Published

November 17, 2017

Imagine the scene: The U.S. unemployment rate is climbing. Crops in the heartland are rotting. Manufacturers are moving abroad. Consumer prices are rising.

That’s the picture painted by Tom Donohue, President and CEO of the U.S. Chamber of Commerce, in his recent column in The Wall Street Journal examining the increasingly precarious state of play in the effort to modernize the North American Free Trade Agreement (NAFTA):

NAFTA supports millions of American jobs, and with thoughtful updates it could create millions more. Renegotiations with Canada and Mexico launched in August, but the White House continues hinting it may withdraw the U.S. from the trade agreement altogether. These threats must be taken seriously. Quitting NAFTA would be an economic, political and national-security disaster.

While modernizing the 23-year-old NAFTA makes sense, withdrawing from the agreement would be a blow for the United States — one that would hit some states particularly hard. Ironically, those likely to suffer most would be Midwestern industrial states, heartland farm states, and border states like Texas and Arizona — nearly all of which voted to elect President Trump.*

Which leads to the following list, a projection of the states that would suffer most if the United States withdraws from NAFTA.

1. Michigan

The Wolverine State is arguably the state that would suffer most if the United States withdraws from NAFTA, putting at risk 366,000 Michigan jobs that depend on trade with Canada and Mexico. According to the American Enterprise Institute, 38.9% of Michigan’s GDP depends on trade—the highest in the nation—and a staggering 65% of the state’s exports are bound for Canada and Mexico.

Michigan’s $35 billion in export sales to Canada and Mexico are topped only by Texas and California. The Detroit metropolitan region’s exports to Mexico are greater in both absolute value and in share than those of any other U.S. city, according to the U.S. Department of Commerce (cited here). Of note, 95% of the state’s steel exports are bound for Canada and Mexico.

“Auto-related exports represented nine of the top 10 state export categories for Michigan in 2016,” according to AEI. The state’s auto sector depends on continental value chains that would be devastated by a return to pre-NAFTA tariffs and other trade barriers. “Michigan’s high concentration of engineering and automotive-related employment could be at risk to foreign countries if production shifts outside the NAFTA region,” according to the Center for Automotive Research.

Michigan voters favored Donald Trump in the 2016 presidential election by a 0.2% margin.

2. Wisconsin

The Badger State would also suffer acutely if the United States withdraws from NAFTA, potentially putting at risk nearly 250,000 jobs that depend on trade with Canada and Mexico. “Wisconsin ranks second in the nation for manufacturing jobs, behind only Indiana,” according to the state legislature. With manufactured goods accounting for 84% of all Wisconsin exports and nearly half of the state’s exports bound for Canada and Mexico, NAFTA has provided critical access to customers. Of course, the opposite holds true as well: Withdrawing from NAFTA would devastate these Wisconsin industries.

Unsurprisingly, dairy products are the top agricultural export from America’s Dairyland (with total dairy exports of nearly $700 million last year), and Mexico is the top export market for U.S. dairy exports. However, without NAFTA, Wisconsin cheese would face a 45% tariff south of the border. Meanwhile, a new EU-Mexico trade pact will soon guarantee European cheese makers duty-free access to Mexico, allowing them to seize market share from their U.S. competitors.

Wisconsin voters favored Donald Trump in the 2016 presidential election by a 0.8% margin.

3. North Dakota

The Peace Garden State leads the nation in terms of the share of its exports (84%) sent to Canada and Mexico, and withdrawing from NAFTA would put at risk 33,000 North Dakota jobs that depend on trade with Canada and Mexico. An intensely export dependent state, more than 98% of its exports of oil and gas and grains are destined for the other two NAFTA economies.

North Dakota’s top agricultural exports are soybeans and wheat, and the Mexican market is critical for both. Mexico is second only to China as an export destination for U.S. soybean exports. Similarly, North Dakota farmers exported nearly $1 billion worth of wheat last year, but Mexican tariffs could rise from zero to 67% on wheat if the United States withdraws from NAFTA, likely driving sales to wheat growers in Canada, France, and elsewhere.

North Dakota voters favored Donald Trump in the 2016 presidential election by a margin of more than 35%.

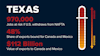

4. Texas

The Lone Star State would take a huge blow if the United States withdraws from NAFTA, putting at risk nearly one million jobs that depend on trade with Canada and Mexico. Not only is Texas the top exporting state, but nearly half (48%) of its exports are destined for the NAFTA market, and these sales bring in more than $112 billion in export revenue. The vast majority of the state’s motor vehicle parts (92%), plastics products (87%), and computer equipment (83%) exports go to Canada and Mexico. All would be devastated by withdrawal from NAFTA.

The Mexican market is especially critical to Texas. According to AEI, “nearly 40% of the state’s exports were to its southern neighbor” in 2016. As the heartland of North America’s energy infrastructure, Texas has played a critical role in turning the U.S. deficit in energy trade with Mexico into a surplus as exports of U.S. natural gas, gasoline, and diesel have soared in recent years. If the United States withdrew from NAFTA, Texas agriculture would also suffer: Notably, Mexican tariffs on beef would rise from zero to 25%, a devastating blow for an iconic Texas product.

Texas voters favored Donald Trump in the 2016 presidential election by a 9% margin.

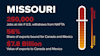

5. Missouri

The “Show-Me State” would suffer if the United States withdraws from NAFTA, putting at risk more than 250,000 jobs that depend on trade with Canada and Mexico. More than half (56%) of Missouri’s exports are destined for Canada and Mexico, generating $7.8 billion in export revenue. The lion’s share of Missouri’s motor vehicle (93%), aluminum (87%), and grain and oilseed (80%) exports go to Canada and Mexico. Withdrawal from NAFTA would inflict sharp job losses on these industries.

Missouri farmers and ranchers would also take a blow, particularly in the critical Mexican market. Soybeans are the state’s most important crop, and over half is exported, with Mexico the second largest market after China. If the United States abandoned NAFTA, Mexican tariffs would rise from zero to 10% on pork and 25% for beef, which are important Missouri exports.

Missouri voters favored Donald Trump in the 2016 presidential election by a margin of more than 18%.

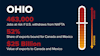

6. Ohio

The Buckeye State would be hit hard if the United States withdraws from NAFTA, putting at risk more than 450,000 jobs that depend on trade with Canada and Mexico. More than half (52%) of the state’s exports are bound for our North American neighbors, generating more than $25 billion in export revenue. Like neighboring Michigan, automobiles and auto parts dominate Ohio’s manufacturing sector, and fully 82% of the state’s exports of autos and auto parts is bound for Canada and Mexico. Soybeans represent the state’s top crop, and over half is exported, with Mexico as the second largest market after China.

Ohio voters favored Donald Trump in the 2016 presidential election by an 8.1% margin.

7. Iowa

The Hawkeye State would suffer sharply if the United States withdraws from NAFTA, putting at risk more than 138,000 jobs that depend on trade with Canada and Mexico. Nearly half (47%) of Iowa’s exports are destined for customers in the other NAFTA markets, generating more than $5.6 billion in export revenue. Iowa is home to major manufacturing facilities, and they would be hit hard by Canadian and Mexican tariff increases that would follow from the termination of NAFTA.

Similarly, Iowa agriculture would lose export sales and market share with devastating effect for farmers and ranchers in the event the United States withdraws from NAFTA. Without the agreement, Mexican tariffs would rise from zero to 10% on pork, 25% on beef, 75% on chicken, and 75% on high fructose corn syrup, a major Iowa export to Mexico.

Iowa voters favored Donald Trump in the 2016 presidential election by a margin of nearly 10%.

8. Indiana

Hoosiers would be hit hard if the United States withdraws from NAFTA, putting at risk more than 250,000 Indiana jobs that depend on trade with Canada and Mexico. Nearly half (47%) of Indiana’s exports are destined for customers immediately north or south of our borders, generating more than $16 billion in export revenue. Indiana ranks first among states in the percent of its workforce engaged in manufacturing, and the vast majority of its iron and steel (96%), motor vehicle (90%), and computer equipment (86%) exports go to Canada and Mexico. All would suffer major job losses upon U.S. withdrawal from NAFTA.

Indiana’s farmers and ranchers would also take a blow, particularly in the critical Mexican market. Soybeans are the state’s second most important crop, and over half of production is exported, with Mexico as the second largest market after China. Upon U.S. withdrawal from NAFTA, Mexican tariffs would rise from zero to 10% on pork, another key Indiana export, likely giving an advantage to producers in Canada and Europe.

Indiana voters favored Donald Trump in the 2016 presidential election by a margin of nearly 20%.

9. Arizona

The Grand Canyon State would suffer if the United States withdraws from NAFTA, putting at risk more than 230,000 jobs that depend on trade with Canada and Mexico. Nearly half (47%) of Arizona exports are destined for customers in Canada and Mexico, generating more than $10 billion in export revenue. A large majority of Arizona’s metal and ores (96%), engines and turbines (91%), and vegetables and melons (77%) exports go to Canada and Mexico. These industries would suffer extensive job losses upon U.S. withdrawal from NAFTA.

Processed vegetables represent Arizona’s top agricultural export. However, without NAFTA, processed vegetables would face tariffs ranging from 10% to 20% in Mexico. As noted above, a new EU-Mexico trade pact will soon guarantee European farmers duty-free access to Mexico for a wide range of products, which could allow them to seize market share from their U.S. competitors.

Arizona voters favored Donald Trump in the 2016 presidential election by a 3.5% margin.

10. Nebraska

The Cornhusker State would take a big hit if the United States withdraws from NAFTA, putting at risk nearly 90,000 jobs that depend on trade with Canada and Mexico. Fully 42% of Nebraska exports are destined for customers in Canada and Mexico, generating more than $2.6 billion in export revenue. A large majority of Nebraska’s grain and oilseed (93%) exports go to Canada and Mexico, and withdrawing from NAFTA would hit this sector hard.

Beef, corn, and soybeans are Nebraska’s chief agricultural products, and the NAFTA market is critical for each. Nebraska is a top beef exporting state, and Mexico is a critical market. However, withdrawal from NAFTA would lead to an increase in Mexican tariffs on beef from zero to 25%, a significant blow for Nebraska ranchers.

Nebraska voters favored Donald Trump in the 2016 presidential election by a 25% margin.

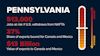

11. Pennsylvania

The Keystone State would suffer if the United States withdraws from NAFTA, putting at risk more than 500,000 jobs that depend on trade with Canada and Mexico. Nearly two-fifths of Pennsylvania exports are destined for customers in Canada and Mexico, generating more than $13 billion in export revenue. A large majority of Pennsylvania’s aluminum (77%), motor vehicle (71%), and glass product (68%) exports go to Canada and Mexico. These industries would suffer extensive job losses upon U.S. withdrawal from NAFTA.

Dairy products represent Pennsylvania’s largest agricultural sector and agricultural export, which underscores the importance of maintaining access to customers in Mexico, the top market for U.S. dairy exports. However, without NAFTA, Pennsylvania cheeses would face a 45% tariff in Mexico. As noted above, a new EU-Mexico trade pact will soon guarantee European cheese makers duty-free access to Mexico, which could allow them to seize market share from their U.S. competitors.

Pennsylvania voters favored Donald Trump in the 2016 presidential election by a 0.7% margin.

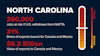

12. North Carolina

The Tar Heel State would suffer if the United States withdraws from NAFTA, putting at risk nearly 400,000 jobs that depend on trade with Canada and Mexico. Nearly one-third of North Carolina exports are destined for customers in Canada and Mexico, generating nearly $10 billion in export revenue. A large majority of North Carolina’s motor vehicle (91%), auto parts (68%), and steel (80%) exports go to Canada and Mexico. These industries would suffer extensive job losses upon U.S. withdrawal from NAFTA.

Pork is the state’s top agricultural export, and Mexico is a critical market. However, if the United States withdraws from NAFTA, Mexican tariffs on pork would rise from zero to 10%, leading directly to lost export sales.

North Carolina voters favored Donald Trump in the 2016 presidential election by a 3.7% margin.

According to the Pew Research Center, the most export dependent places in the United States are small counties in the same collection of states identified above (the industrial Midwest, heartland farm states, and border states such as Texas). The map generated on the basis of Pew’s research suggests that the coastal regions of the U.S. northeastern states and West Coast are much less dependent on exports (with the exception of Washington state). In general, “red” and “purple” states seem to be much more reliant on exports in general and exports to Canada and Mexico in particular than “blue” coastal states.

Editor's note: The post has been updated in the North Dakota section to note that Mexican tariffs could rise from zero to 67% on wheat if the U.S. withdraws from NAFTA.

About the author

John G. Murphy

John Murphy directs the U.S. Chamber’s advocacy relating to international trade and investment policy and regularly represents the Chamber before Congress, the administration, foreign governments, and the World Trade Organization.