Key Takeaways

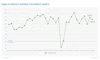

- Overall business conditions remained solid as the top-line sentiment indicator eased to 131.3 from 134.0 in Q2.

- Fifty-two percent of respondents expect an improvement in the general economy in the second half of the year.

- Businesses’ willingness to invest in productivity-enhancing capital expenditures represents a continuing sign of strength in the MMBI survey.

Resilience, not recession, is the primary takeaway for the American economy from the most recent RSM US Middle Market Business survey.

Despite a variety of shocks to the real economy over the past two years, overall business conditions remained solid as the top-line sentiment indicator eased to 131.3 in the second quarter, down modestly from the 134.0 in the first quarter on a seasonally adjusted basis.

“Middle market firms’ optimism about revenue and earnings, as well as increased capital expenditures, reflects an underlying confidence in business conditions looking ahead. Maintaining a healthy credit supply to service this optimism is vitally important to protecting economic growth as companies face continued interest rate, inflation and workforce challenges.”

-Neil Bradley, executive vice president, chief policy officer and head of strategic advocacy at the U.S. Chamber of Commerce

To put that in perspective, the 131.3 reading was in line with the 2017−2020 period before the pandemic, when the middle market generally thrived following steep federal tax cuts, a large increase in federal spending and low interest rates.

The data is based on responses from 404 senior executives at middle market firms in a survey conducted from April 3 to April 24.

While executives expressed optimism about the economy over the next six months with respect to revenues, earnings and capital expenditures, their current views were tempered by lingering inflation, higher wage costs and the recent disruption among small and regional banks that play a vital role in lending to middle market firms.

We anticipate that the Federal Reserve’s aggressive interest rate increases will result in capital growing scarce just as credit is tightened in the wake of the recent banking disruption.

How much the real economy can absorb these shocks will almost surely be the difference between slow growth and a recession over the next year.

During the second quarter, evaluations of the economy soured a bit, with only 35% of survey participants indicating an improvement in the general economy, and 42% saying it had deteriorated.

It is important to note that this survey was put to field during a period of financial stress among small and midsize banks that serve many middle market companies. It is fair to state that some of the current evaluations of the general economy differ from the more optimistic views expressed in the survey.

Yet 52% of respondents expect an improvement in the general economy in the second half of the year, which we would attribute to sustained demand by U.S. households for goods and services.

There is approximately $500 billion in excess savings still in household accounts compared to pre-pandemic levels, according to a recent study by the San Francisco Federal Reserve, and that should support solid spending through the end of the year. As long as that spending prevails, middle market business conditions should remain solid.

On the pricing front, 79% of respondents said they had paid higher prices, which is up from 70% previously, while 79% expect to pay higher costs over the next six months.

For prices received, 57% of respondents indicated they had passed along higher prices to customers, with 70% expecting to do so in the second half of the year.

Expectations on revenues and net earnings remain strong amid a modest deterioration in the current quarter. We attribute this to a general compression in profit margins across the economy as lingering inflation continues to increase business costs and a rise in the cost of capital affects firms’ bottom lines.

In the current quarter, 42% of respondents said that gross revenues improved, down from 53% in the first quarter, while 44% indicated an improvement in net earnings, which is down from 49%.

Survey answers imply that 70% expect improvement in gross revenues over the next six months and 65% assume that net earnings will improve over the next six months.

One continuing sign of strength in the MMBI survey has been firms’ willingness to invest in productivity-enhancing capital expenditures. Almost half, or 46%, said that they increased business investment and 60% expect to do so through the end of the year.

This is a bullish note within the current survey that we think bodes well for middle market firms, even if the economy falls into recession.

The most robust element of the American economy right now is the labor market. Labor demand and higher wages are bringing people off the sidelines and into the workforce.

Not surprisingly, hiring and hiring intentions remain stout, with 50% of respondents saying they increased hiring and 62% indicating they intend to do so over the next 180 days. Fifty-eight percent of survey participants said they increased compensation and 72% said they intend to do so in the near term.

Firms reduced their inventories as one would expect, and a strong majority are getting ready to expand inventory accumulation to get ready for the holiday shopping season. Borrowing conditions remained stable despite the disruption among local and regional banks.

Midsize companies look for a way forward on digital transformation, MMBI finds.

Middle market company executives understand that digital transformation is an important objective, but they are not always backing up their ambitions with action, according to data from the second-quarter MMBI survey.

Almost three-quarters (74%) of all respondents say digital transformation—the large-scale realignment of business operations to take advantage of technology—is either the most important area or among the most important areas of investment for their companies. But a majority (54%) of all respondents say they either are way off from achieving their digital transformation goals or believe it is not relevant to their businesses to even begin a digital transformation program.

And while artificial intelligence has been the subject of both bold predictions and dire warnings, that cultural buzz has not translated to major changes in the middle market. Just over a quarter (28%) of all respondents say they currently use AI in their businesses. This is less than the 34% of respondents who say they have not discussed using AI or have already decided against utilizing it. In addition, over half (56%) of all respondents have not used ChatGPT or other generative AI tools to support their business.

The survey results imply that in some areas of digital transformation, a gap exists between larger companies (annual revenues of $50 million to $1 billion) and smaller companies (annual revenues of $10 million to $50 million). For example, 56% of larger companies say they have substantially achieved their digital transformation goals, a percentage that is more than double the 27% of smaller companies who say the same thing. And two-thirds of bigger companies (66%) say they have a clear strategy that addresses their IT and digital transformation goals, noticeably more than the 41% of smaller companies who say they have a defined plan.

On the middle market mind

We asked middle market executives to describe a top business problem facing their organization. Here’s what they had to say.

- We are struggling to stay ahead of the curve regarding technology, as it plays a crucial role in driving efficiency and productivity. – Retail executive

- Understanding financial risk exposure, particularly regarding currency fluctuations, commodity prices and geopolitical instability. – Finance executive

- Cash flow is a major issue in our industry, especially for long-term projects. It's critical for me to understand the project budget, timeline and payment milestones in order to ensure that the financial aspects of the project are properly managed. – Construction executive

- Our business is highly capital-intensive and I have to closely manage operational costs to ensure the company is competitive and profitable. This includes closely monitoring labor costs, raw material costs, energy costs and other operational costs. – Manufacturing executive

- One of our main obstacles involves locating new customers, and it can be challenging to stand out in a crowded market, particularly with limited resources. – Finance executive

- With the growth of multichannel retailing, managing inventory for our company is becoming more difficult because we need to handle inventory across multiple channels, which calls for cautious planning and coordination. – Retail executive

- Having difficulty in recruiting and retaining quality faculty due to a lack of competitive salaries or benefits, or inadequate professional development opportunities. – Education executive

- Retaining customers and building customer loyalty is a challenge for retailers, as customer tastes and preferences are constantly evolving and the competition is fierce. – Retail executive

- Managing complex supply chains is a challenge for our company. This requires tracking and managing materials, components, and finished goods across multiple locations, and because of disruption it's quite hard for us to manage and track everything. – Manufacturing executive

- As the management of technology is quickly transforming the health care sector, handling new technological advances is necessary to offer services successfully. – Health care executive

See more Middle Market Index data and visualizations at RSM's website.