We’re in the midst of a payment technology revolution, as the purchasing process becomes increasingly seamless and user-friendly. With more people than ever shopping online in the age of social distancing, optimizing online checkout has gained heightened importance, just as retailers look for in-store checkout options with minimal touch.

Among the new generation of payment tech solutions is buy now, pay later (BNPL), a 21st century reworking of what used to be known as layaway, designed for the omnichannel shopping era. While BNPL began as an e-commerce trend, it is rapidly becoming accepted for payments in physical stores as well. For credit-averse consumers, most BNPL solutions don’t require approval, charge little to no interest and generally pose limited threat to the consumer’s credit score, providing they make every payment on time.

Ideally, BNPL services make the checkout process more seamless than having to enter credit card information for each purchase. In exchange for a small percentage of revenue paid to the BNPL service, merchants get fewer abandoned carts and more impulse purchases, be it online or in store.

Traditionally, layaway and installment plans were relied upon for big ticket purchases, like furniture or electronics. A range of financial tech (or “fintech”) startups, including Afterpay, Klarna, Sezzle, Affirm and Quadpay, are enabling a new kind of consumer behavior, normalizing the use of point-of-sale loans for everyday purchases as low as $35.

“Most Gen Xers and boomers wouldn’t think of paying off a $50 pair of jeans over three months,” says Ron Shevlin, director of research at Cornerstone Advisors, “but younger consumers do.”

It’s not necessarily a ‘build it and they will come’ situation, but the inclusion of the programs on many merchants’ websites has made them more available to consumers.

Ron Shevlin, director of research, Cornerstone Advisors

Analyzing the growth of the BNPL trend

Cornerstone Advisors estimates that although just 7% of consumers used the installment payment services in the first nine months of this year, many single users make multiple purchases, with consumers poised to rack up $24 billion on BNPL purchases in 2020. While it’s proven particularly popular among Gen Z, BNPL offers brands and retailers a new angle for appealing to both young people as well as lower-income consumers of all ages.

“As e-commerce continues to be the dominant way that younger consumers shop today,” said Kim Muhota, head of financial services, North America, at consulting firm SSA & Company, a global consultancy advising on strategic execution, “being able to capture the consumer at the point of need, right when they are checking out of an e-commerce transaction, for example, has become ever more seamless.”

BNPL is on the minds of investors as well. Australia’s Afterpay, which serves over 55,000 retailers, went public in 2016 and is now valued at $20 billion. Meanwhile, Klarna has over 200,000 retailers, and raised $650 million in September, and Affirm is on its way to an IPO after reported revenue was up 93% year-over-year.

Though the BNPL disruptors have generated ample growth, they haven’t necessarily built a successful moat around the concept as bigger players encroach on their turf. Afterpay, Affirm and the like face the threat of competition from other tech companies that have already stepped into the payment space, like PayPal, Google and Apple, as well as from larger, tech-enabled retailers like Amazon.

Consumer and demographic changes driving BNPL adoption

However the pay-as-you-go market shakes out, a few major factors are driving its rapid adoption. Firstly, BNPL is optimum for consumers who want to avoid credit, whether they cannot get approved or simply choose to spend as cautiously as possible.

Younger generations have a different relationship with credit. A study by The Ascent found that 67% of millennials surveyed did not have a credit card, instead preferring to pay with debit cards, cash or mobile banking and payment solutions. They’re also more open to paying via new apps and services that use the same slick design and digital interfaces they recognize from other categories, like social media and gaming.

“Fintechs have focused on building powerful customer experiences that are delivered via a beautifully designed web or mobile interface,” Muhota said. “We are seeing the same trend in all facets of financial services with fintech and ‘insurtechs’ [insurance technology] like Robinhood, Lemonade and Hippo. Ultimately, consumers are also very comfortable with using multiple financial providers that do one thing very well, as opposed to having all their relationships with one or two banks.”

It’s possible that the normalization of BNPL could help subtly shift consumer behavior around value, making it more accessible for the average young or lower income consumer to favor patronizing startups and independent businesses over giants like Amazon and Walmart. Though it is much harder for a small business to handle the costs incurred from customers defaulting, adding BNPL options can lessen the sting of paying a premium enough to increase an audience.

It’s not just generational or demographic spending habits pushing shoppers to choose the BNPL option; it’s also because they’re so widely available. “It’s not necessarily a ‘build it and they will come’ situation, but the inclusion of the programs on many merchants’ websites has made them more available to consumers,” says Shevlin.

Sizing up the growing competition

Now that there are nearly half a dozen major options for payment on the installment plan, accepted everywhere from Walmart (via Affirm) to Etsy (via Klarna), the race for differentiation is on. With so many players on the field, it’s hard to say which startups will thrive, catering to long-term consumer behaviors, and which ones will fade away with the novelty of BNPL.

“I couldn’tsay at this point who will survive and win, but it is a race to get associated with as many merchants as possible.” Shevlin said. “We’ll probably see some consolidation among some of the BNPL providers, and I would expect some will be able to survive as standalone firms by specializing in certain types of lending.”

“The hardest challenge for any payment method is staying top of mind and top of wallet, especially when there is limited differentiation,” said Stephen Milbank, co-founder and head of global strategic partnerships at mobile commerce technology company Button. Thus far, "it’s just the retailers with which they’re integrated that sets them apart, and adding new ones is a relatively heavy lift,” he said.

The companies that will win in the space will need to have intelligent integration with a retail partner and deliver a seamless user experience on the merchant’s website, Muhota said.

Ultimately, he predicts, “this space will consolidate to no more than two or three dominant players who will have deep relationships with a vast spectrum of retailers that they can leverage to drive scale.”

Where it’s going: how BNPL is evolving

Innovation at checkout has proven to be a key strategy for driving conversion. However, one of the challenges payment platforms face is capturing consumer activity closer to the top of the funnel, at the start of the shopper’s journey.

Previously, customers were likely to only encounter these payment services when checking out with a brand or retailer’s online store. Now, however, the fintech apps are looking to build their own dedicated base of customers, who shop specifically within its network of participating brands in order to utilize BNPL services.

“Where I expect the key BNPL platforms to lead and innovate in the retail landscape is transforming themselves into discovery platforms,” Button’s Milbank said. “I expect their goals will focus on creating more intent to purchase and then provide the user experience to ensure that the user pays as efficiently as possible in a method that best suits their financial resources.”

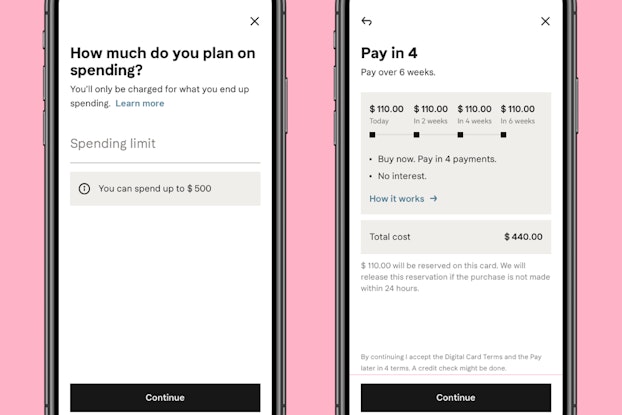

Shopify’s newly launched consumer-facing app, Shop, lets customers track packages purchased through participating merchants, as well as browse and check out directly within it. Shopify is also launching Shop Pay Installments, its own BNPL option, that will allow users to split purchases into four payments at checkout.

“Bigger tech companies are threats,” said Shevlin. “PayPal is already the leader in the space.” Indeed, PayPal’s newly announced Pay in 4 service is ready to take on the competition from startups.

But when it comes to competition from major retailers, Muhota doesn’t expect many traditional players to create their own platform, instead choosing to pursue partnerships like Gap’s with Afterpay, or waiting for BNPL options from financial institutions and credit card companies themselves.

“The most likely disruptor in the BNPL space could be Amazon, who commands the lion’s share of e-commerce transactions,” he said. “Offering a BNPL option that is seamlessly integrated into the shopping experience could be an instant game-changer.”

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.