Last week was Infrastructure Week, and it was more than a joke DC reporters make on Twitter.

Businesses, labor unions, and other advocates came together to tell leaders that rebuilding America’s infrastructure is a national imperative.

Let’s talk about the politics of getting an infrastructure deal done. Everyone knows we need to repair and improve it. (It’s at a D+ grade.) Everyone also knows it will cost a lot of money – President Trump and Democratic Congressional leaders have tossed around a figure of $2 trillion a few weeks ago.

The question is where that money will come from. The obvious answer is raising federal fuel fees – i.e. the gas tax. A modest increase is one part of the U.S. Chamber’s plan.

Politicians and pundits think doing this would be politically disastrous.

However, the idea that raising the gas tax is a guaranteed political disaster is a myth.

Let’s look at the states to see what’s happened. Here are the states that have raised it since 2016:

- Alabama

- Arkansas

- Ohio

- Oklahoma

- California

- Indiana

- Oregon

- South Carolina

- Tennessee

- Utah

- West Virginia

- New Jersey

- Montana

Most of these states are “red” and Republican. Many conservative state legislators who would be repelled at any suggestions of a tax hike voted for investing in roads and bridges.

In Alabama earlier this year, a special session of the newly-installed state legislature took the legal minimum five days to pass a gas tax increase and have it signed into law.

If raising the gas tax was so toxic, we’d see voters punishing politicians at the ballot box, but massive voter blowbacks have been nonexistent.

In New Jersey, every legislator that voted for a gas tax increase was reelected.

And in the case of California, voters had a chance last year to repeal the 2017 gas tax increase. It was defeated.

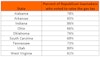

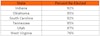

The U.S. Chamber crunched some numbers to provide more evidence that the idea that voting for a gas tax hurts lawmakers politically by looking at Republican-led state legislatures that voted to increase the gas tax since 2016.

Two things you should notice.

First, there was overwhelming support among Republican legislators for the increase.

Second, an overwhelming number of Republicans who voted for the increase and sought re-election won.

The document sums up the politics of the gas tax:

Voters don’t penalize lawmakers who invest in repairing the roads, bridges, highways, and other critical infrastructure in their communities. On the contrary, voters want action. Nearly 80% say that it is extremely important that the government invest more in infrastructure.

It’s not that people are fans of higher taxes. They’re not. It’s that they’re tired of crumbling infrastructure.

Take small business owners. The most recent MetLife & U.S. Chamber of Commerce Small Business Index found: “Sixty-two percent rated local roads and bridges as average, poor, or very poor quality. U.S. highways didn’t rate much better. Fifty-two percent had the same opinion of them.”

Whether it’s a mom stuck in traffic trying to get her kids to softball practice or a plumber who has his van in the shop because a pothole broke a wheel, people want better infrastructure.

Nearly 80% of voters say it’s important that government invest more in infrastructure.

The federal gas tax hasn’t been raised since 1993. It’s lost nearly 40% of its purchasing power. At the same time the condition of our roads and bridges have deteriorated.

U.S. Chamber President and CEO Tom Donohue urged Congress to act and warned of inaction: “The longer we wait to make this investment, the worse our infrastructure will get, and the more it will cost us – not only in money to fix it, but in lost time, lost productivity, and lost lives… things we can never get back.”

A version of this originally appeared in the Taking Care of Business weekly newsletter. If you want more content like this, sign up here.

Updated on 5/22/2019 to include state GOP lawmakers voting data.

Updated on 5/23/2019 to note that Montana voted to raise its gas tax in 2017.

About the authors

Sean Hackbarth

Sean writes about public policies affecting businesses including energy, health care, and regulations. When not battling those making it harder for free enterprise to succeed, he raves about all things Wisconsin (his home state) and religiously follows the Green Bay Packers.