Published

December 13, 2021

The Q4 2021 MetLife and U.S. Chamber of Commerce Small Business Index (SBI) finds small business owners are increasingly optimistic despite headwinds from labor shortages, inflation and supply chain woes.

According to the poll taken October 13 - 27, 2021, more than three in four (77%) small business owners are optimistic about the future of their business. In fact, 62% of small businesses say their business is in good health, up from 55% last quarter, while those who say their business is in very good health is 30% now, compared to 20-23% throughout 2021.

“Small business owners’ optimism is plowing through economic uncertainty, but they now face new obstacles with rising inflation, labor shortages, and supply chain challenges,” said Tom Sullivan, vice president of small business policy at the U.S. Chamber of Commerce. “Addressing these challenges will be key to sustaining Main Street’s optimism and the nation’s economic recovery.”

Most see supply chain disruptions making holidays difficult.

Most small businesses are dealing with supply chain impacts during the most important part of the year for them.

Fully three in five (60%) small businesses say they expect supply chain disruptions to make it difficult for their business to manage the holiday season this year. They also see supply chain issues sticking around—well into 2022. Almost two thirds (64%) of small businesses say they expect supply chain disruptions to last at least six months.

“Since lack of materials and low staffing levels at our partner factories makes processing every order more challenging. Things that could be done in 48 hours now take two weeks. Things that normally take two weeks, take four,” says Julianne Weiner, COO of Sonic Promos of Gaithersburg, Maryland.

Sixty-one percent of small businesses say the COVID-19 pandemic has dramatically disrupted their supply chain, and 55% say worker shortages have done the same.

Small businesses have hunger to hire, invest in 2022

In a clear reversal from last quarter, more small businesses are looking to hire and invest in the coming year.

Despite ongoing labor shortages across the country, 38% of small business owners plan to hire more workers next year, up from 28% last quarter, and the highest mark for this measure since the Index launched in Q2 2017. Investment is also on the uptick: Nearly half (42%) say they plan to invest in their business in the coming year—an increase of 13 percentage points from last quarter.

What small business owners are saying

“Our biggest challenge right now is attracting and retaining talent. We have an opportunity to increase our revenue with a significant number of new customers and increased orders from existing customers, but we need more production team members to capitalize.” – Lori Tapani, Co-CEO, Wyoming Machine based in Stacy, Minnesota.

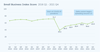

The headline number: reaches pandemic-era high

The current Small Business Index score is 63.0, the highest score since the start of the pandemic. This score is up from last quarter’s score of 56.6 and the nadir of the pandemic in 2020 Q2 when the score reached a record low of 39.

Other key findings:

- Confidence in economy is steady. Confidence in the U.S. economy is unchanged from last quarter, with about a third (32%) rating it as good. Slightly more (39%) small business owners rate the health of their local economy as good, but this is also statistically unchanged from the previous quarter (42%).

- Inflation, revenue remain big concerns. This quarter, inflation is among the top cited concerns for small business owners (23%), along with revenue (26%) and COVID-19 safety/compliance (21%).

For more findings from this quarter, please visit https://www.uschamber.com/sbindex/.

About the author

Thaddeus Swanek

Thaddeus is a senior writer and editor with the U.S. Chamber of Commerce's strategic communications team.