J.D. Foster

J.D. Foster

Former Senior Vice President, Economic Policy Division, and Former Chief Economist

Published

February 10, 2017

President Trump may not appreciate his good luck given the economy’s sluggish expansion and further slowing in 2016, but by recent standards he should. At least Obama didn’t leave the economy proximate to a recession. The same can’t be said of the last three Presidents.

Recall the errant ministrations of then-Fed Chairman Alan Greenspan pushed the U.S. into recession timed to sink George H.W. Bush’s 1992 re-election campaign, leaving the incoming Bill Clinton an economy on the mend. As Clinton exited, the late 1990s dot-com bubble popped abruptly, leaving George W. Bush with the Clinton recession. Then, Barack Obama rode the Great Global Recession into the Oval Office. In contrast, Donald Trump inherited an economy muddling along at about 1.6 percent growth and no recession in sight.

President Trump also benefited in that a few simple steps would give the economy a natural burst of energy. Recent lackluster performance largely resulted from the Obama administration’s efficiency in issuing disruptive, distorting, and expensive rules and regulations. A normally operating economy can handle moderate amounts of such regulatory harassment, but President Obama threw economic growth to the wind in pursuit of his non-economic policies implemented through regulations and executive orders. The consequences are neatly summed in one piece of data: business investment in new equipment fell from the fourth quarter of 2015 to the fourth quarter of 2016. It’s hard to grow an economy when business investment is contracting.

All Donald Trump needed was to give businesses a break from regulatory harassment. This he did in the first hours of his administration with his regulatory freeze. Congress and the Trump administration next began overturning some of the most overbearing Obama administration regulations of recent vintage by exercising authorities under the Congressional Review Act (CRA). The relief provided by the regulatory freeze and via the CRA should give businesses the breathing room and the confidence to increase investment.

The Obvious Domestic Threats in 2017

In another bit of good luck, for all its weakness the economy displays none of the usual domestic warning signs of recession. For example, popped housing bubbles often trigger recession, yet few “frothy” signs signal a bubble. None of the industrial sectors suggest trouble either, nor are the usual financial market indicators suggesting a bubble. Perhaps the only persistent worry remains very low (by historical standards) long-term interest rates, but then this has been true since the mid-2000s.

Of course, international concerns abound, but three federal policy areas remain worth watching domestically for signs of trouble. If Congress and the President can navigate these three issues, the economy should perk up smartly in 2017.

CNBC Fed Survey, Jan 31, 2017 by CNBC

Protectionism

In a poll of America’s CEOs released by CNBC, protectionism was listed as the number one worry.

President Trump has stated his support for expanding trade, but has also made clear he wants to renegotiate existing trade agreements. As the administration seeks to improve our free trade agreements, we also need to keep in place what works – don’t throw the baby out with the bath water as the old saw runs.

The President’s concerns over multilateral free trade agreements, but enthusiastic support for bilateral agreements, has resulted in much confusion about the direction of trade policy. While changing course typically produces some confusion as a new administration fleshes out and communicates its views over time, confusion, miscommunication, or other policy disputes must not be allowed to inadvertently produce new protectionist barriers to free trade. Renegotiating NAFTA, for example, may be a little unsettling at the outset, but if done correctly could prove highly beneficial as we bring a twenty year-old trade agreement into the modern era.

Fiscal Policy and the Debt Limit

President Obama left the nation a legacy of debt and deficits. The budget deficit for 2017, projected to exceed a half trillion dollars, nearly triples over the ensuing decade under the policies Obama left behind. Many in Congress and around the country are rightly very concerned. Congress should embrace every opportunity to restore fiscal discipline, yet one dangerous trap door awaits.

Congress failing to pass a budget is bad form. Congress failing to pass appropriations bills in good order is bad form. When congressional dysfunction leads to a government “shut down” for failing to pass a spending bill, this is very bad form. However, were Congress to fail to address suitably the federal government’s congressionally imposed debt limit, financial mayhem would erupt and likely recession would soon follow. The debt limit is suspended until mid-March, but action won’t be critical until perhaps mid-summer. Raising or suspending the debt limit is sure to be an enormous political challenge. President Trump and Congress must rise to the challenge or potentially sink the economy.

Who Will Chair the Federal Reserve?

Finally, an issue lurking around the corner currently unremarked involves the Federal Reserve Board. Chairman Yellen’s term expires February, 2018. The board’s normal complement is seven members, but the board has two vacancies for which President Trump will likely soon present nominees. One of these two nominees will likely be in line to succeed Chairman Yellen assuming she is not renominated.

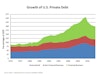

The Fed Chairman has enormous power and influence on the U.S. and indeed the world economy through the execution of monetary policy, through his or her words, through the guidance of the institution itself, and through the exercise of the Fed’s enormous regulatory and supervisory powers. Complicating matters, the next Fed Chair will also have to navigate the ongoing normalization of monetary policy, especially raising the Federal Funds Rate and normalizing the Fed’s balance sheet, now swollen to $4.5 trillion by quantitative easing in years past. Further, the Fed will have to accomplish these tasks while the U.S. expansion grows very long in the tooth and in the face of substantial global uncertainties.

Wisely choosing Fed Chairman Yellen’s successor, as well as the Vice-Chair for Supervision, a position President Obama left vacant for over five years, is a very big deal which if handled well could eliminate pre-emptively what would otherwise become a growing unease in financial markets. The United States has enjoyed some excellent Fed Chairmen, some fair ones, and a few real clunkers. Clunkers inevitably produce really bad results measured in millions of lost jobs, lost wages, closed businesses, and either rapid inflation or even deflation.

Other issues such as comprehensive tax reform, defining and enacting Obamacare’s replacement, and developing a smart infrastructure program will work to make a sound economy stronger. But first, sometimes smart economic policy starts with eliminating bad risks with good actions. Three in particular would go a long way to ensuring the U.S. economy finally begins to deliver on its promise: developing a constructive agenda on trade; dealing with the nation’s fiscal mess but most especially the debt limit, and; the choice of Fed board members and the implied naming of the next Fed Chair. If President Trump and the Congress deal with these three critical matters wisely, the U.S. economy now unshackled from the previous Administration’s regulatory bindings can finally show what it can do.

About the author

J.D. Foster

Dr. J.D. Foster is the former senior vice president, Economic Policy Division, and former chief economist at the U.S. Chamber of Commerce. He explores and explains developments in the U.S. and global economies.