It’s an old cliché, but it still rings true: When you’re in a hole, stop digging. However, when it comes to inflation, that’s just what the Reconciliation Bill would do — keep digging.

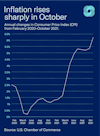

The Bureau of Labor Statistics (BLS) just confirmed what we all knew: prices rose sharply in October. According to BLS, prices rose 0.9 percent from September to October alone. On annual basis prices rose a whopping 6.2 percent. This is the highest inflation level since November 1990 – 31 years ago.

Prices were higher across the board. Food prices rose 0.9 percent over the month and are up 5.3 percent annually. Energy prices jumped a stunning 4.8 percent in October, and gas was up 6.1 percent. Energy is up 30 percent annually, and gas is up 50 percent from a year ago!

Analysts often separate out food and energy prices because they tend to be more volatile than other prices. This is known as Core Inflation. Prices excluding food and energy still rose 4.6 percent annually in October.

Car prices are a major contributor to inflation right now because of the shortage of new vehicles on the market due to supply chain issues. New car prices are up 10 percent annually, and used cars are up more than 26 percent.

What is happening with prices is now plain for all to see. They are rising rapidly. This is not a “transitory” (a fancy way of saying temporary) event. Prices have been increasing sharply since March (see the chart), and that rise is not going to slow any time soon. The supply chain issues and worker shortages, combined with a general inflationary environment where consumers and businesses expect inflation, will keep prices high until the middle of next year – at a minimum.

We are in for a prolonged period of higher prices. The last thing Congress should do now is add to those pressures. Family budgets are already being squeezed tightly. Wage growth is strong right now, but inflation is still outpacing it by a wide margin. In October, inflation was 6.2 percent and wages rose 4.9 percent, so real wages declined by 1.3 percent.

The reconciliation bill would undoubtedly worsen the situation. As currently constructed, the bill funds consumption in the near-term and pays for it by taxing investment over the long-term. In just the next year it would provide a minimum of $120 billion in transfer payments and tax cuts. More payments will put more money into the system, putting upward pressure on prices.

We have called on Members of Congress to demand a full accounting of how the reconciliation bill will add to inflation before it is brought up for a vote. If elected officials want to do something about skyrocketing prices a good place to start is by not making the problem worse.

About the author

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.