Published

January 19, 2021

Were the Trump administration’s trade policies a success? Arriving at a full assessment of their costs and benefits will take time, but doing so is useful in charting a path forward for American trade policy.

The following assessment focuses on those trade policies’ successes and failures in (1) securing new access to export markets; (2) the effects of the administration’s use of tariffs and other policies affecting imports; (3) their impact on U.S. manufacturing and agricultural industries and workers whose sectors were most directly affected; and (4), with regard to a self-declared goal, reducing the U.S. trade deficit. This brief survey focuses on merchandise trade, as the Trump administration’s trade policy did.

Exports: New Market Access Abroad

In terms of seeking new market access abroad for U.S. exports, the Trump administration’s record is poor. One top priority, replacing NAFTA with a new North American trade agreement, was never going to deliver significant new market access for the simple reason that NAFTA had already swept away nearly all of the most obvious trade barriers within North America. USMCA did produce new access to the Canadian market for U.S. dairy producers and some other farmers, but those gains are modest, even within the agricultural sector.

Too little time has passed to assess the U.S. China Economic and Trade Agreement reached in January 2020, but, in any event, that agreement established not market access per se but specific purchasing targets for U.S. agricultural, manufacturing, energy, and services exports well above historical benchmarks. To date, China’s purchases are just under 60% those committed in the agreement (and less than those reached before the U.S.-China trade war). These shortfalls are partly attributable to the COVID-19 pandemic, though China’s economy and domestic demand have recovered more fully than other major economies. It is also worth noting the U.S. Section 301 tariffs on imports from China drew Chinese retaliatory duties, and many of these remain in place. (In addition to purchasing targets, the U.S.-China agreement included Chinese commitments to undertake a number of structural reforms, including improvements to its IP regime and finance services liberalization, whose implementation appears to be proceeding relatively well.)

The “Phase I” trade agreement reached with Japan in late 2019 did deliver valuable market access for U.S. farmers and ranchers, and it includes a strong digital trade agreement, but these outcomes are modest compared to those promised by the Trans-Pacific Partnership, which President Trump abandoned in his first days in office. Not only did the TPP promise new access to the domestic markets of five Asia-Pacific markets with which the United States had not yet struck trade agreements, its 30 chapters extended market access and rules in sectors and disciplines well beyond those the Trump administration reached with Japan. Leaving the TPP has not only provided benefits to its 11 parties in which the United States could have shared, it has left a vacuum in the Asia-Pacific region that China and others are now better situated to fill.

Elsewhere, the Trump administration has pursued “mini-deals,” but talks with India did not bear fruit, and while the recent trade protocol with Brazil includes positive new rules provisions on trade facilitation, anti-corruption, and good regulatory practices, it offers no new market access. A very modest agreement with the EU provides new market access for U.S. lobster exports.

Finally, and despite White House advisor Peter Navarro’s insistence that no country would retaliate, the administration’s Section 232 tariffs imposed on steel and aluminum imports drew immediate retaliatory duties from nearly every corner of the globe. U.S. exports of washing machines to Canada, bourbon to Europe, almonds to India, and rice to Turkey have all been hit with retaliatory tariffs, limiting U.S. exports and handing an advantage to America’s trade competitors.

Imports: Tariffs and Other Actions

The administration of President Trump, a self-described “tariff man,” championed tariffs and other limits on imports as a tonic for a wide range of economic ills. U.S. Trade Representative Robert Lighthizer, in marathon hearings before the House and Senate trade committees in June, hailed the use of tariffs and described his view that they “protect our exporters and workers.” While officials have often denied it, tariffs are in fact taxes paid by the importing nation’s consumers and businesses, and economists in multiple studies have confirmed that price levels and exchange rates did not adjust to shield Americans from bearing almost all of this burden.

The United States during the Trump administration has wielded tariffs more readily than in any other period in the post-World War II era. U.S. Section 301 tariffs on goods from China, Section 232 tariffs on steel and aluminum, and other new tariffs on solar panels and washing machines have been applied to $395 billion of imports (about 17% of the all merchandise imports), according to a report from the Congressional Budget Office. CBO projects tariffs will “reduce average real household income by $1,277 (in 2019 dollars) in 2020,” with a host of other studies showing a similar hit to U.S. consumers. These tariffs dramatically surpass any analogous action by any other postwar president, and nearly all are still in place.

In addition to raising costs for businesses and consumers, tariffs sow uncertainty that stifles economic growth. Business managers are less willing to make long-term capital investments and hiring decisions if they are uncertain about their future ability to acquire needed inputs at a reasonable price or to export products without having to pay foreign retaliatory duties. In 2018-2019, U.S. business investment unexpectedly declined—despite the benefits of the Tax Cuts and Jobs Act—and various indices of business confidence dropped. The fact that aluminum tariffs were briefly reimposed on Canada in August 2020—USMCA notwithstanding—illustrates how Trump administration trade deals failed to quash tariff-engendered uncertainty.

On occasion, some in and out of government have said the administration was deploying tariffs and tariff threats in pursuit of the outcome of “zero tariffs, zero non-tariff barriers, and zero subsidies… a radical free-trade agenda.” However, the record does not support this view. In the hearing mentioned above, Lighthizer spoke favorably about imposing or at least retaining tariffs on a host of products from semiconductors and medical supplies to metals. As noted in the preceding section, the administration has secured little new market access abroad despite its tariffs and tariff threats, and, where applied, tariffs have rarely been lifted. In other instances where U.S. interests have won new market access abroad—for example, in Taiwan’s recent move to drop bogus sanitary barriers blocking imports of pork and beef from the United States—the carrot of a possible trade pact rather than the stick of tariffs was the obvious incentive.

In addition, the apolitical trade remedy machinery of government has continued to impose tariffs—anti-dumping and countervailing duties (AD/CVDs)—on dumped or subsidized imports. As Commerce Secretary Wilbur Ross tweeted on August 24: “Since the beginning of the @realDonaldTrump administration, @CommerceGov has initiated 286 new Antidumping and Countervailing Duty investigations — a 267 percent increase from the comparable period in the previous administration.” As a result, many commodities such as steel are subject to average U.S. tariffs that soar into the triple digits for many specific subcategories.

Output: Impact on U.S. Manufacturing and Agriculture

It’s worthwhile conducting a closer examination of the impact of these policies on U.S. production of tradeable goods. For American manufacturers, Trump administration trade policy—most notably Section 301 and 232 tariffs and related foreign retaliation—clearly played a role in producing the U.S. manufacturing recession of 2019, when the sector contracted for three quarters. This manufacturing recession is especially striking given its appearance at a time when the U.S. economy writ large was demonstrating strength: Growth reached 2.3% in 2019, consumer demand was robust, tax cuts were in force, and interest rates were low. And yet U.S. manufacturing contracted, and wages for U.S. manufacturing workers fell even as average wages for all workers rose. Manufacturing strongholds such as Michigan, Wisconsin, and Pennsylvania saw net manufacturing job losses.

Why would Trump administration trade policies have such an effect on manufacturing? As noted, more than half of U.S. imports are raw materials, parts and components, and other inputs used by manufacturing. The Section 232 tariffs, for example, drove up domestic prices for steel by about 40% for a period, benefitting iron and steel manufacturers and the approximately 100,000 American workers they employ. However, U.S. workers employed in manufacturing industries that depend on steel as an input outnumber those in steel production by approximately 45-to-1, and those much larger industries were harmed by higher costs and reduced competitiveness. Tariff exclusions often proved hard to secure and tended to leave small businesses in the lurch, according to multiplereports. In similar ways, Section 301 tariffs on industrial materials and components from China hit U.S. manufacturers hard.

The impact on U.S. farmers and ranchers was arguably worse. U.S. agricultural exports fell by approximately 6% (or about $8 billion) in FY 2019 as the trade war took hold; meanwhile, the administration directed tens of billions of dollars to U.S. farmers and ranchers to compensate for lost export sales. Direct federal subsidies to farmers doubled to $46.5 billion in 2020, representing more than one-third of farm income, according to USDA. These developments undermine decades of efforts by the U.S. agricultural community to build foreign markets and reduce the need for federal support.

Anecdotally, many American manufacturing workers and farmers and ranchers have indicated a willingness to bear the burden of the Trump administration’s trade war if it were to produce long-term benefits. However, with the administration leaving most tariffs intact and eliciting retaliatory duties that close foreign markets, those benefits were not materializing even before the pandemic. Further, foreign direct investment in the United States—much of it in the manufacturing sector—fell by 37% in 2019 to $195 billion, a level well below the $333 billion average for 2014-2018. While many factors drive FDI flows, surveys indicate trade tensions were a notable drag on greenfield and M&A investments from abroad.

The Trade Balance: Reducing the U.S. Trade Deficit

Trump administration officials have often said reducing or eliminating the U.S. merchandise trade deficit is a primary goal of their trade policy. For example, the first goal in its negotiating objectives for the USMCA reads: “Improve the U.S. trade balance and reduce the trade deficit with the NAFTA countries.”

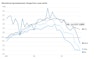

The Trump administration failed to achieve the goal it set of reducing the U.S. merchandise trade deficit, which rose over four years by approximately $130 billion to reach $854 billion in 2019.

However, the trade balance is a poor measure of whether a particular set of trade policies—or trade agreements—is delivering benefits to the American people. The vast majority of economists agree that “foreign import barriers and exports subsidies are not the reason for the US trade deficit,” as Martin Feldstein, who chaired President Ronald Reagan’s Council of Economic Advisers, wrote. He summarizes: “The real reason is that Americans are spending more than they produce. The overall trade deficit is the result of the saving and investment decisions of US households and businesses. The policies of foreign governments affect only how that deficit is divided among America’s trading partners.”

For these reasons, the Trump administration’s failure to attain this self-imposed goal is one that economists or business leaders are unlikely to emphasize.

About the author

John G. Murphy

John Murphy directs the U.S. Chamber’s advocacy relating to international trade and investment policy and regularly represents the Chamber before Congress, the administration, foreign governments, and the World Trade Organization.