North American trade is the new Commerce Secretary’s top priority.

Secretary Wilbur Ross told CNBC, “The first on our agenda is NAFTA because we think it makes sense to solidify your own neighborhood first.”

Since the trade agreement is 24 years old, it’s not surprising that there are areas where NAFTA could be modernized.

Recently in a speech in Canada, U.S. Chamber President and CEO Tom Donohue noted that “things like e-commerce and the digital economy didn’t even exist when NAFTA was negotiated more than two decades ago.”

Another applicable area is energy.

Senator John Cornyn (R-Tex.), whose state economy has benefitted greatly by the trade agreement, wrote in Politico:

Consider the nation’s energy landscape. It has changed dramatically since the trade deal was hammered out in the 1990s. With the recent lifting of the U.S. crude oil export ban and Mexico’s energy reforms, a renegotiated deal should account for regulatory cooperation and capacity-building provisions that promote investment and the free flow of American energy, particularly a streamlined approval process for LNG exports.

Given the U.S.-Mexico energy trade relationship, changes with NAFTA on this front could have important implications to U.S. companies.

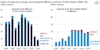

Mexico is the United States’ number two energy trading partner behind Canada. Oil imports from Mexico have decreased while U.S. exports of petroleum products (gasoline, diesel, jet fuel, etc.) to Mexico have gone up. The Energy Information Administration (EIA) points out:

In 2015 and 2016, the value of U.S. energy exports to Mexico, including rapidly growing volumes of both petroleum products and natural gas, exceeded the value of U.S. energy imports from Mexico as volumes of Mexican crude oil sold in the United States continued to decline.

Mexican crude oil production is declining, while more of it is going to Europe and Asia instead of the U.S.

Energy Information Administration.

According to Mexico’s national energy ministry (SENER), more than 60% of Mexico’s electric capacity additions between 2016 and 2020 are projected to come from natural gas-fired power plants, and significant natural gas capacity additions are expected to continue through 2029.

With the fracking boom, U.S. natural gas can be sold to our southern neighbor. Again from EIA:

Expected demand growth will be met mainly by a combination of increasing imports of natural gas from the United States and by large expansions of both cross-border U.S.-Mexico pipeline capacity and Mexico’s domestic natural gas pipeline networks.

What’s more, these numbers don’t fully take into account the increasing opportunities U.S. energy companies--developers, service companies, and equipment manufacturers--now have as Mexico opens more domestic energy development to foreign companies.

Any modifications to NAFTA must take these changes into account to protect these mutually-beneficial (and job-creating) gains. Keeping barriers to the flow of investment and energy low is good for U.S. businesses and consumers.

At the same time, strengthening energy ties among Canada, Mexico, and the U.S. will make North America businesses more competitive, helping American workers.

About the author

Sean Hackbarth

Sean writes about public policies affecting businesses including energy, health care, and regulations. When not battling those making it harder for free enterprise to succeed, he raves about all things Wisconsin (his home state) and religiously follows the Green Bay Packers.