J.D. Foster

J.D. Foster

Former Senior Vice President, Economic Policy Division, and Former Chief Economist

Published

February 28, 2017

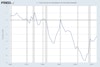

Protectionist pressures in the United States typically wax and wane over time as economic and political trends develop. As protectionist voices are again rising, a little perspective may help put America’s trade profile in context. The United States has run a trade deficit since the second quarter of 1991, which followed on the heels of a short, sharp recession. Prior to that, the U.S. had run a trade deficit for almost a decade. So, with the exception of a short, six month recession-related interlude, the U.S. has run a trade deficit for almost 35 years. Is this a sign of something deeply troubling and systemically wrong, or a sign that the trade deficit really isn’t a cause for concern despite all the localized hyperventilation?

To answer, consider that the United States has run trade deficits when the economy was especially strong. For example, in the latter half of the 1990s the economy grew about 23 percent, while the trade deficit grew about 33 percent.

Over the last 50 years the U.S. economy put in its strongest 4-year performance from the first quarter of 1983 to the first quarter of 1987, growing an average of 4.9 percent annually. Surely, if trade deficits are as harmful as some suggest, then the United States must have run large trade surpluses over such a period of strong economic growth. On the contrary, the U.S. trade deficit grew ten-fold over this period, or at about a 44 percent annual rate.

Perhaps the surest way to reduce a trade deficit is to induce a recession, though even deep recessions cannot guarantee a trade surplus. The U.S. ran an annual trade deficit of nearly $400 billion even at the depth of the Great Global Recession in 2009.

The United States has run a trade deficit when the dollar was particularly strong relative to other major currencies, and when the dollar was relatively weak.

It has run trade deficits under Republican and Democratic presidencies, and when Republicans controlled the Congress and when Democrats controlled the Congress.

Should the U.S. abstain from sound economic policies because those policies might as a byproduct of producing better jobs at higher wages also increase the trade deficit?

Given this pattern of running trade deficits over so many diverse historical periods, it is very difficult to generalize about underlying causes. It is then equally difficult to generalize about the implications for the overall economy. For example, a rising trade deficit is often associated with positive developments in the domestic economy. When the U.S. economy grows rapidly compared to the economies of its trading partners, then U.S. imports tend to rise faster than exports and so the trade deficit increases.

Similarly, if some change in circumstances or policies makes the United States a relatively more attractive place to invest, then increasing net capital inflows will push up the U.S. trade deficit to preserve the balance of payments. For example, the Federal Reserve moderated the inflation rate in the early to mid-1980s and so foreign investors’ interest in the United States quickly increased. Net capital inflows increased and thus the trade deficit ballooned as noted.

Pro-Growth Policies

Other positive policy shifts can have similar effects. A substantially more pro-growth, pro-capital formation tax policy would make the United States a more attractive place to invest for Americans and for foreigners. As domestic investment accelerated, it would likely do so more rapidly than domestic saving, with the difference supplied for foreign savers who would be pleased to invest in a re-invigorated U.S. economy. The resulting increase in net capital inflows would be matched by an increase in the trade deficit as the balance of payments does indeed balance.

Should the United States abstain from sound economic policies because those policies might as a byproduct of producing better jobs at higher wages also increase the trade deficit? Should the United States seek to copy the weak economic performance of its trading partners just to keep the trade deficit contained? Obviously not.

To be sure, not every large trade deficit results from sound policies at home. Sometimes, the trade deficit increases because America’s foreign trading partners’ economies are weakening, thereby reducing demand for U.S. products, but there’s little the U.S. government can do about that.

Sometimes, a trade deficit results because a nation’s fiscal policies are unsustainable. Large budget deficits may be financed by hoovering up vast quantities of foreign saving. The resulting increase in net capital inflows from selling domestic debt to foreign investors to finance budget deficits may produce a commensurate increase in the trade deficit.

Though the U.S. budget deficit in 2017 will exceed a half trillion dollars, the budget deficit does not appear to be driving the trade deficit, especially as large budget deficits appear to be the order of the day in most industrialized countries.

Bi-Lateral Trade Deficits Generally Even Less Relevant

In contrast to overall trade deficits, which though sometimes difficult to interpret at least are economically relevant, bi-lateral trade deficits and surpluses generally have little meaning for national economies. Years ago, American politicians and pundits fixated on the U.S. trade deficit with Japan. These concerns then largely faded and were replaced with concerns over the U.S. trade deficit with China. This concern is similarly largely misplaced.

To see why bilateral trade deficits generally ought not be a subject of concern, consider three countries, A, B, and C. Suppose A has a $100 trade deficit with B, which in turn has a $100 trade deficit with C, while C has a $100 trade deficit with A. Should the residents of A have a complaint because they run a deficit with B? If so, then the residents of C would have the same complaint with A. Each country has a bilateral deficit, but each country is also running an overall neutral balance of trade.

As a rule, every country seeks a competitive advantage and sometimes these efforts cross the line into unfair trade practices. Trade agreements are needed to identify methods for adjudicating resulting trade disputes. When appropriate, the United States government brings these issues to a head, just as other nation’s sometimes contest against U.S. policies.

Often, however, the lines get blurry. China, for example, can be very difficult to analyze sensibly because so many of its major industries are dominated by state-owned-enterprises. China has also long been accused of manipulating the renminbi to prevent it from appreciating to market levels to gain a competitive advantage. Ironically, any currency manipulation China has attempted in recent months was more in the nature of protecting the renminbi from falling too fast, exactly the opposite of the charge being leveled in some quarters. Hardly dispositive, it is nonetheless interesting that William R. Kline of the Petersen Institute in his November estimates of “fundamental equilibrium exchange rates” finds “no misalignment of the euro and the Chinese renminbi” against the dollar as of this past October.

It’s not that large and persistent trade deficits don’t matter. They matter for many reasons, including influencing the composition of domestic economic activity, whether the country has access to sufficient saving to finance desired net investment plus any government budget deficits, and for the evolution of a country’s net asset position with respect to the rest of the world.

However, just because trade deficits matter does not mean they are necessarily a problem. Discerning a problem requires discerning the cause, and as noted, for the United States with its long history of trade deficits over good times and bad, discerning a cause is not an easy task. Further, as the United States has long run a trade deficit through thick and thin, the evidence suggests the trade deficit is much more of a conundrum for economists than a problem for policymakers.

About the author

J.D. Foster

Dr. J.D. Foster is the former senior vice president, Economic Policy Division, and former chief economist at the U.S. Chamber of Commerce. He explores and explains developments in the U.S. and global economies.