future. Guidelines do not change the law, nor do they have the force of regulation, but they are an attempt to influence the thinking of the courts. However, they will be implemented to challenge and condition mergers that agencies don’t like, forcing merging parties to either litigate or walk away.

The current leadership at the Federal Trade Commission and the Department of Justice, following the direction of President Biden’s executive order on competition, have made it clear that they believe that previous administrations’ approach to merger review had been too acquiescent, suggesting that far more mergers should have been challenged that weren’t. As a result, they believe that this lax approach to merger enforcement has created excessive concentration levels in our economy, harmed innovation, and has led to inflation.

This narrative is deeply flawed. Generalizations are always dangerous, and each merger is unique and should be evaluated on its merits. Some may present competition concerns, but the vast majority do not. Taking a sweeping view of merger enforcement to suggest that merger policy for decades has been deeply flawed, is a thesis that is empirically without foundation.

Merger activity has not led to excessive levels of concentration in our economy.

In March 2022, the U.S. Chamber released its first study conducted by NERA Economic Consulting which found that industrial concentration in the United States is declining. It has in fact declined in several sectors where merger activity was cited to have been problematic. That study also found that rising industrial concentration in some sectors is often a sign of increasing market competition and associated with positive outcomes such as output growth, job creation, and higher employee compensation. In short, the study on concentration laid bare the reality that concentration has not reached new heights, is not persistent in the economy, and is not a reliable measure for determining the state of competition in a given market.

Merger activity is not associated with reduced innovation.

To evaluate the view that the merger policy has been administered in a manner that has dampened innovation as a result mergers being allowed to proceed that should have been blocked, the Chamber again turned to NERA to dig into the data to empirically evaluate this claim.

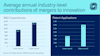

As it turns out, despite there being increased scrutiny over merger activity in recent years, little empirical analysis has been done to investigate the relationship between M&A and innovation. The latest NERA study combined industry-level merger data from the FTC/DOJ annual Hart-Scott-Rodino (HSR) reports with industry-level data from the National Science Foundation (NSF) on R&D expenditure and patent applications.

One would expect that if lax enforcement had led to anticompetitive mergers, the incentives to compete would diminish. The lack of incentives would lead to the lack of investment in risk-taking research and development, resulting in fewer innovative outputs.

Yet, the NERA study points to the opposite conclusion. R&D expenditure and patent applications increased substantially over the period studied, and this increase occurred at the same time as there was in increase in merger activity. This suggests that mergers within these industries result in the entire industry needing to make increased investments in R&D in order to remain competitive.

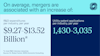

On average, the study found that mergers are associated with an increase in R&D expenditure of between $9.39 billion and $14.54 billion per year in R&D intensive industries and an increase of between 1,421 and 3,045 utility patent applications per year. The study empirically found no signs that merger activity at the industry level has slowed down innovation.

Why it matters

While neither of these studies evaluate specific transactions at the firm level, both studies expose the unfounded nature of the view that merger policy has been too permissive, that previous administrations approach to merger review has been wrong, and that we need a fundamental shift in the direction of merger policy.

While we await the revised merger guidelines, what is increasingly clear is that if merger enforcement is not careful, it will overreach, and deeply harm our economic competitiveness and our nation's innovative capacity. Merger guidelines are too important to be written on the erroneous basis that our economy has a concentration problem or that mergers have undermined innovation.

NERA Mergers and Innovation Feb 2023

About the author

Sean Heather

Sean Heather is Senior Vice President for International Regulatory Affairs and Antitrust.