President Biden has proposed raising the corporate tax rate to 28% from its current 21% level.

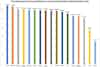

The 2017 Tax Cuts and Jobs Act (TCJA) lowered the rate from 35% to the present level, putting the U.S. in the middle of the pack with other developed nations and ensuring we were competitive in the global economy. Prior to that reduction, the U.S. was bleeding investment and jobs to other developed countries because our rate was so much higher than the average. The weighted average of the Organisation for Economic Co-operation and Development (OECD), an organization of developed nations, is currently 26.3%. When adding on the average state tax rates, the combined U.S. tax rate prior to TCJA was close to 40%. For comparison, China’s tax rate is 25% and Ireland’s is 12.5%. These key facts alone show why tax reform was badly needed. The strong economy prior to COVID-19 showed it was working.

The TCJA was not a rate reduction alone though. It was truly tax reform because it broadened the tax base to the tune of almost $700 billion. The business community paid for a big chunk of its tax rate cut.

Recently we’ve seen that raising the rate up to 28% is losing steam in Congress, with some including President Biden expressing willingness to negotiate and raise it to 25% instead.

The President often states that he wants to raise the rate less than the TCJA cut it, arguing that the rate increase won’t be too damaging because we won’t be going back to the prior rate. The truth is, however, raising the rate to even 25% would be extremely harmful.

Competitively it would put us back near where we were prior to tax reform. Combined with the average state rate, our tax rate would be 29.3%, back above the OECD average. And well above China’s 25% rate.

The punitive impact would extend even greater to the state level. Every state with a corporate income tax would have a rate higher than the OECD average and China. Some key states would see their rates rise well above those benchmarks.

Further, comparing raising the rate under the now-broader tax base to the tax code prior to tax reform is an apples-to-oranges comparison and not the full picture. A recent report from the National Association of Manufacturers shows just how damaging a rate increase to 25% would be, finding that a 25% rate would cost the economy 1 million jobs in the first two years and an average of 500,000 over ten years. It would reduce GDP by $107 billion in the first two years as well. These are large, painful effects.

The corporate tax hike is being proposed to pay for infrastructure spending. While we agree with the administration that we need infrastructure investment, there are better ways to pay for it than undoing the progress of tax reform.

About the author

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.