Table of Contents

Download the 2023 Transatlantic Economy Report Chapter 4 PDF here

Three major shifts are transforming the transatlantic energy economy. First, the United States has become a critical energy supplier to Europe. Second, groundbreaking U.S. and EU policy initiatives are generating some adjustment challenges, yet ultimately promise to accelerate each party’s efforts to address climate change, supercharge the transition to cleaner energies, boost competitiveness, and reduce strategic vulnerabilities. Third, already dense and now deepening transatlantic linkages among energy investors, innovators and firms offer substantial opportunities for North America and Europe to spearhead the next generation of clean technologies.

The United States: A Critical Energy Partner for Europe

Europe has reduced its dependence on Russian gas from 40% to 10% in less than one year.1 Spiking prices have fallen back to pre-war levels. Europeans used less gas, built up their strategic reserves, and switched to alternative energy sources. They benefited from a relatively mild winter. Critical gaps were filled by a surge in gas imports from other countries – notably the United States. U.S. liquefied natural gas (LNG) exporters supplied more than three-fourths of Europe’s additional gas needs in the critical months following the outbreak of the war, and accounted for more than 50% of Europe’s LNG supplies for the year as a whole.2 More than half of U.S. global LNG exports went to Europe in 2022. U.S. exporters shipped roughly 2.5 times more LNG supplies to Europe in 2022 than in 2021, and 3 times more than they supplied to all of Asia in 2022 (Table 1).

Europe has been slower at weaning itself off Russian oil, but a package of recent measures – including price caps on Russian oil and bans on seaborne imports of Russian crude and refined petroleum products – could shrink Russian oil supplies by 90% in 2023. In the meantime, U.S. crude oil exports to Europe jumped 70% in 2022, and now account for 12% of Europe’s oil supplies. In the first six months of 2022 Europe surged ahead of Asia as the top purchaser of U.S. crude oil.

Three major shifts

- U.S. as critical energy supplier to Europe

- New policy initiatives to accelerate green transition and boost competitiveness

- Substantial opportunities in clean technology for private sector

Comparing U.S. and EU Green Subsidies

The Inflation Reduction Act

The U.S. Inflation Reduction Act (IRA) passed by the U.S. Congress in 2022 is by far the single biggest climate investment in U.S. history. It puts the U.S. on a path to roughly 40% emissions reductions by 2030. It is fueled by $369 billion in subsidies and tax credits to qualifying parties. As we discuss in Chapter 3, it is part of an even larger U.S. effortt oposition its domestic economy for a cleaner energy future, to be more globally competitive, and to mitigate critical materials dependencies on China and other suppliers. The IRA could spur $1.7 trillion in public and private investments, according to Credit Suisse. BCG forecasts that the IRA could lower global clean- energy costs by as much as 25% ($120 billion) this decade.

European officials have hailed the IRA’s climate goals yet expressed concerns about the Act’s discriminatory local content provisions, and its market-distorting manufacturing subsidies that might induce European firms to shift their production to the United States. Such concerns are amplified by far lower U.S. energy costs. The U.S. and the EU have established a Task Force to explore whether the IRA may be implemented in ways that alleviate EU worries.

Some concerns are being addressed. Used clean vehicles, which comprise 70% of the market, will benefit from tax credits and are not subject to local sourcing requirements. The new implementing rules also allow subsidies for “commercial clean vehicles” produced by European and other foreign carmakers if they are leased and not purchased, a favored option of U.S. consumers. Currently half of German electric vehicles in the United States are leased.

Discussions continue about batteries. The IRA stipulates that batteries must meet a gradually increasing threshold of critical minerals extracted and processed in countries with “free trade agreements” with the U.S., beginning at 40% in 2023 and increasing by 10% each year through 2026. Neither the EU nor the UK has a free trade agreement with the United States. Drawing on their 2022 Minerals Security Partnership with a number of other countries, the U.S. and the EU are advancing critical materials pacts facilitating freer trade of these materials amongst signatories. These limited arrangements might qualify the EU and others as "free trade" partners, without requiring congressional approval for formal, comprehensive Free Trade Agreements.

-

$369 billion

Inflation Reduction Act subsidies and tax credits

Some European carmakers have complained that their exports could be hit by IRA provisions limiting tax credits to manufacturers that complete “final vehicle assembly” in North America. This ignores the dense transatlantic linkages that underpin the auto industry. The main European automakers already conduct “final vehicle assembly” at their plants in the United States. Volkswagen is the largest European seller of electric vehicles in the U.S., for instance, and it produces its best-selling model in Chattanooga, Tennessee. Mercedes produces its electric EQS in Tuscaloosa, Alabama. Two of BMW’s electric vehicle brands are produced at its plant in Spartanburg, South Carolina, which is bigger than its home plant in Munich.

These activities mean that European exports of finished electric vehicles to the United States are quite low. Those that are exported from Europe face a 2.5% tariff when they enter the U.S., but that is far lower than the 10% tariff the European Commission imposes on every U.S. car exported to the EU. In fact, most European auto-related exports to the U.S. do not consist of finished vehicles. They are components shipped from one part of a European firm based in Europe to its affiliate in the United States.

The EU’s Green Subsidies

In February 2023, the European Commission proposed a Green Deal Industrial Plan for the Net-Zero Age, accompanied by a Net Zero Industry Act, as new elements to the EU’s existing array of measures intended to speed up and incentivize development of clean technology. To power the Plan, the Commission wants to repurpose roughly $250 billion in loans from the NextGenerationEU pandemic recovery fund that have not been drawn down. It has proposed establishing a European Sovereignty Fund to drive joint investment in specific clean technology projects. The Commission wants to hone in on a key set of industries, including the production of batteries, solar panels, wind turbines, heat- pumps, electrolyzers and carbon capture usage and storage as well as related critical raw materials. Any potential joint funding could draw on new funding instruments or an array of existing industrial policy tools and mechanisms designed to achieve energy breakthroughs, including the RePower EU initiative, the cohesion funds, the large-scale Important Projects of Common European Interest (IPCEI), and the Green Deal.

Many EU member states offer additional support measures. For instance, almost every EU country subsidizes the purchase of electric vehicles; Bruegel estimates such support totaled $6.5 billion and averaged about $6,500 per vehicle in 2022 (compared to IRA tax credits of up to $7,500 per vehicle). And while EU rules limit state aid by member governments as a way to ensure smaller and poorer states are not swamped by bigger and richer ones, those limits were loosened for the pandemic recovery and again after Russia’s 2022 invasion of Ukraine. EU rules are now likely to be relaxed once more, at least until 2025, in response to the IRA.

Comparing U.S. and EU Initiatives

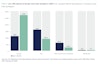

Bruegel concludes that EU and U.S. IRA subsidies for electric vehicles and cleantech manufacturing are roughly similar in size, and that European subsidies for renewable energy production are four times higher than subsidies foreseen by the IRA (Table 2).

These figures suggest that Europe’s challenge is not a lack of financial or state resources, but its own fragmentation and the legacy effects of its overreliance on cheap Russian energy. Bruegel concludes that U.S.-EU differences are less about the sheer size of their respective efforts and more about how those initiatives are being rolled out. It judges IRA clean tech subsidies to be simpler, faster, and less fragmented than those in Europe, but argues that some discriminate against foreign producers, while most EU subsidies do not. IRA subsidies are focused mainly on mass deployment of current generation technologies, whereas EU-level support is more focused on spurring innovation and new technologies.

Lost in the transatlantic debate about competing transatlantic subsidies is the challenge posed by China. As President von der Leyen has said, “The true pressure, the unleveling of the playing field, is not our American friends, it’s China – with massive hidden subsidies, with a lot of denial of access to our companies to the Chinese market and of course there is strategic shopping towards here, the European Union.” China invested $546 billion in the energy transition in 2022, nearly four times the amount the U.S. spent, according to Bloomberg.

Empowering the Transatlantic Energy Innovation Economy

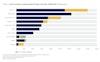

Transatlantic investment is not a zero-sum game, as we demonstrate throughout this book. That is particularly true regarding the transatlantic energy economy. U.S. and European firms are deeply embedded in each other’s fossil-fuel and renewable energy markets – through trade, foreign investment, cross-border financing, and collaboration in research and development (R&D).9 U.S. companies in Europe have become a driving force for Europe’s green revolution, accounting for more than half of the long-term renewable energy purchase agreements signed in Europe since 2007 (Table 3). European companies are the leading source of foreign direct investment (FDI) in the U.S. energy sector (Table 4).

-

$870 billion

Global clean technology market value by 2030

The U.S. and EU share both interest and capacity to accelerate innovative frontier technologies that can provide abundant, affordable, clean energy and manufactured goods. The potential is significant. According to the International Energy Agency, by 2030 the global clean tech market will surpass the value of the oil market, rising from $122 billion to $870 billion.

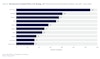

Transatlantic flows of risk capital are critical to cleantech innovation. EU investors are tapping into U.S. innovation and U.S. venture investors are providing scale-up capital for EU startups. Between 2017 and 2022, U.S. investors participated in 758 EU-based cleantech deals and EU investors joined 682 U.S.-based cleantech deals, according to CleanTech Group analysis (Tables 5 and 6). On average, U.S. and EU companies that received transatlantic investments reached growth stage, and received growth funding, faster than those that did not: 20% faster for EU-based companies; 8% faster for U.S.-based companies (Tables 7 and 8). Deal sizes for EU innovator investment rounds that included U.S. risk capital were significantly larger than those that did not involve a U.S. investor. 31% of EU deals that included U.S. investors were over $100 million. Only 8% of EU deals without a U.S. investor were over $100 million (Table 9).

Mind the Gaps

These figures underscore that transatlantic risk capital can be deployed successfully by venture investors to advance clean technologies at the innovation frontier. However, full transatlantic potential is being hampered by two major gaps along the innovation lifecycle.

First, the voices of innovation are absent in transatlantic policy discussions. There is no place for cleantech innovators and investors to inform and exchange views with U.S. and EU officials. As a result, significant transatlantic R&D synergies remain untapped. The U.S. and the EU have separately prioritized R&D focus areas between now and 2040-2050. Yet CleanTech Group research reveals that many official priorities and the actual state of innovation are not fully aligned. Innovators are ahead of governments in some areas, and they are exploring other breakthrough technologies that are not on official radars. Neither side of the Atlantic alone is likely to develop, fund, and scale technologies needed to reach net-zero targets at sufficient speed. The voices of innovators and investors can help inform R&D priorities and generate synergies between the U.S. and EU ecosystems to accelerate innovation, funding and scale-up to commercialization.

Second, large corporations and other demand owners that have made net-zero pledges need access to relevant innovators who have been accelerated by risk capital, and who are ready to scale up to meet net-zero targets as fast as possible. Yet access is fragmented and does not take advantage of transatlantic innovation or the potential to scale faster through coordinated engagement. Easier access to innovation could increase the pool of potential solutions, and innovation scaled up on one side of the Atlantic could quickly spur growth on the other.

Time for TACTA

These gaps could be addressed, and transatlantic synergies catalyzed more effectively, if the U.S. and the EU moved forward on the pledge made at the June 2021 U.S.-EU Summit to “work towards a Transatlantic Green Technology Alliance that would foster cooperation on the development and deployment of green technologies, as well as promote markets to scale such technologies.” At the time, European Commission President Ursula von der Leyen said the two parties would join forces to “enable breakthrough technologies and amazing innovations to be competitive on the market.”

Almost two years later, little progress has been made, despite the tremendous potential – and the urgency – of such an initiative. It’s time for TACTA: a Transatlantic Clean Technology Alliance. As a platform for officials, demand owners, and the investor/innovation community to share perspectives and identify priorities, TACTA could highlight and support synergies among existing EU and U.S. cleantech efforts, identify and close gaps, and prioritize innovations that reduce, rather than exacerbate their critical materials dependencies.

Download the 2023 Transatlantic Economy Report Chapter 4 PDF here