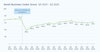

Washington, D.C. — The MetLife and U.S. Chamber of Commerce Small Business Index, released today, shows that small business owners continue to face tough economic conditions amid high inflation and rising interest rates but are increasingly hopeful for the future.

The overall Index score rose in the second quarter to 63.1 from 60 as a record high share of small business owners (71%) expect their revenue to increase in the next year. A record high share also anticipates hiring more staff in the next year (47% up from 37% last quarter). These are the most optimistic readings for both measures since the Index began in 2017.

“The challenges of our current economy may have delayed some small business owners’ plans to expand or hire more staff, but now they see opportunity for growth on the horizon,” said Tom Sullivan, Vice President of Small Business Policy at the U.S. Chamber of Commerce. "Small businesses are again showing remarkable resiliency. There has been a strong majority reporting that their business is in good health over the last year and it’s clear many have high expectations for the future.”

Small Businesses Adjust to Higher Interest Rates, Tighter Credit

While interest rate hikes have implications for the broader economy, nine in ten (91%) respondents say small businesses are the most vulnerable to rising interest rates (52% strongly agree with this).

More than three-quarters (76%) say that rising interest rates are limiting their ability to raise capital, up from 66% who said the same last quarter. A similar percentage (73%) say it’s harder to borrow money because banks are tightening lines of credit.

Small businesses are also turning to more sources for capital compared to a year ago, particularly personal savings, friends, and family.

Half (50%) of small businesses report that they have delayed plans to grow their business in response to higher interest rates. A similar number (49%) indicate they have taken out a loan within the past year to cover higher costs due to inflation.

Stephanie Sims, Founder of Finance-Ability in Scottsdale, Arizona and member of the U.S. Chamber of Commerce Small Business Council, has been watching these trends closely.

“Tightening in both credit and private equity markets is creating challenges for many small business owners,” says Sims. “Rising interest rates make it more challenging for some entrepreneurs to qualify for financing, although I have seen several loan guarantee programs step up and assist some of these borrowers in securing funding.”

This is the sixth consecutive quarter where inflation tops the list of challenges for small business owners. More than half (54%) say inflation is a top challenge followed by interest rates rising (23%), supply chain issues (23%) and revenue (20%).

“The percentages of small business owners expecting an increase in revenues and hiring this quarter represent record highs in the six-year history of the Index, which is a very promising sign,” says Cynthia Smith, senior vice president, Regional Business at MetLife. “While the current economic conditions may have stalled their plans to grow, the combination of small business owners’ determination, drive and positive outlook bodes well for the future.”

About the Small Business Index

The MetLife and U.S. Chamber of Commerce Small Business Index is part of a multiyear collaboration by MetLife and the U.S. Chamber to elevate the voice of America’s small business owners and highlight the important role they play in the nation’s economy. The quarterly Index, an online survey of approximately 750 small business owners and decision makers, is designed to take the temperature of the sector, see where small business owners are confident, and where they are experiencing challenges.

The Q2 2023 survey was conducted May 8-24, 2023. The survey has a credibility interval of plus or minus 4.4 percentage points for all respondents.

About the U.S. Chamber of Commerce

The U.S. Chamber of Commerce is the world’s largest business organization representing companies of all sizes across every sector of the economy. Our members range from the small businesses and local chambers of commerce that line the Main Streets of America to leading industry associations and large corporations.

They all share one thing: They count on the U.S. Chamber to be their voice in Washington, across the country, and around the world. For more than 100 years, we have advocated for pro-business policies that help businesses create jobs and grow our economy.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and affiliates ("MetLife"), is one of the world's leading financial services companies, providing insurance, annuities, employee benefits and asset management to help its individual and institutional customers navigate their changing world. Founded in 1868, MetLife has operations in more than 40 markets globally and holds leading positions in the United States, Japan, Latin America, Asia, Europe and the Middle East. For more information, visit www.metlife.com.